China's Credit Crunch Signaling Stress in Global Financial System

Interest-Rates / Credit Crisis 2013 Jun 19, 2013 - 07:09 PM GMTBy: Jesse

Here is some interesting data out of China. The story is by Matt Phillips.

Here is some interesting data out of China. The story is by Matt Phillips.

The inter-bank liquidity crunch is a classic banking problem for which the central bank as lender and regulator was created.

It would be nice if the bankers could get in front of these problems as they develop, and not merely throw the public's money at them after the fact when bad bank management, official corruption, and excessive greed have made the system vulnerable.

LIBOR itself is quiet, which suggests that this problem is particular to China, at least for now. The only LIBOR stories breaking are charges against bank traders for manipulating that interbank rate.

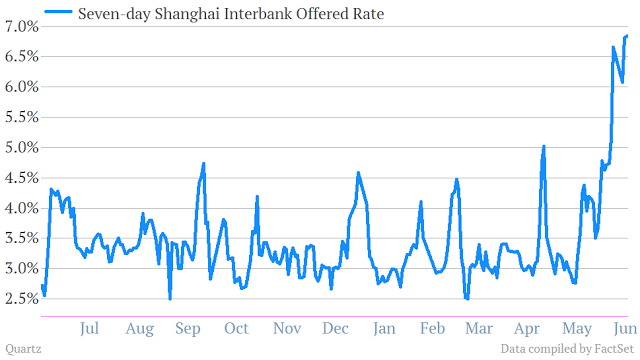

Shibor

Here’s what’s behind the Chinese cash crunch

By Matt Phillips

"Remember Libor? When that once obscure measure of short-term interest rates shot higher in 2007 and 2008, it was one of the earliest warnings signs of what would eventually become the financial crisis. Now, its Chinese cousin—known as Shibor—is telegraphing the rising stress in the opaque financial system of the world’s second largest economy.

What does the spike in rates mean? Large banks are increasingly leery of tapping into their pools of cash to lend to each other. Recent reports that China Everbright Bank failed to repay a short-term loan to Industrial Bank Co. aren’t helping. Industrial Bank says that report is “untrue and exaggerated.” But short-term lending markets suggest other bankers are skeptical.

So what’s the solution? Chinese authorities tamed short-term interest rate spikes before. They could create new cash to lubricate lending, or lower reserve requirements for banks, which would boost liquidity. According to the Wall Street Journal, that’s what bankers are hoping for..."

Read the complete original here.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.