END GAME Singularity: The System Will Be Purged through Interest Rates

Interest-Rates / Global Debt Crisis 2013 Jun 19, 2013 - 06:53 AM GMTBy: Charlie_Tarango

Interest

Interest

Interest Rates represent the Balance Between Capital and Labor.

Economic History revolves around that Balance Moving from one extreme to the other.

Human Nature and Mathematics Drive those Swings. No Group or Force can Stop that. Any Machination or Manipulation, Individually or Collectively can only Elongate, Not Alter that Outcome.

“Control” is an Illusion. But Being in The Right Position, is Not

What Can’t Be Paid, Won’t Be Paid = Consequences

We are at a Generational Inflection Point in the Swing of Interest Rates and No Manipulation or Machination can Stop the Natural and Inevitable Consequences that necessarily flow therefrom. “Money Printing/Quantitative Easing” etc., etc., all defined as Creating Liabilities Out of Thin Air against Future Production far in Excess of Current Production, can’t and won’t alter that – only exacerbate it

2 + 2 is Not 5. Yet we are Living in an “Extraordinary Popular Delusion” otherwise – where Arrogance, Greed and Impunity Rule the Roost.

Hypothecation is the Mortar of the Derivative Complex supporting it all that purports to stand against Mathematics. What do you think will prevail, The Mortar or Mathematics ?

Mathematics Are in Control

No Individual or Group of Individuals are in Control. Mathematics are in Control, and they Won’t Be Denied.

The Mathematical Imperative: GROSS Debt Divided by NET GDP:

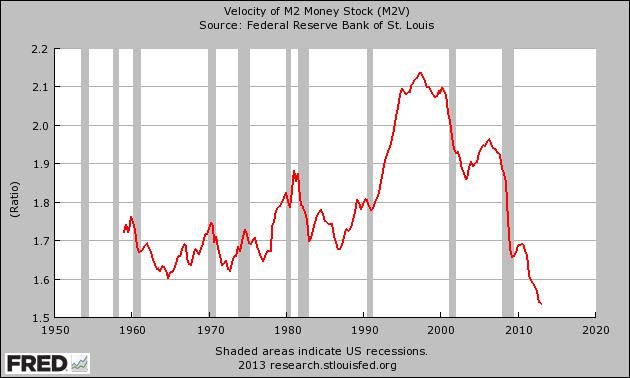

“Velocity of Money” is the “Smoking Gun”; “Rate of Change” the Bullets.

Adam Smith teaches Economic Gravity – Menger, Von Mises, Rothbard & Hayek, et al.,teach ‘Why’ Math cannot be Denied and Jesse Livermore teaches us that Human Nature will always Lead us to Defy both.

Icarus Manifested: When you Count all “Long” Positions in the World in all Asset Classes:

The World is 100 % Net Long and Leveraged 100-1.

The entire Mantra with all its Proponents of “Inflating away the Debt” cannot work Without Wage Inflation. The concomitant Mantra of “Stagflation”likewise misapprehends – The “Stagflation” of the 1970’s was a Temporal State BETWEEN Outcomes; we’re in the Outcome Now. Rates could Rise in a Benignly Curative way then – that’s impossible now. Failing to grasp this dichotomy is fatal to Capital.

Structural Unemployment ( Debt, EROEI, Demographics & Technology ) and Wage Arbitrage via “Globalization” prevent Inflationary Policies from creating Wage Inflation – Proven Out by GDP Prints Worldwide since 2009 = “Zugzwang”.

If Billy Bob owes a Million Dollars, and tomorrow by some Miracle, Water could be put in Gas Tanks instead of Gasoline, Billy Bob still owes that Million. Payment or Default, period. There are no “Magic Bullets” – and that analogy proves why.

Rate of Change is a Power unto itself.

Singularity: The System Will Be Purged through Interest Rates

By Choice, but not by Knowledge and Understanding, virtually Everyone is Positioned the Same, No Matter Where or in What Asset Class, whether they Realize or Not:

Any Rise in Rates will be Orderly.

Mathematics and Human Nature Dictate otherwise. Logic Guarantees it in a Zero Sum Game.

The analogy to Japan is inapposite as could be, Mathematically, Factually and Historically. In Point of Fact, since 1990 Japan has only Proven Elongation, Not Alteration; Plain to See. Think of Japan as a Playoff Game on the Road to the “Super Bowl” viz., The World Debt Bubble which is Now in its “Final Quarter”.

Three Positions

Gold the “Universal Money” has Proven Two Seminal Points:

There are only Three Positions in Capital in the World:

Long

“Owning” Anything of any Kind, Physically or on Paper,

“Short the Market” and

The Only Guaranteed True Money in the World,

US Treasury Bills.

And Most Importantly, Cash is King. Gold is just another Asset held Long or Short.

All this talk of “Insiders”, “Manipulation”, “Crony Capitalism”, with the utmost respect to David Stockman, et al., means nothing, zero:

Only these Three Positions Exist – If you are Not in the Right One, You Lose - No Matter who you are or who you are Connected to, Period when the Music Stops – and Mathematically it already has.

The Cold Hard Truth is, most of the Biggest Players are Trapped and Sure to Lose – because they can’t take the Right Position – and couldn’t handle it even if they could take it.

At those Sums, they really are Not in Direct Control of their Capital. Need Proof:

Could Carlos Slim turn what he has “On Paper” into Cash in US Treasury Bills ?

– but US Treasury Bills could absorb that Sum Easily.

Could He take on Even 10 % of his Capital Net Short ? = Trapped, and Sure to Lose on the Road to the Endgame:

“Losing” Defined as Working Years to End with Less = Years Wasted = Time, the Most Valuable Commodity of all. Time will Reflect clearly that Number is defined in the Tens of Billions. But he won’t be Alone.

Nobody today actually handles Capital like Jesse Livermore – Huge Sums of Pure Cash in Markets – in whatever The Right Position is.

Paul Tudor Jones is rumored to have Sold 90 % of his Apple close to 700 – but I Guarantee You that he didn’t “throw his Line Short” as the Master Says. No Way. Billions Naked Net Short – Can’t Do It. The very fact that he has a “13-F” Says it and Volume is what Proves He Didn’t. And if Paul Tudor Jones can’t take it, all the Pretender’s to the Throne surely can’t.

Capital Wise, Jesse has yet to be surpassed by Anyone. But with all Respect, I Aim to Change That.

The “Greed Equilibrium” will TAKE most “Gains”, ill-gotten or otherwise, through Voluntarily Being in The WRONG Position, and put them back in the Pool, Revalued of Course, at the Real Bottom. “Bailed Out” only to be “Busted Out” at the Endgame. Buy and Win shifts to Hold and Lose.

You see, as Jesse explains, Markets don’t Beat anyone, they Always Beat themselves.

No immunity Exists or can be Provided to Human Nature.

The Market is Not Manipulated, The Participants Are

“Manipulation” is an Excuse.

Nobody Forces anyone to take any Position. All Participants take Position by Choice.

And there is an Endless Supply of those who do so – The “Who”, “Where” and “Sum” of the Capital being no matter.

If you Shorted Apple at $ 700 in 2012, you have been handsomely paid some 40 % - and that Capital would have been Paid to Anyone, or any size, anywhere. That Position would have Paid in the Tens of Billions, No Problem.

If you would have placed 20% of your Capital in Gold in 2001, and in 2011, you sold the Gold, “Paper” or “Physical”, as they Say, and placed that Money in the 13 Week Treasury, you would have been paid. This too would have Paid Billions, again No Problem.

If you sold Stocks and Real Estate and went Long “King Dollar” in 2008, by 2009 you would have been Paid – and again, on Any Sum

If you would have went Long US 10 Year Bonds in February 2010, and Sold them in September 2011, you would have been Paid Handsomely. Mathematics, Geopolitics and History dictated @ 4 % that US Ten Year Rates were a Sure Bet to the Down Side. And this Bet the USA could Control Rates at that Point, would have Paid 100 Billion Dollars to someone who truly had the Capital – and the Courage of their Convictions. There were No Takers.

But there were many “Top Dogs”who Bet just the Opposite – and many other Pseudo Guru Book Peddlers professing the “Short of a Lifetime” – actual RESULTS = “Sucker Play of a Lifetime”. The “Hippocratic Oath” need not apply. “Tips” and their “Peddlers” are worthless. Now these same folks say throw “Long”at SPX 500 all-time highs. As Einsteinsaid …“there are only two things that are infinite: The Universe and Stupidity – and I am not sure about the former.” Indeed.

There are Winning Positions at all Times in Markets whereby a Handsome Profit can be Made. If you are in the Right Position, you Get Paid, No Problem and at any Sum. If you would have made Billions Short in APPLE, you could have Transferred that Capital in a few-clicks via Direct Ownership to the 13 Week Treasury:

No Malfeasance, No Hypothecation and No Legal Encumbrance Possible.

And as Gold has Proven, No Loss would be Possible either.

Manipulation and Malfeasance are Perennial Pretexts and Excuses. The Market always has been and always will be Abundant with Opportunity. The Truth is, most Participant’s Knowledge and Skills simply don’t match their Ambitions; but the Lure of “Big”or “Easy”Money will always draw them in.

The Blackjack Analogy

Imagine is Las Vegas You Could Pick the Cards you wanted at the Blackjack Table:

If you don’t Know the Winning Cards, you might Pick them or Not.

A Fortiori, The Ability to Pick Proves by Force of Fact & Logic that “Randomness” is Completely Fallacious and yet another excuse.

The Market is a Game of Skill, Not Luck.

Volume is the Language of the Market, and as Jesse says, it may not tell the Truth on the Moment, but it NEVER Lies. The problem is nobody Learns that Language,and think they are Smarter or more Powerful than that Language – or that Someone or Something Else can Speak on its Behalf.

What is Random is the Knowledge and Skills of The Participants, not the Market itself. There are always “Blackjacks” in the Market – with Knowledge and Skill, you can Pick them and Profit. Most only actually “Know” how to “Buy”– but little else. And Most Certainly not when to Sell.

That “One Trick Pony” has run its course over this Generation. The Net Results of the “Top Dogs” Collectively in recent years Prove this out. Don’t believe me ? Ask Bill.

Bill Gross’ Mea Culpa - Ante

They Believe because they have to Believe and Go along Voluntarily. A whole Generation of Participant’s and Market “Stars” only Know the Long Side and can’t even begin to Hold Majority Capital Short here.

As Jan Brueghel the Younger depicts Classically, the Monkeys don’t Know any better; Not then, Not Now.

You Need The Courage of Your Convictions to go Short at a Generational Peak.

The Monkeys don’t have them. So they can’t - and they are Not. Volume Says So.

“The Man in the Mirror” Says So.

They have Learned all the Wrong Things while Being in the “Right Place at the Right Time” =

Long Anything. And that is at its End. The “Epoch” indeed Made many Men; the “Epilogue” will Ruin them as the Piper comes calling.

Bill Gross is only Front Running what History is about to Show. At the Real Bottom, many Reputations will have been Destroyed. This is one of the Biggest “Tells” of all as to where things stand.

The Promise to Pay

Gold is telling a story, as all Markets do.

What is failing is the Promise to Pay, in a Classic Bust of Epic Proportions.

Every Major Country has accumulated More Debt than can be Liquidated by the current Generation.

Debt is Massively GDP Net Negative on a World Wide Scale – Bottom Line to ALL.

Asset Values are at a Generational Peak

“Zugzwang” is ‘Why’ ; “Res Ipsa Loquitur” Proves it.

The Mediums of Exchanges – be they Currencies or other Instruments - are inapposite to the issue:

Insolvent a Little or a Lot = The Same.

What will Fail is The Claims – Not the Medium(s) of Exchange. So Simple.

Thus all Major Countries in the same Position means the System Reverts to the Status Quo Ante =

The 64 Billion Dollar Question ? But Can You Profit from Knowing the Answer ?

King Dollar, Prince Deutsche Mark

The final outcome is defined by Mathematics, Geopolitics and History:

The Year c. 1500 Marked the beginning of a Bi-Polar World that is just in its early stages – America has at least 100’s of Years yet to come. Geopolitics and Geography are Symbiotic.

The Revolutionary War showed that a Giant Over Seas Power could not Hold the Western Hemisphere even with overwhelming Military Superiority. This was Proven again with Spain’s Ejection from the Western Hemisphereover the Next Century.

Bloody Civil War – the Worst in US History, couldn’t and didn’t stop this. If the US was going to Fail through its Own Actions, it was then. World War 1 set the Stage and World War 2 Delivered. Cuba Sealed it. Today with overwhelming Military Superiority, Who is going to dislodge the USA and How ?

As for Germany, history repeats. There are those who say Germany cannot abide the break-up of the “Euro”. Long Term History and Short Term History belie that in every respect. Germany went from a Diametrically Divided Country to the Economic Engine of the Continent – not just Europe - in a mere 20 years. Once again, they are underestimated – both in Power and Future Direction.

America is only in its Infancy. And Germany is Rising – yet again. Betting against this, is a Losing Proposition – But contrary to what the “Meme” is, the Value of the SP 500 or Any Market for that matter, is Irrelevant to that Geopolitical Equation. The World is NOT Going to End, but the Purge has to Occur to Move Forward.

Mathematics Will Not Be Denied - Nor Will Human Nature.

But they Can Be Profited From.

Master & Student

It is no Accident that those Winning Positions articulated earlier, Match My Credentials.

Success is Not an Accident.

These Few Positions Prove that there are Plenty of High Yielding Positions, that are Completely Safe, No Matter what happens. And crucially, they PROVE the Mantras “You Have to Be Long” and “Don’t Fight the Fed” are Absolutely False. Truly, “Monkey See, Monkey Do”! Irrespective of what the Central Banks et al., May or May Not be Doing, all of that in the Totality is Moot to these Facts.

The Outcome is Certain. The Uncertainty lies in the Multitude of Participant’s who Lack the Courage of their Convictions. Despite the Chorus of Incantations otherwise, what is unfolding is only “Uncharted” or “Unprecedented”to those ignorant of History, either in Point of Fact, or by Choice.

When the Real Bottom arrives, it will Last Years, Not Months. The “L” Left Down – Not “V”.

Show Me the Money, and I will Show you that in the Right Positions, No Matter What Occurs, Billions – even a $ 100 Billion – can be Made – and in just a Few Positions.

My Credentials and Public Record Back That Up Fully.

Contrary to Myth, “When” is Not at All a Necessary Piece of Information – only “What” and “How”.

Newton discovered Gravity – but Einstein explained it.

The Seminal Point Jesse Livermore teaches: Being Right is Not Enough.

You must not only be “Right” but you need the Courage of your Convictions to Profit when you are – and those Convictions are Sure to Be Severely Tested when the Big Money is there to be made. “Sitting Tight” is sine qua non to Winning. This is very essence of “The Market” in toto – that can’t be Manipulated, Controlled, Replicated or Faked – No Matter “Who” the Participant is, Be it a Government, Institution or Individual.

One Student eventually exceeds The Master: Jesse Livermore had the “Why”– I’ve Got the “What”.

I Know there are some in the Financial World who have been looking for the Next Jesse Livermore, well here I am. For those who will Embrace Reality in Order to Win:

The Right Position Now is:

Majority Capital Short and the Balance in US Treasury Bills.

From Here to the Bottom, That is the Winning Position.

Can You Take It ?

I Can, and in Any Amount – Without Control of the Capital.

g

About Carlos:

Some try to Get Rich Quick or Easy or are seeking Fame & Adulation –

I’m Working to Become a Billionaire and Stay There for the Duration.

I have and continue to Lay the Foundation both Publicly and Privately to

Clearly Demonstrate an Alliance with Me can Yield Billions.

The “Right” Party will Recognize that and Embrace it.

My Ambitions don’t exceed My Abilities.

The Parable of The Hare and The Tortoise is instructive.

To make Billions in Markets, you need Billions on the Table.

That requires a Major Participant(s) Allied with Me.

Credibility is the Key to Achieving that.

At the Real Bottom, Credibility will be the Strongest Asset.

If you Have seen the Film “Good Will Hunting”, then you already Know Me.

When Einstein wrote “Special Relativity” in c. 1905, he wasn’t recognized either.

Quite the Contrary.

My Seminal Work to Back That Up is Set Forth in

“The Gravity of Capital & Graphic Visualization”.

The Most Important Thing a Man Can Know is What He Doesn’t Know.

This Allows a Man to Know the

Life Defining Difference Between Arrogance & Confidence.

For this and other Works in PDF

Carlos can be Contacted at:

“ZUGZWANG”

c. 1932 – 1966: Foundations of Real Growth

c. 1966 – 1980: Stagflation = Temporal State Between Outcomes

c. 1980 – 2008: World Debt Bubble

Highest Ratios of Debt to Net GDP in History

Debt Grows Exponentially – Everyone is a Winner

Real Estate, Stocks, Commodities, Metals, Bonds, Debt in Myriad Structured/Hypothecated Forms

“Globalized” Demand Structure built on this Debt = Virtuous Circle

Valuations Rise BASED on this Debt until they Exceed Economically Sustainable Metrics

2008 “Crisis” = Outer Parameters of Debt Saturation Point Reached = Debt is GDP Negative

2008 – 2013 to Social and Political Upheaval =

ALL Major Governments Respond by ‘Printing Money’ to Sustain Debt Bubble

Printing Money aka “Monetization” Causes Higher Prices

Structural Unemployment and “Globalization” ( Wage Arbitrage ) Prevents Rising Wages –

The Mantra of “Inflating away the Debt” cannot work Without Wage Inflation.

Higher Prices absent Rising Wages = Falling Demand

2008 – 2013 to Social and Political Upheaval =

Corporations & Businesses Respond to Falling Demand by Cutting Jobs

Cutting Jobs = Falling Demand = Less Real Growth

Less Jobs & Less Demand & Less Real Growth = Less Government Revenue

Less Government Revenues = Higher Deficits

Higher Deficits = More Interest Compounding

Higher Deficits & Interest = More Money Printing

More Money Printing = Higher Prices

Higher Prices = Less Demand

Less Demand = More Job Losses = Less Real Growth = Slow Strangulation of the Economies

The “Smoking Gun” as it were are the 2011-2013 Prints in GDP WorldWide:

Inflationary Policies cannot create Wage Inflation +

METRICAL Debt Saturation = Deflation occurs by Choice or Collapse.

The Mathematical Imperative: GROSS Debt Divided by NET GDP.

“THE SMOKING GUN”

THE 1 % DON’T DRIVE VELOCITY – THE 99 % DO.

IN THE LIFE OF “PAPER PLENTY” THE 1 % ARE OBLIVIOUS.

WAGES ARE THE FUEL BY WHICH THE 99 % DO SO:

“ZUGZWANG” =

PRICE INFLATION BUT NO WAGE INFLATION =

VELOCITY DECLINES UNTIL THE HOUSE OF CARDS COLLAPSES.

SO SIMPLE. EVERYTHING ELSE IS NOISE.

UNSTOPPABLE AND JUST A MATTER OF TIME.

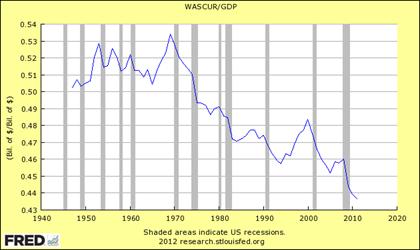

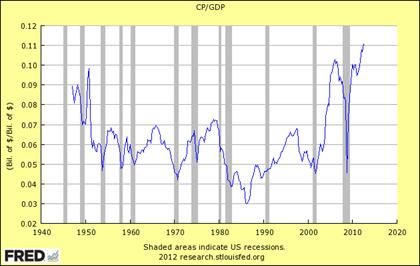

GENERATIONAL PEAK

1940 – 2012

ç LABOR

ç ZERO LINE

ç CAPITAL

“RATE OF CHANGE”

IS

MATH SAYING

“THIS IS PEAKING”

ç ZERO LINE

ç ZERO LINE

INTEREST RATES REPRESENT THE BALANCE BETWEEN CAPITAL & LABOR

THIS IS THE M

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.