China Stock Market Crashes, SPX Gaps Down

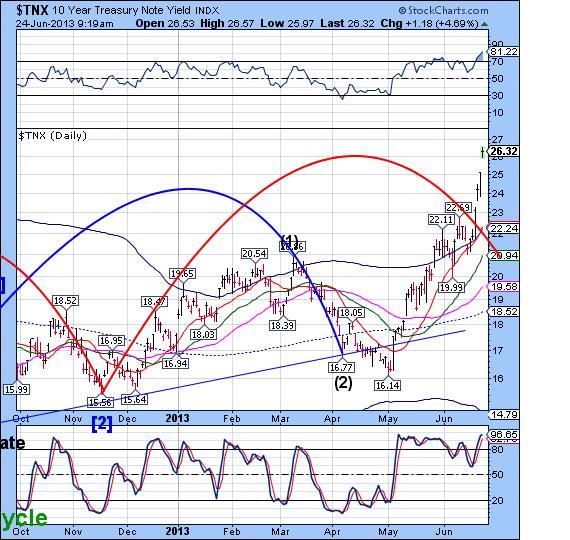

Stock-Markets / Stock Markets 2013 Jun 24, 2013 - 06:15 PM GMT The 10-year treasury yield… Is headed for the moon... in yield terms that is. Because if Bernanke's hope was that the handoff from buyers to sellers would be a smooth one, he may want to conference in Kuroda and get some advice on what happens when the bond market is halted limit down.Good thing Bernanke is not a real hedge fund, or else the $35 billion intraday P&L crash (so far), and $250 billion in the past two months, may raise a few eyebrows.

The 10-year treasury yield… Is headed for the moon... in yield terms that is. Because if Bernanke's hope was that the handoff from buyers to sellers would be a smooth one, he may want to conference in Kuroda and get some advice on what happens when the bond market is halted limit down.Good thing Bernanke is not a real hedge fund, or else the $35 billion intraday P&L crash (so far), and $250 billion in the past two months, may raise a few eyebrows.

China Crashing: Shanghai Composite Tumbles Most Since 2009

Those who have been holding their breath until China joins the overnight market fireworks can finally exhale.

Following yesterday's unprecedented formal announcement of epic capital misallocation, the PBOC tried to continue the damage control when a few hours ago it announced that Chinese banking system liquidity "is at a reasonable level", but that banks must control liquidity risks from fast capital expansion, especially credit expansion, according to a statement on management of banks’ liquidity on website. The implication: no easing any time soon, and sure enough no repo or reverse repo activity was logged in the overnight session meaning Chinese banks, for the time being, continue to be on their own, without any hope of the central bank stepping in to bail them out.

US Traders Walk In To Another Bloodbath

Lots of sellside squeals this morning following the epic bloodbath in China, where in addition to what we already covered hours ago, has seen at least five companies (China Development Bank, Shanghai ShenTong Metro, China Three Gorges Corp., Doosan Infracore China Co. and Chongqing Shipping Construction Development) delay or cancel bond offerings as the PBOC's admission of capital "misallocation" is slowly but surely freezing both bond and stock markets. And while the plunge was contained first to China, then to Asia, then to Europe (where the Spanish 10 Year once again surpassed 5% as expected following the carry trade unwind), with the arrival of bleary-eyed US traders the contagion is finally coming home.

It gets worse…

From Caijing, google translated. We hope the gist of the narrative in Mandarin is far less scary, because if the translation is even remotely accurate, then all hell may be about to break loose in China.

From Caijing: Bank of China, Bank of suspension of transfers morning counters were unable to apply for online banking

Update: Customer service said, now silver futures transfer service has been fully suspended, online banking, the counter can not be handled, and now has the background system response, recovery time is not yet known

…and the SPX gaps down.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.