U.S. Treasury Bond Market Panic Profitable Plays for Investors

Interest-Rates / US Interest Rates Jun 24, 2013 - 03:14 PM GMTBy: DailyGainsLetter

Moe Zulfiqar writes: It’s no secret: the Federal Reserve has kept U.S. bond prices higher and yields historically low by keeping interest rates low with multiple rounds of quantitative easing.

Moe Zulfiqar writes: It’s no secret: the Federal Reserve has kept U.S. bond prices higher and yields historically low by keeping interest rates low with multiple rounds of quantitative easing.

But now things have taken a minor turn, after the Federal Open Market Committee (FOMC) meeting minutes were released on June 19. “The committee currently anticipates that it will be appropriate to moderate the monthly pace of purchases later this year,” said Fed chairman Ben Bernanke. “And if the subsequent data remain broadly aligned with our current expectations for the economy, we will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year.” (Source: “Bernanke says Fed likely to reduce bond buying this year,” Reuters, June 19, 2013.)

Simply put, the Federal Reserve will slow the pace of its current quantitative easing. With its most recent quantitative easing, the Federal Reserve is buying $45.0 billion worth of long-term U.S. bonds and $40.0 billion worth of mortgage-backed securities.

But it may end the whole program by next year, depending on the performance of the U.S. economy.

As a result of this, market participants panicked, quickly sold their positions in U.S. bonds, and ran through the exit door.

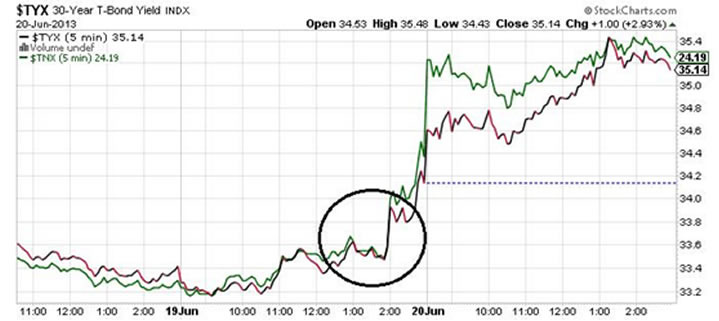

Please look at the intraday chart below of the 30-year U.S. bond yield (marked by the black and red line) and the 10-year U.S. notes yield (the green line). Pay close attention to the circled area, because this is the general area that shows what happened when the press conference was happening and the FOMC meeting minutes were released.

Chart courtesy of www.StockCharts.com

While this is a very short-term picture of the U.S. bonds and what exactly happened at this moment, looking at the bigger picture, they are showing weakness, as well.

Investors should note that this may just be the beginning of an unwinding in the bond market that had a great run. What many feared for some time may have started already.

Investors shouldn’t be discouraged by this; rather, they can actually profit from this situation from exchange-traded funds (ETFs) like the Direxion Daily 20+ Year Treasury Bear 3X Shares (NYSEArca/TMV). This ETF essentially shorts the U.S. bonds that have a maturity of more than 20 years. It follows the performance of the NYSE 20-Year Plus Treasury Bond Index and provides investors with three-times the leverage.

That means that if the underlying index declines by one percent in value, this ETF increases by three percent. (Source: “Direxion Daily 20+ Year Treasury Bear 3x Shares,” Direxion web site, last accessed June 20, 2013.)

Another investment vehicle investors may use to profit from declining bond yields is through an exchange-traded note (ETN) called the iPath US Treasury 10-year Bear ETN (NYSEArca/DTYS). This ETN follows the inverse performance of Barclays 10Y US Treasury Futures Targeted Exposure Index and, in essence, lets investors profit as the 10-year U.S. note yields rise. (Source: “iPath US Treasury 10-year Bear ETN,” iPath web site, last accessed June 20, 2013.)

Source: http://www.dailygainsletter.com/stock-market/bo...

Copyright © 2013 Daily Gains Letter – All Rights Reserved

Bio: The Daily Gains Letter provides independent and unbiased research. Our goal at the Daily Gains Letter is to provide our readership with personal wealth guidance, money management and investment strategies to help our readers make more money from their investments.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.