Stocks Bear Market- How Bad Can It Get?

Stock-Markets / Stocks Bear Market Mar 20, 2008 - 04:35 PM GMTBy: Hans_Wagner

To beat the market you need to invest with the trend. The stock market is down and continues to fall almost every day. As of March 19, 2008 the DJIA is down 8.8% for the year, the NASDAQ is down 16.7%, the S&P 500 is down 11.6% and the Russell 2000 is down 13.3%. Most investors are looking at their portfolios and they are very unhappy. The initial problems with the mortgage market started this tumble. Will it continue to get worse and is it spilling over into other parts of the U.S. economy? So how bad can it get?

To beat the market you need to invest with the trend. The stock market is down and continues to fall almost every day. As of March 19, 2008 the DJIA is down 8.8% for the year, the NASDAQ is down 16.7%, the S&P 500 is down 11.6% and the Russell 2000 is down 13.3%. Most investors are looking at their portfolios and they are very unhappy. The initial problems with the mortgage market started this tumble. Will it continue to get worse and is it spilling over into other parts of the U.S. economy? So how bad can it get?

We are in a Recession

First of all, we are in a recession. Yes, we need to wait for the National Board of Economic Research (NBER) to opine on whether we have two consecutive quarters of decline in the Gross Domestic Product (GDP), but that will not happen for up to a year after the fact. Here are some of the economic factors that lead me to this conclusion:

1. The jobs outlook is deterating. For February the government reported that the economy lost 63,000 jobs. Actually, the private sector lost 101,000, meaning that government hiring continues to increase. Due to the way the government counts the impact of births and deaths, this factor supposdly added 135,000 new jobs. This bit of statistical chicanery probably means that the real loss in jobs was probaly much larger. Moreover, the unemployment rate fell slightly to 4.8% from 4.9% due to a sharp contraction in the total number of people looking for work. This is not a good sign.

Generally, employment is a lagging indicator and is is highly unusual to see two months in a row of job losses and not experience a recession. Yes, that is right, jobs fell in January as well.

2. The U.S. dollar hit new lows against the basket of ninteen currencies, trading as low as 72.46. The dollar's weakness is one of the reasons we are seeing the price of most commdities climb higher, since it takes more dollars to buy such commodities as oil. A falling dollar is considered good for any companies that expors from the U.S. as their goods and services are less expensive each time the U.S. Dollar falls. On the other hand, a falling U.S. dollar depreciates the value of the U.S. government, so investors and countries that are holding this debt may sell part of their holdings to find higher returns. If this happens it tends to raise interest rates on this debt, which can cause the U.S. to experience higher inflation and raises the cost of our own debt. The best scenario is stability in the U.S. dollar which allows investors to have more confidence in their holdings.

3. Oil is trading around $105 a barrel. As mentioned part of this high price is due to the falling U.S. Dollar, as oil is priced in that currency. Part is due to concern that Veneuzela, Ecuador and Columbia will exclate the current sabre rattling and actually go to war. It looks like this risk is now over as the presidents of the countries involved have backed asay from their threats and now seem to want to avoid further confrontation. But such is the story of oil. There seems to be new problems poking its head up all over the world when there are large reservors of oil.

And part of the higher price in oil is due to speculators buying on expectation of higher prices. Opis Speaking of Oil by Tom Kloza provided this insight. The following is from the government report (published weekly by the Commodities Futures Trading Commission or CFTC).

The CFTC refers to speculators as non-commercial entities -- there is about $24-billion more money bet on higher crude oil, gasoline, and heating oil prices than is wagered on a lower price outcome. The typical large speculator that has bet on higher crude prices holds a position of 3,000 futures contracts, or a nice tidy clean number of 3-million bbl worth of WTI or more than $300-million worth of crude!

There are 99 of companies that comprise this group. And as Tom said, “In the casino business, they would be known as whales.” The whales can and do move the market. Then they move on to the next thing that interests them and the market gets back to normal.

We will see when and if the price of oil falls as predicted by T. Boone Pickens.

4. The index of Leading Economic Indicators (LEI) continues to plunge, and is not far away from levels last seen in 2001. Such a drop by the LEI has always been accompanied by a recession. U.S. leading index decreased 0.1 percent which is the fourth straight month of declines.

5. Personal income for the average U.S. consumer rose by the same amount as inflation, around 0.4%, and with rising energy and food costs, it is no wonder that retail sales are down and falling. The savings rate is still negative, which means consumers are using savings to maintain their consumption.

If this doesn't convince you then the world's richest man, Warren Buffett recently said that any reasonable person believes the U.S. is in a recession.

Going Down from Here

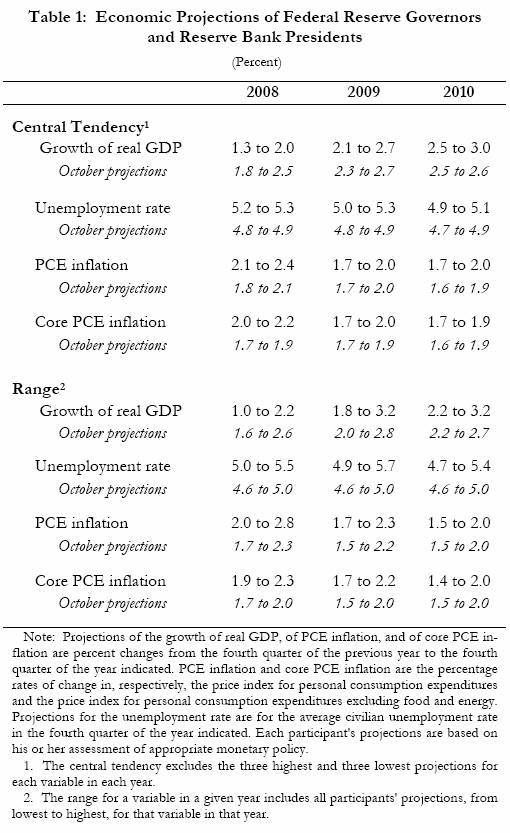

The Federal Reserve has some of the best economists, so it pays to listen to what they have to say. The table below is from the minutes of the Federal Open Market Committee (FOMC) held January 30-31, 2008. As you can see the average Fed member is more bearish now than they were in October. For those of you inclined to read the minutes they are available at this link. http://www.federalreserve.gov/monetarypolicy/files/fomcminutes20080130.pdf

The Fed's Central Tendency forecast indicates that the U.S. GDP will be 1.3 to 2.0 % for 2008 down from their forecast of 1.8 to 2.5 in October. It looks like their forecasts are trending down which is not a good sign, especially given the further weakness we are now seeing. I suspect we will see an even lower forecast in the release of the minutes from their next meeting in March.

Of further concern is the upward trend in inflation as measured by the Core PCE now projected to be 2.0 to 2.2 up from 1.7 to 1.9. First, this is now above the Fed's own target for inflation which is believed to be below 2.0. Second, with the January Consumer Price Index reports in at 4.3% tells us that inflation is rising not falling. However, the Fed expects inflation to fall further later in 2008. Perhaps this is because the economy will be much weaker than it is now, which will cause downward pressure on prices, helping to reduce inflation. This is usually what happens during a recession. If so, then that means they really expect much slower growth. An interesting conflict in their forecasts.

If we see further rate cuts, and many analysts believe there will be, then it is a sign the Fed is even more worried about economic growth and not as worried about inflation. Moreover, do not expect the Fed to predict we are in or about to enter a recession. First, the markets are likely to react much more negatively to such an announcement and the Fed would not want to take the blame. Second, even though the Fed is an independent agency it still must report to the Congress. The Fed needs to keep its independence, so it is very unlikely to forecast the economy is going into a recession. If they did so, many in congress would want to take away some of their power, thinking the elected representatives could do better. Talk about out of the frying pan and into the fire, or how to make a bad situation worse.

Looking for the Bottom

The bear market started with the problems in the mortgage industry that are spilling over into other parts of the credit arena. Banks and investment firms must have the necessary liquidity to meet their margins calls and provide sufficient capital to remain a going business. As a result, investors keep trying to determine if the problems in the mortgage business will end any time soon.

The bear market started with the problems in the mortgage industry that are spilling over into other parts of the credit arena. Banks and investment firms must have the necessary liquidity to meet their margins calls and provide sufficient capital to remain a going business. As a result, investors keep trying to determine if the problems in the mortgage business will end any time soon.

As of November, housing was down 8.4%. It is certainly worse now, but that is a place to start for this discussion. The question is, how much further down can it go. Goldman was the firm that saw the problems in the mortgage business coming and managed to short some of the market, thus avoiding the hit to earnings that other financial firms encountered. According to Goldman if there is no recession, the housing market will fall by 15%. On the other hand, if there is a recession, then housing prices could fall by 30%. Ouch! That is substantially more than the 8.4% experienced up through last November.

Along comes First American (FAF), who has calculated how many homeowners will be experiencing negative equity in their homes if the prices fall 15% and then 30%. It is not a good picture as the table below shows.

TOTAL % DECLINE IN HOUSING PRICES |

PERCENT MORTGAGES WITH NEGATIVE EQUITY |

8.4% (today) |

13.5% |

15% (No Recession) |

21% |

30 % (Recession) |

39% |

If this forecast from Goldman and the analysis from First American is correct, then by the end of November 13.5% of the mortgages outstanding are backed by homes with negative equity. This not much of a surprise, since many of the mortgages that have been written in the last few years were with little or no money down. All parties counted on the appreciation in homes to continue. When the value of the house falls, the borrower is paying for an asset that is worth less than the outstanding loan(s). This causes people to walk away from their commitments and the house goes into foreclosure.

If Goldman's prediction of a 15% decline in the value of housing , then 21% of the outstanding mortgages will be backed by negative equity. Moreover, this is without a recession. However, we are in a recession, so, according to Goldman, we will see a 30% decline in the value of homes; and with it, 39% of the mortgages will be backed by negative equity.

This means the financial crisis we are now experiencing has more to go. There are going too be more unhappy surprises coming from the financial sector as this problem works through the system. Keep in mind that more defaults on these loans cause the banks and other owners of these credits to experience losses that must be written off. These write offs cause the the institutions to either sell off their good loans or sell additional equity to meet the minimal capital requirements. But no one wants to buy these loans, since they are having the same problem. It creates a vicious cycle that brings down the good firms along with the bad. It also makes borrowing more difficult as rates climb even for the firms with the best of credit. The recent implosion by Bear Stearns is just one example.

The Fed sees this, which is why they are providing $200 billion in emergency credit and backing the bail out of the Bear Stearns investors. But so far that hasn't fixed the problem. I suspect that we will see more failures that will then cause them to buy more of these securities to get them off the books of these firms. In the mean time the economy will suffer even more.

What Should You Do

This situation will create the best buying opportunity in a decade. So you should remain invested. But the question is where and how to protect your portfolio from a complete meltdown.

Investors should look for companies that have solid fundamentals with global exposure, so the problems in the U.S. are lessened. Many of these companies have already lost much of their stock price value and are likely trading at discounted prices. Perhaps, they are forming a strong technical base while they continue to grow their earnings. They seem to be holding their own as everything around them continues to melt down further. Should the market turn they are likely to move up nicely. Cisco Systems (CSCO) is one such firm.

Once you have identified such companies and decide to take positions, you should protect your positions from further moves down.. Covered call options are a low risk way to provide some down side protection while generating an additional return. You could also buy puts that provide more dpwn side protection in case the price of the shares of your stocks fall further. These protective puts provide more down side protection much like insurance. And finally set stops at points where you do not want to experi3nce any more losses incase the market takes everything down.

In addition you can short the market using many of the Exchange Traded Funds (ETFs) that short either a sector or the market overall such as the Proshares Short S&P 500 (SH).. There are even ETFs that will give you twice the move in the market such as Proshares Ultra Short S&P 500 Exchange Traded Fund (SDS), the Proshares Ultra Short QQQ ETF (QID) and the Proshares Ultra Short Russell 2000 (TWM). These provide further down side protection for your entire portfolio. Sector specific shorts like the Proshares Ultrashort financial (SKF) is just one example. Look to enter these short funds on any riase in the market to an interim high and/or resistance level.

This approach will position your portfolio to be ready to take advantage of the move up when it finally comes. In the mean time you have down side protection and you might even grow the size of your portfolio in a bear market.

Vitaliy Katsenelson's book Active Value Investing: Making Money in Range-Bound Markets (Wiley Finance) helps to break down into three key pieces what you need to look at when analyzing a company: Quality, Valuation, and Growth (QVG). For some ideas on how to use options you might consider Options Made Easy: Your Guide to Profitable Trading (2nd Edition) by Guy Cohen. It is an easy read that helps investors understand options.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.