Wall St. Stocks Rally on Philly Fed US Economic Outlook

Economics / US Economy Mar 22, 2008 - 06:31 AM GMTBy: Paul_L_Kasriel

"NEW YORK, March 20 (Reuters) - U.S. stocks jumped on Thursday, pushing the Dow briefly up more than 1 percent, as a reading on factory activity in the mid-Atlantic region fell by less than analysts' had forecast, improving views on the U.S. economic outlook."

Tell me. On what basis did "analysts" have to predict what the Philly Fed March factory activity headline would be? For that matter, on what basis do "analysts" have for predicting what weekly initial jobless claims will be.

At the end of each week "analysts" are sent forms to fill out as to what their forecasts are for economic reports to be released in the next week. For many of these economic reports there is no way to accurately predict the data based on fundamentals - seasonal variation, perhaps, but not underlying economic fundamentals.

Similarly, in this current environment, how can an equity analyst accurately predict the earnings of an investment bank when it does not know how that bank is valuing its Level 3 assets? So an investment bank reports that its earnings are down 50% and its stock rallies because "analysts," on the basis of very little, had predicted that its earning would fall by 70%.

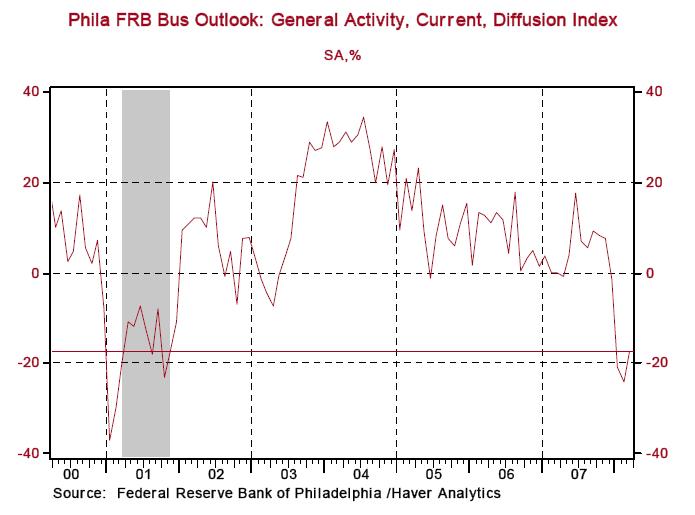

The chart below shows the behavior of the headline index for the Philly Fed region's factory activity. Notice that the headline was in deep negative territory, but rising, as we entered the 2001 recession. The March reading of the headline, at minus 17.4, is lower than where it was during most months of the last recession. Yes, indeed, the Dow should rally on this because "analysts" had predicted that the headline would be worse than it turned out. What nonsense!

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.