Big Brother Is Watching! Worlds Bond Markets Could Seize Up

Stock-Markets / Financial Markets 2013 Jun 09, 2013 - 03:59 PM GMT “In life we all have an unspeakable secret, and unreachable dream, an irreversible regret, and an unforgettable love.” Diego Marchi

“In life we all have an unspeakable secret, and unreachable dream, an irreversible regret, and an unforgettable love.” Diego Marchi

A month ago we learned that the FBI was bugging the phones in the cloakrooms of Congress and listening to personal conversations of reporters and politicians. Then two weeks ago we read that the IRS was using their power against Obama’s political opponents. So I guess it shouldn’t come as a surprise to learn that the National Security Agency is currently collecting the telephone records of millions of US customers of Verizon, one of America's largest telecom providers, under a top secret court order issued in April. The order, a copy of which has been obtained by the Guardian, requires Verizon on an “ongoing, daily basis” to give the NSA information on all telephone calls in its system, both within the US and between the US and other countries.

The document shows for the first time that under the Obama administration the communication records of millions of US citizens are being collected indiscriminately and in bulk – regardless of whether they are suspected of any wrongdoing. The secret Foreign Intelligence Surveillance Court (Fisa) granted the order to the FBI on April 25, giving the government unlimited authority to obtain the data for a specified three-month period ending on July 19. Under the terms of the blanket order, the numbers of both parties on a call are handed over, as is location data, call duration, unique identifiers, and the time and duration of all calls. The contents of the conversation itself are not covered.

The unlimited nature of the records being handed over to the NSA is, to say the least, extremely unusual. Fisa court orders typically direct the production of records pertaining to a specific named target who is suspected of being an agent of a terrorist group or foreign state, or a finite set of individually named targets. The Guardian approached the National Security Agency, the White House and the Department of Justice for comment in advance of publication on Wednesday. All declined. The agencies were also offered the opportunity to raise specific security concerns regarding the publication of the court order. The court order expressly bars Verizon from disclosing to the public either the existence of the FBI's request for its customers' records, or the court order itself.

The order, signed by Judge Roger Vinson, compels Verizon to produce to the NSA electronic copies of "all call detail records or 'telephony metadata' created by Verizon for communications between the United States and abroad" or "wholly within the United States, including local telephone calls". The order directs Verizon to "continue production on an ongoing daily basis thereafter for the duration of this order". It specifies that the records to be produced include "session identifying information", such as "originating and terminating number", the duration of each call, telephone calling card numbers, trunk identifiers, International Mobile Subscriber Identity (IMSI) number, and "comprehensive communication routing information".

While the order itself supposedly does not include either the contents of messages or the personal information of the subscriber of any particular cell number, its collection would allow the NSA to build easily a comprehensive picture of who any individual contacted, how and when, and possibly from where, retrospectively. Initially it was not known whether Verizon is the only cell-phone provider to be targeted with such an order, but now its being suggested the NSA has collected cell records from all major mobile networks. It is also unclear from the leaked document whether the three-month order was a one-off, or the latest in a series of similar orders.

The court order appears to explain the numerous cryptic public warnings by two US senators, Ron Wyden and Mark Udall, about the scope of the Obama administration's surveillance activities. For roughly two years, the two Democrats have been stridently advising the public that the US government is relying on "secret legal interpretations" to claim surveillance powers so broad that the American public would be "stunned" to learn of the kind of domestic spying being conducted. Because those activities are classified, the senators, both members of the Senate intelligence committee, have been prevented from specifying which domestic surveillance programs they find so alarming. But the information they have been able to disclose in their public warnings perfectly tracks both the specific law cited by the April 25 court order as well as the vast scope of record-gathering it authorized.

The law on which the order explicitly relies is the so-called "business records" provision of the Patriot Act, 50 USC section 1861. That is the provision which Wyden and Udall have repeatedly cited when warning the public of what they believe is the Obama administration's extreme interpretation of the law to engage in excessive domestic surveillance. In a letter to attorney general Eric Holder last year, they argued "there is now a significant gap between what most Americans think the law allows and what the government secretly claims the law allows. We believe," they wrote, "that most Americans would be stunned to learn the details of how these secret court opinions have interpreted" the "business records" provision of the Patriot Act.

Privacy advocates have long warned that allowing the government to collect and store unlimited "metadata" is a highly invasive form of surveillance of citizens' communications activities. Those records enable the government to know the identity of every person with whom an individual communicates electronically, how long they spoke, and their location at the time of the communication. The NSA, as part of a program secretly authorized by President Bush on 4 October 2001, implemented a bulk collection program of domestic telephone, Internet and email records. This isn’t the first time this has been tried. A furor erupted in 2006 when USA Today reported that the NSA had "been secretly collecting the phone call records of tens of millions of Americans, using data provided by AT&T, Verizon and BellSouth" and was "using the data to analyze calling patterns in an effort to detect terrorist activity." Until now, there has been no indication that the Obama administration implemented a similar program.

In the mid-1970s, Congress, for the first time, investigated the surveillance activities of the US government. Back then the mandate of the NSA was that it would never direct its surveillance apparatus domestically. At the conclusion of that investigation, Frank Church, the Democratic senator from Idaho who chaired the investigative committee, warned: "The NSA's capability at any time could be turned around on the American people, and no American would have any privacy left, such is the capability to monitor everything: telephone conversations, telegrams, it doesn't matter." Americans of course are ready to give up their freedom at the drop of a hat in return for the illusion of security.

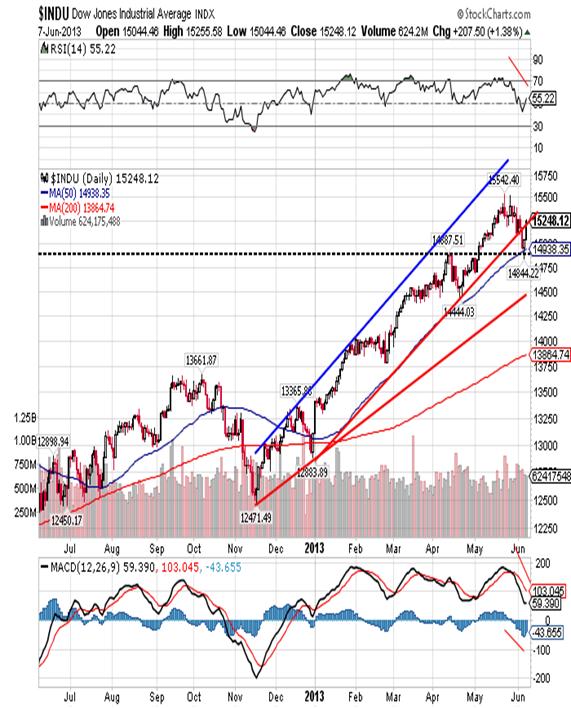

Life in the markets goes on and in spite of the distractions and bad news, and the majority of investors remain quite bullish. After all the Fed has all but guaranteed that stocks will go higher so why should anyone by worried? This week was no exception although it was more volatile than what we’ve been used to. In spite of the volatility the Dow still managed to post a 207-point gain on Friday to end the week at 15,248. This is still below the 15,409 all-time closing high on May 28th but was more than enough to get the mainstream media hawking stocks one more time.

The big question on everybody’s mind is just how high is high? The recent correction saw the Dow fall from the May 28th intraday high of 15,521 to the June 6th intraday low of 14,844 taking the Index down below the trading range that was established in November of last year:

The recovery that began at noon Thursday and continued on Friday pushed the price back up into the old range and turned RSI back up. Interestingly enough, the rallies on Thursday and Friday were on decreasing volume and that is always a red flag.

With respect to the long run the 4.5% correction is but a speck on the wall. Take a look at this weekly chart of the Dow for a better perspective:

Here you can see that I’ve highlighted a formation known as a megaphone and it has some very interesting characteristics. You’ll see that the two times the index managed to touch the top band it was followed by a massive sell-off. Right now that band rests at 15,725 so the Dow still has another 500 points to go. Finally, you can see that the Dow is extremely oversold on the weekly chart.

No one knows just how high is high and for how long the Fed will continue to support markets. For the moment the Dow is pricing in continued quantitative easing and that’s enough to push stock prices higher. The NYSE percentage

of stocks trading above their 50-dma is on the mend even though the Dow is extremely overbought. Warning signs abound with the non-confirmation of the Transports and weakening volume on advances. In spite of that I can see the Dow testing the top band in the megaphone formation but with that said I would avoid stocks from here on out for the simple reason that value is almost impossible to find.

The bond market is a different story as it now has a trend that is easy to identify:

The bond market made a significant top in July 2012 and since then has traced out a series of lower highs and lower lows. On Friday the 30-year treasury made a new closing low for the year and for the entire move down at 139.39. Even though bonds are extremely oversold I continue to look for this leg down to reach the 135.00 to 138.00 area so it doesn’t have all that far to go. Then we’ll see a decent rally followed by another move down to lower lows at the 128.00 to 130.00 area, and so on for the next couple of years as bonds have now entered a bear market that will last quite some time.

I know that the Fed has stated that they’ll keep interest rates at historic lows well into 2015, but the Fed doesn’t set the interest rate. The bond market sets the interest rate and that rate hit a fourteen-month high on Friday. That means the interest on mortgages, credit card debt, student loans and auto loans is on the rise. In short the cost of doing business is on the rise and that will stifle what little growth there is in the economy. Many people are quick to attribute the rise in rates to “a growing fear of inflation,” but that just isn’t the case. The reason rates are on the rise has to due with the world’s biggest debtor generating more and more debt and the only way to pay that debt is to print more money. The problem no one talks about is the fact that debt is growing faster than the Fed can print, and that’s the only reason QE will be discontinued. It’s inadequate!

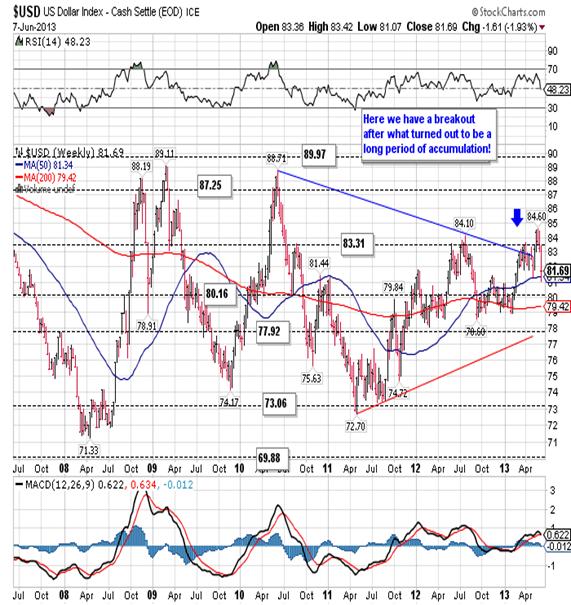

The US dollar continued a strong correction this week as it closed on Friday at 81.69 as new longs abandoned ship:

After making a new two-year high in May the dollar has tumbled for three weeks but it is still trending higher as you can see in the chart above. Also, we’ve seen these sharp reactions on a number of occasions over the last year or so and then the greenback moves on to a new high.

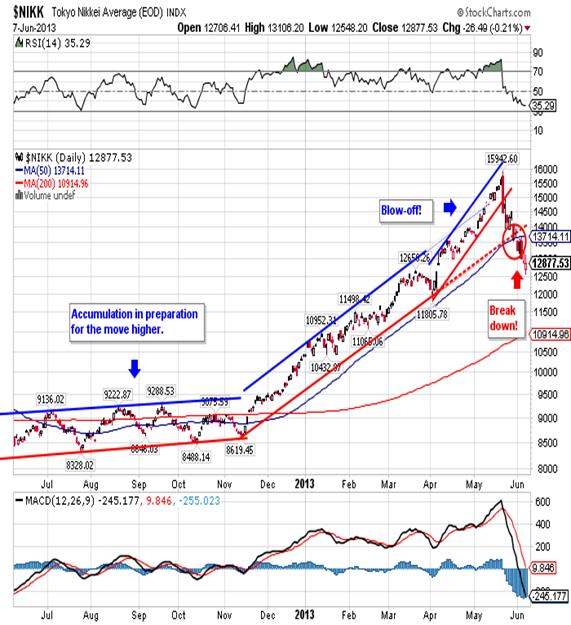

I believe the last leg up in the dollar had a lot to do with the Japanese announcement that they were going to buy US $1.3 trillion in new debt. That made the dollar look attractive by comparison and produced a significant rally in the Tokyo Exchange:

Then people thought better about the whole thing and stocks came tumbling down and I don’t think it’s an accident that the dollar turned lower as well. However the Japanese will intervene to push the Yen lower and the dollar higher as they’re convinced it will help their trade. Aside from that the ECB is about to embark on a campaign of negative interest rates and additional QE so I wouldn’t rush out to sell the dollar short just yet. How high could the dollar go before it fizzles out depends on others:

The greenback has good resistance at 85.35 (not shown) and strong resistance at 87.25 so that’s the range I would look at. On the other hand if the dollar moves and closes below strong support at the historical low of 80.16, then I am wrong and the greenback is all done heading higher. In any event the dollar will turn lower sooner or later, and when it does it will get ugly. It’s all just a question of time!

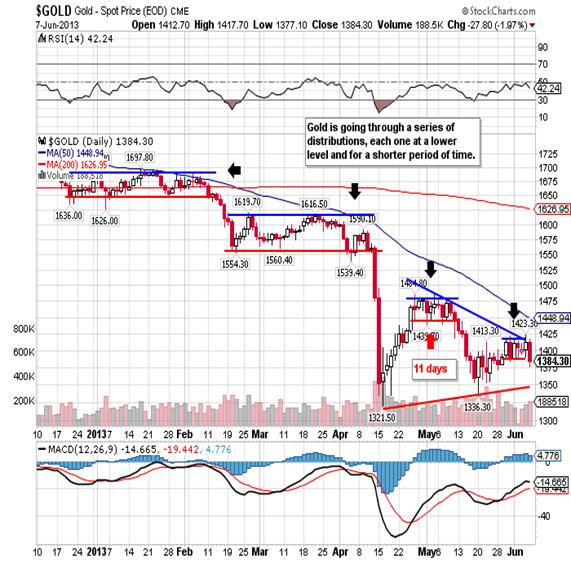

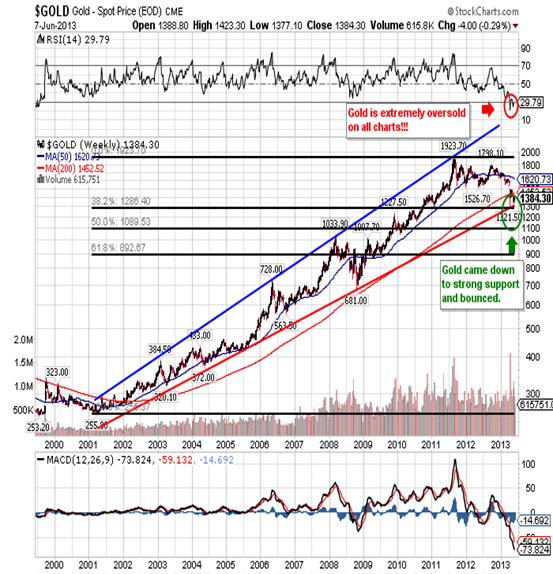

Gold continued to struggle within a trading range as it has done previously during this prolonged move lower:

Gold had been stuck all week in a range from 1,388.30 to 1,423.30 and even closed above the 1,411.00 resistance on Thursday. Then came the breakdown on Friday as the spot gold traded as low as 1,377.10 before closing at 1,384.30 and below the previously mentioned range.

I still don’t think gold is quite done to the downside but that is the minority opinion right now. Many see the May 20th dip to 1,336.30 as a higher low and bullish signal. I disagree! Since the current reaction within this bull market

is so over extended time wise, I believe the decline must exceed the 38.1% achieved in April. I continue to look for a move down to the 50% retracement at 1,089.00 and I think it could occur this month. I also believe that once the bottom is reached the primary trend will reassert itself in very short order and the price of gold will head higher with considerable haste.

There is an awful lot being said about the manipulation of the gold price and I have no doubt that is the case. With that said all the manipulation has done is extend the decline in the secondary trend in terms of time and price, but it has not in any way changed the upward direction of the primary trend. Since most of us live in 24-hour compartments with little concern for what’s coming months or years from now, the modification of the secondary trend makes us uncomfortable. This discomfort has reached such a high degree that even long time investors in the yellow metal have given up and gone in search of greener pastures. One more wicked dip will clean out even the most passionate gold bug and then the rise will begin in earnest. The problem is that we’re all so emotional when it comes to gold that we simply refuse to see what’s right under our noses.

CONCLUSION

On Friday President Obama addressed recent reports of the National Security Agency secretly obtaining phone records and private data for surveillance. During his speech he indicated that Americans needed to trust the system of government set up to thwart abuse. “If people can’t trust not only the executive branch but also don’t trust Congress, and don’t trust federal judges, to make sure that we’re abiding by the Constitution with due process and rule of law, then we’re going to have some problems here.” Obama added that the National Security agents behind the surveillance programs “cherish our Constitution.” It seems very strange that a man whose administration uses the IRS to go after his political enemies, tapes the private conversations of reporters and Congressmen, and obtains your e-mails and phone calls without your permission is asking that you trust him. Does anyone else see a problem here?

We are now getting to the point where Americans are willing to spy on each other, and in some jurisdictions there are actually monetary incentives for doing so. On the other hand we have a growing welfare society with 50% of all Americans receiving some sort of government aid, forty-eight million Americans on food stamps and twelve million homes being foreclosed on. When Obama ran for President in 2008 he promised massive public works projects to repair an aging infrastructure, and when he came up short he renewed that pledge in 2012. So far no such program is even on the drawing board and I suppose we’ll have to wait for a few more bridges to fall into the river before the next presidential candidate comes and makes the same empty promise.

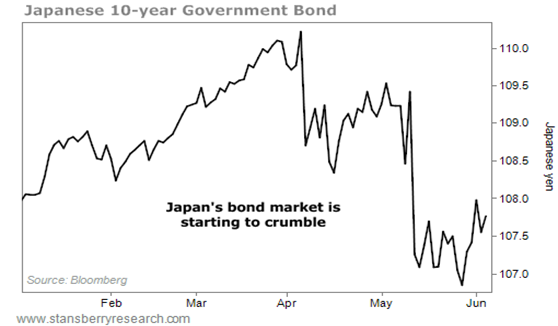

If I look beyond US shores I see two large problems closing in on the horizon, Japan and Italy. Japanese government debt now reach 250% of GDP, and for the last couple of months the government had to borrow additional funds just to meet interest payments. In short the country is

broke. Most intelligent people would cut spending and borrowing under these circumstances, but the new government has decided to follow Bernanke’s lead. They will create US $1.3 trillion in new debt! Originally it was thought that this would drive bond prices higher and interest rates lower (sound familiar?) but the opposite is now happening. The falling bond price and rising interest rates coincide with a falling Yen and that makes the cost of living rise in real terms. In short Abenomics will turn out to be an Abedisaster in one of the world’s largest economies.

Italy isn’t any better off and that’s important because the Italians possess the world’s third largest bond market, right behind the US and Japan. I don’t think it’s a coincidence that interest rates in Italy began to trend higher in late April and continue to move higher:

This is in spite of the fact that the ECB is acting as the buyer of last resort in all the southern European markets. My thinking is that we just may see the credit markets seize up in the three biggest bond markets, all at the same time, and it would be a disaster. That means there’s a generalized crisis of confidence and no amount of printing would change that. In fact it would only exacerbate the problem. So if you want to know if and when the wheels will come off, all you have to do is keep your eye on the bonds. It’s the modern day canary in the coalmine, and unlike gold it seems to be resistance to manipulation.

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Robert M. Williams Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.