Stock Market Going the Wrong Way for the Bulls

Stock-Markets / Stock Markets 2013 Jun 07, 2013 - 02:13 AM GMT SPX broke its 50-day moving average at 1605.00 a short while ago. It is now retesting its 50-day and may rise above it to the hourly Cycle Bottom at 1613.00. The SPX now has permission to Flash Crash once it loses its grip on the 50-day.

SPX broke its 50-day moving average at 1605.00 a short while ago. It is now retesting its 50-day and may rise above it to the hourly Cycle Bottom at 1613.00. The SPX now has permission to Flash Crash once it loses its grip on the 50-day.

Just a month ago we broke above the magical 1,600 level on the S&P 500... today we broke back below, with the index now down over 5% from its 5/22 highs. From a technical perspective, the Nikkei 225 is below its 100DMA, and the Dow and S&P 500 just broke below the 50DMA. VIX has risen, now back above 18% (highest in over 3 months). No Hindenburg Omen signal (yet). What we worry about is that everyone is focused on tomorrow's NFP print as some panacea for "Taper." This is incorrect. The "Taper" jawboning from the Fed is because they are increasingly fearful of the bubbles they have created…

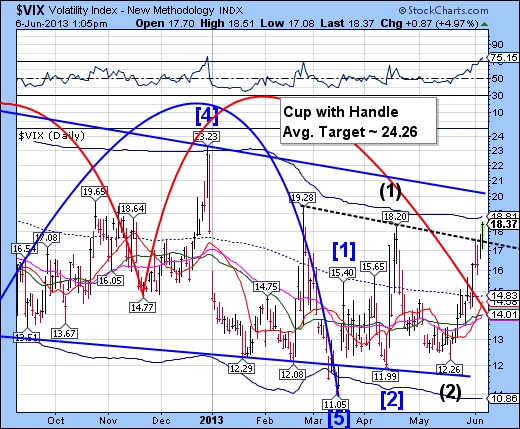

The VIX has now triggered its Cup with Handle formation with a target of 24.26.

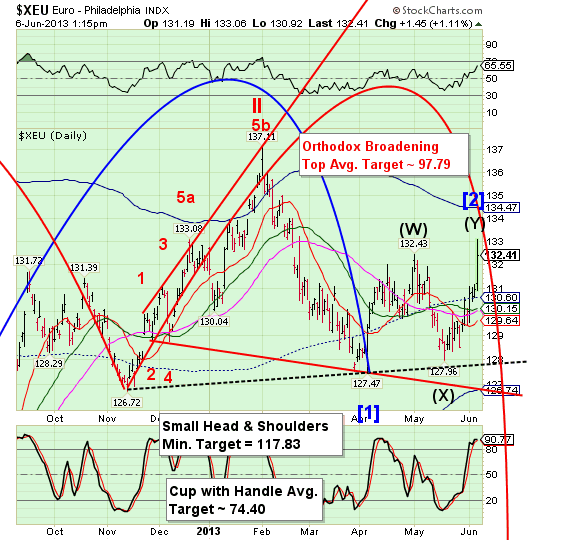

XEU has completed a complex rally to run the shorts. The Euro is within 24 hours of a turn and may have already begun it. This appears to be a Trading Cycle high. That may be a set-up for a Primary Cycle “Panic Decline” through the end of June.

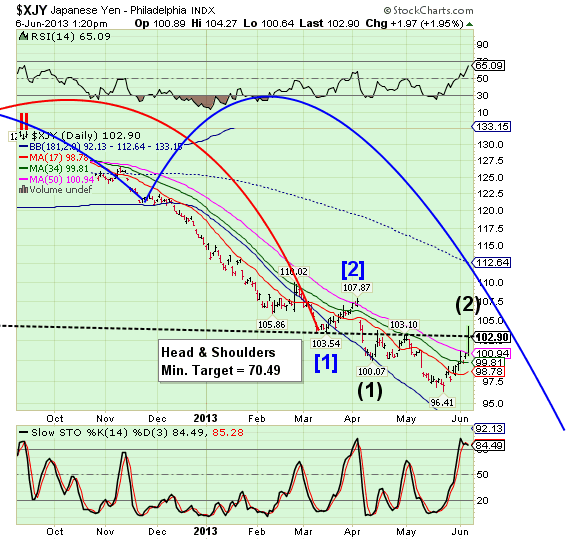

XJY is also running the shorts today. It has revisited its Head & Shoulders neckline and is likely now to reverse hard down. If it Flash Crashes, we may see the low as early as Wednesday.

JPY's biggest daily gain in 3 years!!

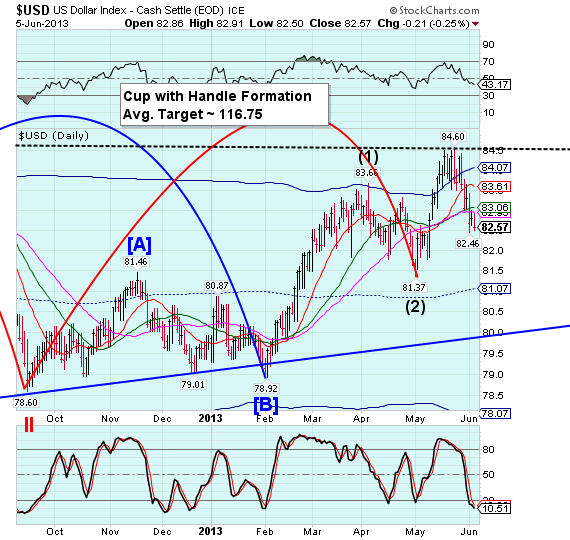

US Dollar futures declined to 81.08 and reversed higher as the PTB are running the stops on the longs. This market is not for the weak of heart. By the way, this move just extended the Master Cycle low to today.

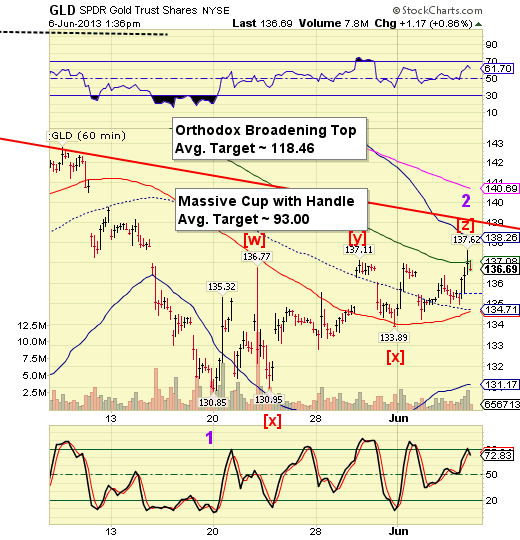

GLD has made a very complex correction to discourage the shorts.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.