Batten Down the Tatches for a Perfect Stock Market Storm!

Stock-Markets / Financial Crash Jun 20, 2013 - 04:38 PM GMT Good Morning!

Good Morning!

Yesterday was quite a day. I took a crew down to Wabash, IN to help “dig out” a friend who suffered a direct hit by a tornado. Fortunately, the city of Wabash has a wood recycling operation, so we only had to move the limbs and more than a few mature trees to the street for pickup. When we were done, the stack of logs and branches was nearly a block long by about 4 feet high!

The SPX futures declined to 1605.95 last night and are experiencing a mild bounce (still beneath the 50-day m.a.) prior to a busy economic announcement schedule this morning. These include;

o *Unemployment claims 8:30am

o * PMI Manufacturing Index 8:58am

o *Existing Home Sales 10am

o *Philadelphia Fed Index 10am

o *Leading Economic Indicators 10am

Here is a summary of the first report, “In the week ending June 15, the advance figure for seasonally adjusted initial claims was 354,000, an increase of 18,000 from the previous week's revised figure of 336,000. The 4-week moving average was 348,250, an increase of 2,500 from the previous week's revised average of 345,750.

Futures are coming down again and there’s no telling where they will end. Chances are that the 50-day moving average was already retested in the futures, so while still a possibility, we may see an open beneath the hourly Cycle Bottom support/resistance at 1608.59. What a time for a sell-off!

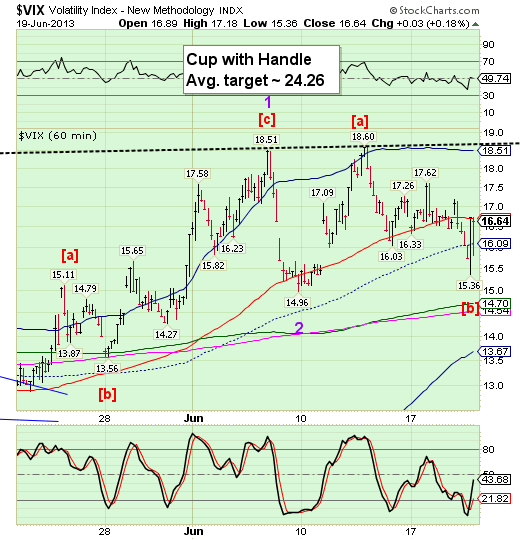

Tomorrow is quadruple witching and the volatility will likely go through the roof! This is the setup for the perfect storm, notwithstanding problem in other markets as well!

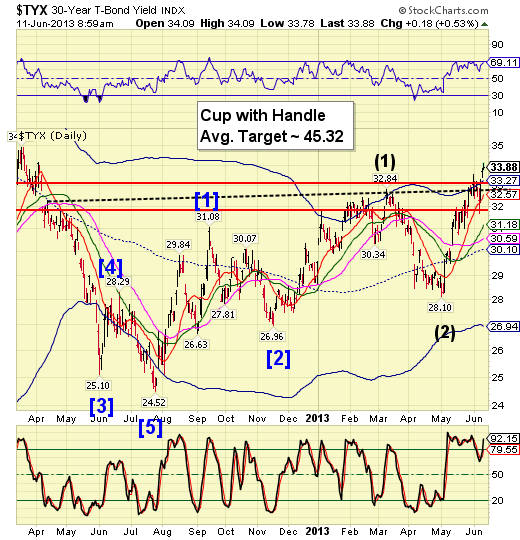

TYS has broken out above the Lip of its Cup with Handle formation, which is extremely bullish for yields. In a recent study released by the Fed, the authors had a rise in interest rates to 4.5% would cripple the Fed and leave it impotent to continue its bond purchases. The study further suggested that interest rates might rise to that level no sooner than 2015.

Well, the future is now. Their forecasting model, if they even have one, is broken. Unfortunately, Obama doesn’t want the Fed to stop buying treasuries. Thus we see Bernanke’s fall from favor. Bernanke knows what is happening to the markets and wants to avoid it, but he may be being set up as the fall guy for the market crash.

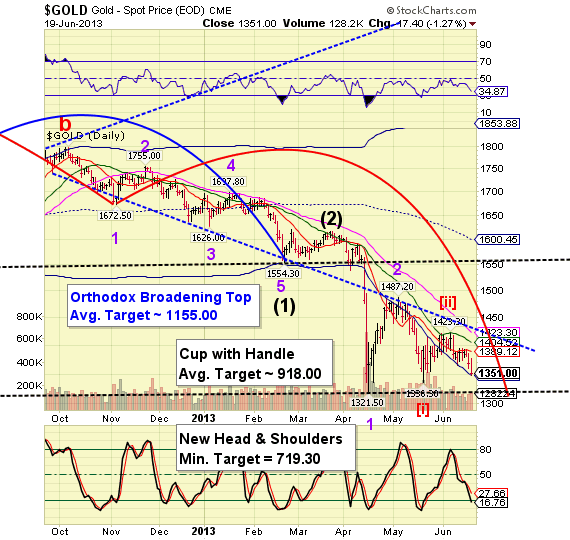

Gold futures dropped to 1293.00 in the overnight markets. It is clearly broken and is now in a potential free-fall.

There is no place to hide in risk assets, including treasuries.

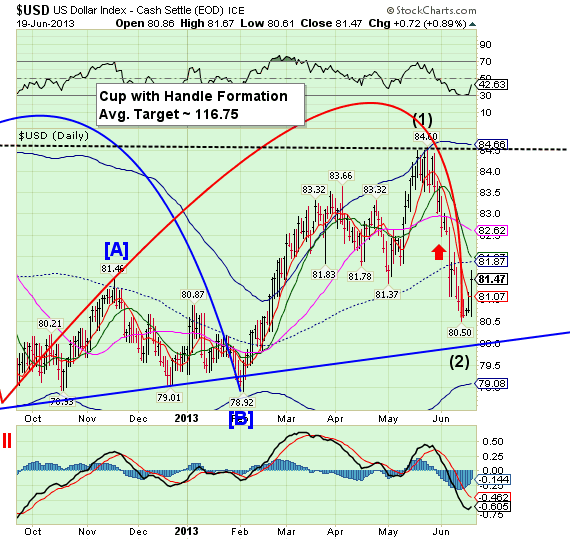

USD surged to 82.20 in the overnight markets and is currently hovering near 82.04. It has risen above both mid-Cycle resistance and Intermediate-term resistance, which will now provide support for the rally. The last bastion of resistance is the 50-day moving average at 82.62, which may be challenged or broken today, IMO.

This will be one of the best long plays for the summer.

Despite VIX’s relatively poor performance yesterday, the VIX futures are at 18.38. VIX futures are somewhat higher than the cash market shown in the chart. We think that the poor performan=ce may be due to paired trades, where long positions are linked with a hedge. In this case it would be either VIX futures or a derivative (ETF) of VIX. I think that this is something that Wall Street “cooked up” to suppress the VIX while the market is being sold. It shouldn’t last long, though.

All the best!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.