BIS Bank Forecasts More Of The Same

Stock-Markets / Banksters Jun 24, 2013 - 05:30 PM GMTBy: Andrew_McKillop

BORROWED MONEY AND LOST TIME

BORROWED MONEY AND LOST TIME

The strange story of the BIS – whose forerunner founded in 1930 was the lynchpin bank of the Third Reich – is well known and heavily documented. Introducing its 83rd annual report for 2013, the Bank for International Settlements strikes a supposedly pragmatic we-can-fix-it tone. Its Overview under the title 'Making the most of borrowed time' says: “Originally forged to describe central banks’ actions to prevent financial collapse, Whatever It Takes has become a rallying cry for them to continue their extraordinary policies”.

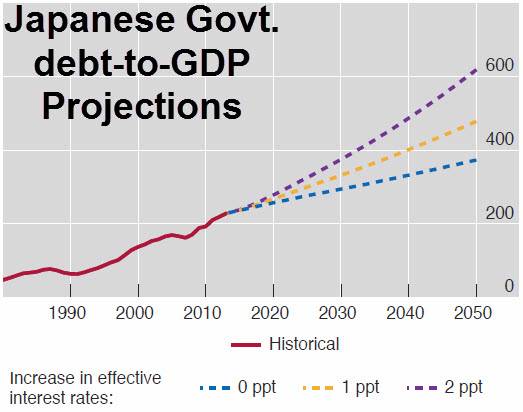

Page 47 of this report, apparently without any intention of being ironic, publishes government debt projections - based on OECD, national and BIS data - for the US, Japan and the UK. For people who like fiscal fantasy and fiction, instead of the real world, the Japanese projections are “interesting”, but those for the US and the UK are also lurid.

The BIS is not fazed by these forecasts or projections, which for the US and UK power up to 250%-350% of GDP by 2050. For the UK, using hard-to-understand reasoning, the BIS believes the debt spiral could be completely broken by raising real “effective” interest rates by 2%. but the trick for lower debt growth forecasts in all three cases concerns “age-related government spending”, that is capping spending on older persons at some near-term stage, for example 2018, despite the proportion of older persons in national populations growing rapidly and continually, to at least 2035. For the BIS, this move reflects the “need to hasten structural reforms” so that economic growth can be restored, after private citizens and enterprises have completed “the repair and reform of their balance sheets”. For older persons, and anybody with savings, this in fact means enforced poverty. The BIS says governments must redouble their efforts to obtain “fiscal sustainability”, by ensuring that the private bank sector delevers, removes “impaired assets”, and sets aside enough capital to match their financial and economic risks. The BIS predictably says that everybody – through taxes and near zero interest rates on savings – must pay for this. Everybody but the private banks, that is.

The bottom line for the BIS is therefore simple: What it calls forceful efforts to make “repair and reform” are obligatory for returning the developed economies to strong and sustainable real growth.

We could call this naïve, pie in the sky, even mendacious but the BIS is a critical link in the global finance and monetary system, the main link between the IMF and governments on one side, and the world's private banks on the other. The BIS is forced to make a pitch for “restoring growth” but it also has no option but republish official-source forecasts and projections of national debt.

THE REAL WORLD IS NOT A FAIRY TALE

Nowhere in its 83rd annual report will we find the BIS saying we can have the continued spiral of public debt – or we can have restored economic growth at some stage in the future, but we can't have both. The BIS makes a point of fudging or sidestepping this necessary conclusion. Far from being the only person saying such things, David Stockman's readout is becoming mainstream – outside of idiot friendly media, of course. In his book 'The Great Deformation' he says the mainstream notion of there being a choice between fiscal austerity and fiscal stimulus is pure wishful thinking. The BIS faithfully provides that wishful thinking.

The idiot friendly “considered view” does not recognize that crony capitalism and printing-press money have scored a total victory, right across the developed world and further afield – China for example. America is a failed state, fiscally. Several European states, the PIIGS, are in terminal fiscal decline, and economic decline, and this simple fact is very hard to deny or talk around. What lies ahead, Stockman says, is a continuous mad-cap cycling between deficit cutting through “austerity” and fiscal stimulus to the crony capitalist machine through QE.

The role or potential for GDP growth in that mix is basically very low, an occasional feel-good surprise on an on-off occasional quarterly basis, but you will not find that on the teleprompter of any leading politician or reports from the BIS. What has happened in state after state is that governments and their monetary authorities have encountered Peak Debt – and panicked. Peak Debt is not a magical statistical abstraction such as a public debt ratio of 100 percent of GDP, which can be magicked away “by the right policies” but a condition of permanent crisis. It has a cause and more debt will not fix it!

As a dip in the 204-page report from the BIS shows, page after page, the elite fantasy view is that saying with Stockman that "no viable economy can survive chronic fiscal deficits nor can avoid the need for savings at a sufficient rate to fund healthy investment in productive assets” is pure defeatism and pessimism. Austerity and QE with their necessary and linked “near zero interest policy” spell death to savings and a permanent drag on investment. At least as bad as this unhappy proof our elite deciders live on another planet, the reaction of monetary and fiscal deciders since 2008 has been and is a de facto pretence that “deficits don’t matter”.

At the same time they regularly panic about deficits, showing fantastic schizophrenia. The BIS for example takes a look at what is called “the Chinese savings glut”. This is not a deficit but a surplus and Chinese should be out there, spending. If they can't be tweaked into doing it, they should be forced into doing it. The vast debts of the US, Japanese and European economies and societies can be whittled away and down, but China has to keep growing, as well as India, Brazil, Russia and other G20 countries. Unfortunately – in the real world – all the non-G8 developed and emerging economies have, sometimes to a large and now better known extent, pursued the same Keynesian policy mix.

As we know or can find out from the quickest check of economic growth trends in G20 countries outside the G8 developed group, their growth is slowing. While it is now almost mainstream to say the American economy faces a long twilight of no growth-low growth, rising taxes, and brutally intensifying fiscal conflict, it is still verboten to say this also applies to the G20 countries. These are almost literally believed to operate on another planet, with another economy, which will somehow “play locomotive” with the West and the developed economies despite all the massive proof to the contrary.

THE LOW ORBIT ECONOMY

Fiscal drag is now a well known term. Linked with debt drag we have a knockout blow for any sane prospect of “high and sustained economic growth”.

Binding and hobbling the future of hundreds of millions of persons – because a few crony capitalists and their friends in government “blew the economy” - is in no way politically sustainable, whatever the BIS report might say. Whether it is the PIIGS or Turkey and Brazil, the people finally rise and rebel against such rank injustice.

In its section IV on “fiscal sustainability” the BIS report says (because it has no choice) that six years after the onset of the global financial crisis, public debt in almost all advanced economies has reached “levels unprecedented in peacetime”. And it is rising. Also because it has no choice, and has all the data to hand, the BIS adds that this “trend growth of debt” is in no way a sudden defect-of-reality but is a process that has continued “more or less continuously since the mid-1970s”.

This was the period of so-called “adjustment” that begun after the Oil Shocks of the 1970s.

This enables us to date the onset of the Low Orbit Economy. Like the BIS report tells us, in its own way, the real break with the past that started in the 1970s was that despite economic growth falling, governments made endless and rising fantasy economy promises of future pensions and health care spending. By the 1980s, they also applied the lethal mix of neoliberalism-and-Keynesianism, which ushered in the age of crony capitalism and banksterism, after which History Stopped. The 2008 crisis was a totally logical sequel just waiting to happen. Pretending the contrary is a waste of time.

For sure and certain the BIS talks about economic actors “enjoying very low interest rates” but despite this the “progress in closing current deficits as well as in tackling unfunded liabilities has been slower” than expected or hoped. It then leaps to its only conclusion – that is large scale “fiscal adjustments” which it warns cannot include higher interest rates – to reward savings – because this will drive public debt even higher, even faster. Equally sure and certain, the BIS doe not say this means economic growth has to be low or zero – but this is the only possible conclusion. Anytime there is growth, however feeble, the fatal role of crony capitalism will drive unreal asset bubbles sucking in any short term capital, then exploding them in dreary and predictable crashes. The coming equities crash is one example; the recent gold price crash was another.

No hint of the above conclusions or analysis will be found in the BIS report. Much of the report gives a glowing, admirative account couched in fairy tale prose about the world's central banks “building their asset bases” in order to relaunch economic growth. Or supposedly. Much of these assets, bought from private banks using borrowed and printed money, are to use the keyword “impaired” or even virtual, but this does not faze the BIS!

Occasional and rare flashes of honesty are however to be found. The BIS report firstly tells us it is basically impossible for interest rates to rise, then tells us that prolonged low rates “tend to encourage

aggressive risk-taking, the build-up of financial imbalances and distortions in financial markets” and unsurprisingly this results in “incentives” for delaying what the BIS calls balance sheet repair and reforms. While at no time admitting this is Mad Hatter economics, its report say that countries running zero or near-zero interest rate policies cause “upward pressure on exchange rates” for their currencies. As any true grit Keynesian will tell you it is necessary to permanently devalue national currencies while personal savings are treated as a crime against the State – in fact menaced with seizure under so-called “bail-ins” whenever the crony capitalist super-state has a panic phase implosion.

The bottom line from this 2013 report of the BIS is unfortunately that we can expect more of the same, until and unless the next blowout or implosion does such critical damage to the fantasy economy that it falls apart so massively – that there is no possibility of putting Humpty Dumpty together again.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.