Peak Oil - A Simple, Perfect Lie for Politicians

Commodities / Crude Oil Jun 09, 2013 - 09:03 AM GMTBy: DailyWealth

Porter Stansberry writes: Peak Oil was a fantastic lie.

Porter Stansberry writes: Peak Oil was a fantastic lie.

The idea was that our ability to discover and produce higher amounts of hydrocarbon-based energy had peaked and would be forever in decline. This "inevitable" decline in energy production would destroy the modern world, as all the luxuries and technologies that we enjoy today (such as cheap electricity and automobiles) rely on these fuels.

I believe historians will look back and marvel over how we could imagine the world would run out of oil... and the incredible mania that thinking produced in the oil markets in the mid-2000s.

And as I've said before, I believe having a correct understanding of these issues is critical... perhaps the single most important economic issue of the next several decades.

Peak Oil was a terrific lie because it enriched so many powerful constituencies.

Oil and gas promoters used the theory to scare the public into investing huge amounts of capital into oil and gas exploration. Globally, the oil and gas industry's annual capital investment budget soared, from a little more than $100 billion in 1999 to an all-time record $1 trillion in 2012.

The promoters' pitch was intoxicating. Their siren song was the idea of the last barrel in the world. What would the world's last barrel of oil be worth? After all, if supplies could never be increased, then the price of oil and gas would soon reach unimagined heights. All this speculation drove oil prices to more than $150 per barrel in the summer of 2008.

Peak Oil was such a simple lie, even politicians could understand it. It was perfect for them because Peak Oil was a problem with no possible solution. When something can't be fixed, politicians claim all sorts of powers to regulate the issue. That's when the real trouble started.

The idea that we were going to quickly run out of oil played into the same guilty narrative that many politicians were telling about global warming. Not only were hydrocarbons bad for the environment, consuming them was tantamount to impoverishing our children and dooming them to a future without affordable transportation and electricity.

These ideas were used as cudgels by politicians to discredit the oil and gas industry. They justified all kinds of massive and stupid government-led investments into supposed alternatives.

None of these alternatives had the capacity to replace our country's massive energy infrastructure (which is based almost completely on hydrocarbons). But that wasn't really the point. These huge public-sector investments mostly served to enrich politicians (like Al Gore) and their lobbyists and backers.

We estimate that to date, the government has spent, wasted, or simply lost roughly $500 billion on absurd energy investments. That's roughly twice as much as it lost on the housing bubble.

This has fueled a huge binge of crony capitalism. Just look at solar-energy company Solyndra... Here, the government lost half a billion dollars on one company. No one has gone to jail. No one has been kicked out of office. That's because the politicians weren't lining the pockets of their supporters, right? No, they nobly were trying to "solve" global warming... and forestall Peak Oil.

Sure.

The irony is... long before the shale oil and gas boom started... we had more than enough evidence to completely discredit Peak Oil.

The theory's main flaw is that it assumes our knowledge of oil and gas reserves is complete. The truth is plainly the opposite. For example, the U.S. Geological Survey estimated in 1994 that the recoverable amount of oil and gas in the North Dakota's Bakken shale formation totaled 151 million barrels.

Today, about 15 years later, producers in the Bakken are extracting 255 million barrels each year – about 100 million more barrels annually than were supposedly to be in the entire basin.

Harold Hamm, the CEO of the largest Bakken producer, Continental Resources, says the Bakken has at least 24 billion barrels of recoverable oil. His firm is currently producing more than 40 million barrels per year. If Hamm is right, the Bakken could be four times larger than the biggest oilfield ever discovered in the continental U.S. – H.L. Hunt's giant elephant field, known as East Texas.

Peak Oil's second main flaw is that it assumed recovery methods would forever be limited to extracting about 10% of the oil contained in a conventional reservoir. But as technology improves, most knowledgeable industry experts predict that ultimate recovery rates will exceed 40%. So even if we never discovered any additional oil reservoirs, we might still only be halfway toward Peak Oil.

Consider Denbury Resources, one of the best companies in the world at "renovating" existing oilfields by using new, advanced recovery methods. Denbury can take an old conventional oilfield and increase the average recovery rate from 10% to 25%.

Applying new technologies to existing oil reservoirs is a very good business, by the way. Denbury's shares have soared from around $0.50 in the late 1990s to more than $40 at the peak of oil prices in the summer of 2008. Clearly, if Peak Oil was real, Denbury's entire business model wouldn't have worked. Not only did it work, it worked incredibly well because Denbury's strategy eliminated the main capital risk of oil production – dry holes.

Here's the fascinating thing...

Enhanced production techniques were pioneered by the firm Kinder Morgan in the 1990s and then copied by dozens of companies, like Apache and Denbury, in the late 1990s and early 2000s. The actual results of these businesses made it clear that the assumptions of Peak Oil were simply wrong.

They weren't sometimes wrong... They were always wrong. They weren't merely wrong in theory... They were completely wrong in practice.

Regardless, the widespread belief in Peak Oil caused billions of dollars to flow toward oil and gas exploration and production companies. These companies, in turn, have used that capital to find and produce vastly more oil and gas than almost anyone thought was possible. That's how the free market works: Demand drives savings and investment, which increases supply... until prices fall.

Since hitting a bottom in mid-2005, total annual energy production in the U.S. has grown 10%... from 62.6 trillion cubic feet equivalent (tcfe) to more than 69 tcfe.

But this doesn't tell the real story.

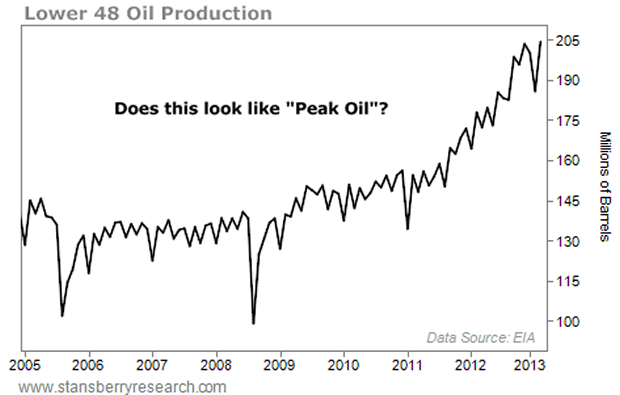

Total energy production in the U.S. includes coal and petroleum from the North Slope of Alaska. When you look at only the lower 48 states and take out coal... you see the real trend.

Oil production in the lower 48 states is up a stunning 75% and dry gas production is up 35% over the past eight years.

These increases are on a scale we haven't seen in more than 50 years. They are huge increases in production that most people believed could never happen again.

These unprecedented increases have finally laid bare the self-serving lies of Peak Oil theorists.

Regards,

Porter Stansberry

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.