A Safe Place for Your Cash... OUTSIDE the U.S. Dollar

Currencies / Canadian $ Jun 17, 2013 - 02:09 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: Money flows to where it's treated best... that's one of the surest rules in finance.

Dr. Steve Sjuggerud writes: Money flows to where it's treated best... that's one of the surest rules in finance.

And it is key to picking currencies.

Right now, money is treated better in Canada than in just about any other major country on the globe. And with the setup we have today, you could make as much as 27% over the next 12 months.

Let me show you what I mean...

Canadian politicians aren't as dumb with their country's money as U.S. politicians are.

For example, there's talk in the government of eliminating its deficit by 2015. No politicians in the U.S. are talking about doing that any time soon.

Also, while central banks around the world have cut interest rates to near zero, Canada has held interest rates at 1%. One percent doesn't sound like much, but behind Australia, it's the second-highest interest rate among major currencies.

In short, Canada is treating money well.

The thing is, investors consider the Canadian dollar a "commodity currency." When commodities are strong, the Canadian dollar should be strong. But lately, commodities are down and gold prices have crashed. So everyone expects the Canadian dollar to continue to fall.

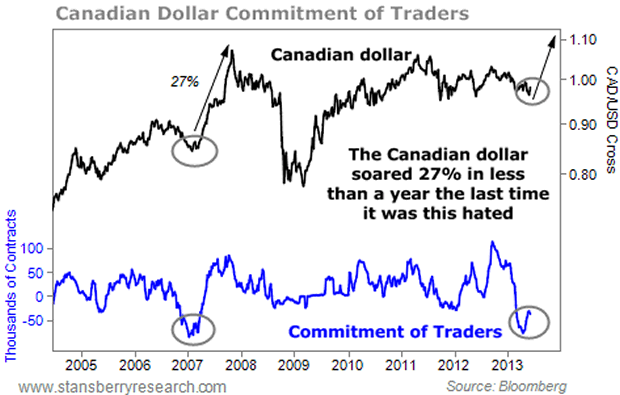

The chart below tells the story. It shows the "Commitment of Traders" (COT) report. This measures real bets futures traders have on the Canadian dollar, right now. When the blue line is high, traders are bullish... When it's low, traders are bearish.

As you can see, the Canadian dollar is hated today. It has only been more hated once in its history... in 2007. From trough to peak in 2007, the Canadian dollar soared against the U.S. dollar...

Everyone is betting against the Canadian dollar... And historically, when you reach points like this – when there's nobody left to be against a currency like this – then it goes up in value.

In my True Wealth newsletter, we're taking this bet...

I recommended buying the Canadian dollar through the stock market... by buying the CurrencyShares Canadian Dollar Trust (NYSE: FXC).

As I write, FXC is at around $98. Its two-year low is around $94. We can limit our risk to just 3.8% by using $94 as our stop loss.

Compared to that, our upside potential is great... The last time we saw this setup, the Canadian dollar soared 27% in less than a year. We could see a similar return this time around. Heck, I'd be happy to take a 15% gain in less than a year here.

Even with 15%, the "reward-to-risk" ratio on this trade is fantastic... 15% upside with 3.8% downside. That is a 4-to-1 reward-to-risk ratio. That's excellent!

Now is a great moment to get some of your money outside of U.S. dollars. And shares of FXC are an easy way to make the trade. The timing is perfect: Canada is treating money well. And it's as hated now as it was at its low in 2007.

Our odds are about as good as they get in the financial markets... It's time to buy.

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.