What If The Secular Stocks Bear Market Is Not Over?

Stock-Markets / Stocks Bear Market Jun 15, 2013 - 10:01 AM GMTBy: Sy_Harding

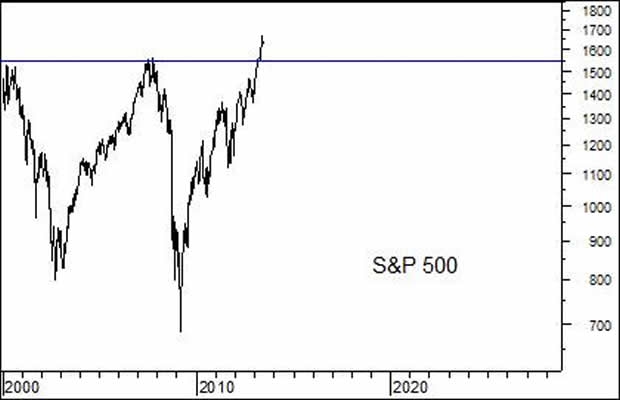

It’s easy to forget, especially in the excitement of the recent new market highs, that not only a cyclical bear market, but also a secular bear market began when the market topped out in 2000.

It’s easy to forget, especially in the excitement of the recent new market highs, that not only a cyclical bear market, but also a secular bear market began when the market topped out in 2000.

None other than Warren Buffet warned in November 1999 that “Over the next 17 years equities will not perform anything like – anything like - they’ve performed over the last 17 years.”

When Buffett made his perceptive forecast in 1999 the market had been in a typical 18-year secular bull market since 1982, and had become extremely overbought in the process.

Over the last 110 years the market has cycled fairly regularly between secular bull markets that lasted up to 18 years, and sideways secular bear markets that typically lasted about 17 years.

In a secular bull market there are periodic bear markets, but they are usually brief, and then the next cyclical bull market takes over and carries the market onward and upward to ever higher new highs.

In a secular bear market, periodic cyclical bull markets take place that carry the market back up to the vicinity of its previous peaks. But then the next bear market takes over, the market tops out again, and the long-term sideways secular bear market continues.

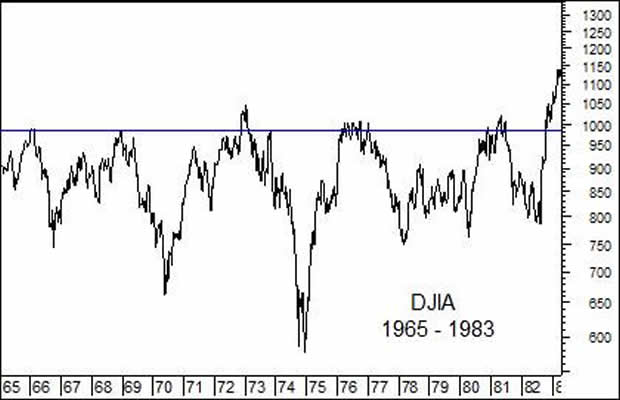

The last secular bear market ran from 1965, when the Dow reached 1000 for the first time ever, until 1982, when it reached 1000 for the sixth time in 17 years, and finally kept going into the 18-year 1982-2000 secular bull market.

In the current cyclical bull market that began in 2009, within the secular bear market that began 13 years ago in 2000, the market recently again reached its previous peaks of 2000 and 2007, and this time exceeded those peaks.

But rather than the excitement and bullishness that has created, it might be more appropriate to consider whether the secular bear market remains in place.

Because if it does, the current situation of the S&P 500 looks ominously similar to when the Dow returned to its previous two peaks in 1973, and broke out to a new high, which had investors excited, bullish, and convinced that the secular bear was over. But the next cyclical bear was even worse than the previous two.

So is the current secular bear market over? Is the current bullishness and confidence justified?

A few observations:

If the current secular bear is over it will be the shortest one in the last 110 years.

Then there is the fact that there have been 25 bear markets over the last 110 years, one on average of every 4.4 years. The bull market that began in March, 2009 is now 4.2 years old.

We are also in the first year of the Four-Year Presidential Cycle. The historical pattern is that the first year or two of the cycle tend to be negative, while the last two years of the cycle tend to be positive. The catalyst for the pattern seems to be that each administration wants to see any problems for the economy or the stock market take place in the first two years of the term. They then have time to pull out all the stops in the third and fourth year, to make sure the economy and markets are recovered and positive by the time the next election rolls around.

Then we also have the remaining serious situations created by the 2008 financial collapse that still must be tackled at some point down the road, with their impact unknown. They include the record global government debt loads, the reversal of the unprecedented massive stimulus efforts of central banks, including the U.S. Fed, the return of near zero interest rates to more normal levels, and so on.

We also have a number of conditions that are not comforting if you think about conditions at the market top in 2007, including very bullish investor sentiment, record margin debt (confident investors buying stock with 50% down-payments), consumer confidence, auto sales, home sales, etc. being described as at “levels not seen since 2007”.

That’s similar to conditions during the last secular bear market of 1965-82. Some issues would be resolved, supporting the periodic bull markets, only to have it realized that other unusually serious problems remained to be solved. In those times it was the Vietnam war, runaway inflation, oil embargoes by OPEC, repeated economic recessions, political scandals (Watergate, Nixon’s resignation, etc.), and then record government debt and budget deficits incurred in trying to pull the country out of the malaise of the 1970’s.

That’s not unlike the current situation of the Iraq and Afghanistan wars, political gridlock, two recessions in 8 years, the still questionable anemic recovery from the last one, record budget deficits and debt loads, and still to come fiscal and monetary reversals of the unprecedented stimulus efforts of the last five years.

Unfortunately, the evidence seems to indicate the secular bear market is not only still with us, but may be near its next critical point.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.