China Stock Market 400-Point Flip-Flop

Stock-Markets / Stock Markets 2013 Jun 25, 2013 - 02:23 PM GMTBy: PhilStockWorld

The worst is now past.

That's the word from an HSBC economist after the PBOC's Ling Tao assures the bank will keep money-market rates "within reasonable ranges." The People’s Bank of China has provided liquidity to some financial institutions to stabilize money market rates and will use short-term liquidity operation and standing lending facility tools to ensure steady markets, according to a statement posted to its website today. It also called on commercial banks to improve their liquidity management.

The PBOC is giving the market “a pill to soothe the nerves,” Xu Gao, Everbright Securities Co.’s Beijing-based chief economist. “The message is clear: the central bank doesn’t want to see a tsunami in China’s financial markets and market rates will drop further.” That saved the Hang Seng from an additional 500-point nosedive and, in fact, they bounced back 400 points off the low at 19,426 to finish back at 19,855

As I said yesterday, it's an artificial crisis and one we felt had ran its course (see yesterday's post) and, in our Member Chat, we went more aggressively bullish off yesterday's low as we flip-flopped our bearish index positions at 10:07, pretty much catching the day's lows on the nose.

However, just because China is TRYING to stop their economic slowdown from turning into a crash doesn't mean they can successfully regain their lost momentum and now we need to turn our focus back to the myriad of problems that plague the rest of the World so we are in now way complacently bullish – merely playing for the bounce we expected to get into the end of quarter at some point this week – it just so happens that point came earlier than expected yesterday.

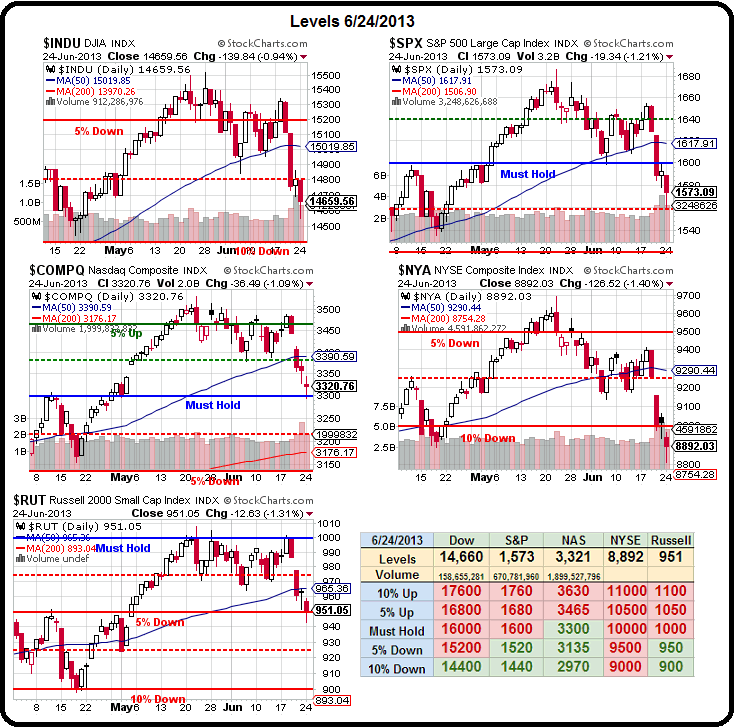

As you can see from our Big Chart, there's been quite a lot of technical damage done to our indices, with all of them breaking below their 50 dmas and already you can see them curling over but the 200 dmas (5-10% below the 50s) are generally rising so it would be easy to turn the 50s back up – if we can get over them by the end of the week.

If, on the other hand, we stay below them – the daily dots will pull the line that connects them lower and we all know what happens when a 50 dma is falling and a…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.