Deflation By Any Other Name Would Smell As Foul

Economics / Deflation Jun 25, 2013 - 02:04 PM GMTBy: Raul_I_Meijer

Over the past two weeks or so, we've been seeing a very clear portrait of how sick our economies are. Not that you would know it from reading the press. The term deflation pops up only very cautiously. Could that be because people don't understand what's going on? Or are they simply afraid of the word? This is the real thing, guys. And it's going to hurt.

Over the past two weeks or so, we've been seeing a very clear portrait of how sick our economies are. Not that you would know it from reading the press. The term deflation pops up only very cautiously. Could that be because people don't understand what's going on? Or are they simply afraid of the word? This is the real thing, guys. And it's going to hurt.

Money (actually: credit) has shifted out of emerging markets by the trillions. So where did it go? Not into bonds, stocks or precious metals. Money shifted out of there too, and also by the trillions. Money isn't going anywhere, it's going "poof". It's vanishing and will never be seen again.

Markets may still rise at times to some extent, but only if and when more stimulus is flooded into the system, or people think it will be. Markets have simply been undead for the past 5 years - or so -, as long as central banks have issued stimulus. Take that away and all you're left with is zombies. And even if markets rise, or "normalize", a little in the future, this genie's out of the bottle and won't get back in: bond yields and interest rates will not go back to the extremely low levels of the past few years. Central banks' longer term control of either has always been no more than an illusion. And as for another illusion: you can't call something a "recovery" if you pay for it with more debt, that doesn't make nearly enough sense.

People think they can find the reason behind the vanishing trillions in money/credit in things Ben Bernanke may or may not have said, and perhaps in a hard stance by the Chinese central bank. But they are merely small parts of a bigger story. The problem is not that the Fed hints at tapering, it's that the US economy is too sick to stand up straight without constant and/or increasing credit infusions. A zombie economy propped up with zombie money. And that can't last. It never could.

Nothing Ben does, whether it's issuing stimulus or hinting at less stimulus, represents real value. And that, to many people focused on the illusion of value, may have become clear only when Abenomics appeared on stage, seemed a success at first and then showed its true colors in a substantial Nikkei crash. Abenomics is the Fed's QE on steroids; both follow the same trajectory, but it's a matter of the harder they come, the harder they fall. Japan wanted too much too fast, and ended up shattering the stimulus illusion worldwide. As I put it three weeks ago:

What If Stimulus Is Self-Defeating?

... in today's world stimulus is self-defeating because it's stimulus itself that reveals the weak spots in an economy, and more stimulus reveals more weak spots.

Note: this is not the same as saying all stimulus is bad, or must necessarily defeat itself. But it is, and it does, in today's world, where stimulus doesn't serve to jolt the real economy into recovery, but to hide existing debt and create only the illusion of recovery. What makes it worse is that even just about everybody who should have known this instead elects to cling to the illusion. Well, your wake up call has come, and if you still don't listen it'll come back louder next time.

Today's stimulus is self-defeating simply because it is unleashed in a toxic financial environment, ridden with hidden debt. [..] ... it can only function when debts are properly restructured, defaulted upon, their holders bankrupted where applicable.

And there's no chance of that: the most prolific debt holders are Wall Street banks, and their debts have been made more secret than the latest whereabouts of Jimmy Hoffa. As long as that stays the way it is, QE is nothing but a very expensive - and very temporary - stop gap. Short term profits for the financial world, long term losses for you and me.

How much money/credit has evaporated into thin air in the last few weeks? It's impossible to even estimate, and nobody's trying, maybe because of a fear of some kind, but it's certainly multiple trillions. A Reuters article over the weekend stated that "global equity markets lost $1 trillion on Thursday alone". And Thursday was by no means the worst of the lot. The biggest losses have come not in stock markets, but in the bond markets, and these losses will continue. Not only did central banks never have control here, what's crucial is that nobody believes anymore that they have. More from the article:

The CBOE Volatility Index, a gauge of anxiety on Wall Street, jumped 23% on Thursday to 20.49, the first time this year it has exceeded 20, an often-used dividing line between calm and stressed markets. It closed at 18.90 on Friday.

Signs of concern about high-flying assets like emerging markets can be seen in the options market, where more than 1.35 million contracts in the iShares MSCI Emerging Markets exchange-traded fund traded on Thursday - 82% of which were put options, generally used to protect against losses.

The Merrill Lynch MOVE Index, a measure of expected volatility in the U.S. Treasury market, rose to 103.7 on Friday; that index sat at 50 in early May, a multi-year low.

Volatility, nerves, uncertainty. Deadly for an economy based on make-believe. The problem is not what Bernanke says or does not say, the problem is the debt still hiding underneath the layers of stimulus. Peel those layers away and guess what you see? And nerves or no nerves, bonds are losing value fast, the losses for institutional investors, governments, central banks and other parties will be enormous. And that is deflation.

Over the weekend, the BIS came with a curious number on the losses, as quoted by Reuters :

The BIS said in its annual report that a rise in bond yields of 3 percentage points across the maturity spectrum would inflict losses on U.S. bond investors - excluding the Federal Reserve - of more than $1 trillion, or 8% of U.S. gross domestic product.

The potential loss of value in government debt as a share of GDP is at a record high for most advanced economies, ranging from about 15% to 35% in France, Italy, Japan and Britain.

"As foreign and domestic banks would be among those experiencing the losses, interest rate increases pose risks to the stability of the financial system if not executed with great care," the BIS said.

Curious, because a 3 percentage point rise is a large number (so large it may well have been picked to throw people off) and losses will already be very substantial at a much lower percentage too. Moreover, in the $82 trillion or so global bond markets, a $1 trillion loss looks very low in comparison, certainly when you see the BIS claim that France, Italy, Japan and Britain can see their bonds lose a third of their value. But still, again, this is deflation.

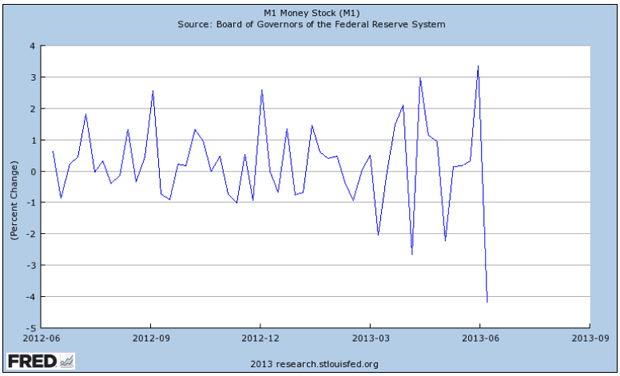

Perhaps the clearest, most down to earth and black and white illustration of deflation comes from two graphs that Ambrose Evans-Pritchard posted overnight . Remember, deflation does not equal falling prices, they're just a consequence. Deflation is the combination of the money and credit supply with the velocity of money. We know what that means for Japan, where velocity is extremely low, and PM Abe finds out that he can try to increase the money supply, but he has no control over the velocity. Here are M1 and velocity for the US:

Not a picture that leaves many questions open, it would seem. Still, it would be good to note that these developments didn't start with the latest market turmoil. If anything, they're the best illustration we can hope for of the failure of QE and other stimulus to induce an economic recovery. It's still impossible for all intents and purposes to find even one single politician or "expert" who does not talk about a return to growth and recovery, and that, in view of what we see out there, is taking on a bizarre character.

Someone should start talking about what we're going to do if and when growth does not return, when recovery is not just around the corner. We've lost precious years in which we could have cleaned up our economies but didn't. We instead borrowed from the future to put lipstick on the zombie. And now, behold: we've run headfirst into deflation, the very dreaded enemy we all wish to avoid. Are the Bernanke's and Krugmans et al of this world simply not smart enough to understand what is happening, and why? Perhaps, but I'm not so sure of that. It's too obvious. Even if Krugman seems to genuinely think a federal government can never suffer from debt deflation.

You can call it something else, and everybody has until now. But that doesn't change a thing. Trying to solve a debt problem with more debt creates bigger bubbles. In the end, there's one rule that always applies: credit bubbles lead to debt deflation, and the bigger the bubble, the more deflation there will be. It's inevitable. And it's not all bad: it cleanses the system, albeit in a painful way. But the longer you try to postpone it, the more painful it becomes.

Just because our economies can no longer function without stimulus doesn't mean they can with it.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.