Stock Market Margin Buying Surpasses 2007 Danger Levels – Another Crash Coming?

Stock-Markets / Financial Crash Jun 06, 2013 - 03:34 PM GMTBy: Money_Morning

Gary Gately writes:

There's nothing like buying securities with money you don't have - or, more precisely, with borrowed money from your broker, with your investments as collateral.

Gary Gately writes:

There's nothing like buying securities with money you don't have - or, more precisely, with borrowed money from your broker, with your investments as collateral.

It's called buying on margin, and it's soaring as the market continues its tear and speculative investors seek a piece of the action. As your stocks appreciate you can borrow even more. A market rally lets you expand your portfolio by piling on more debt.

But it's potentially dangerous and could portend a stock market crash.

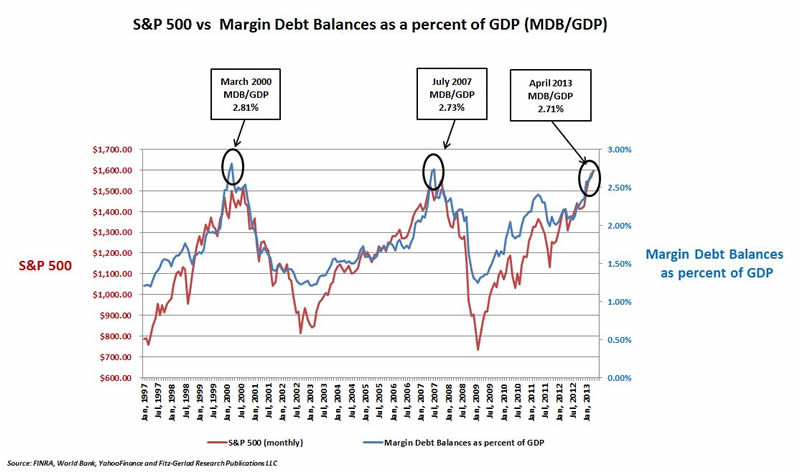

As the accompanying chart shows, historically there has been a direct link between a surge in margin loans and corresponding stock market peaks - followed by sharp declines in the markets.

So it's no small matter of concern that the Financial Industry Regulatory Authority reports the amount owed on loans secured by investments climbed to a record high $384 billion at the end of April.

That topped the previous high - $381 billion in 2007, not coincidentally, just before the financial meltdown and the Great Recession.

As a percentage of the economy, the latest margin borrowing totaled 2.71% of gross domestic product.

By comparison, margin borrowing hit 2.73% of GDP in July 2007, during the housing bubble, and 2.81% in March 2000 during the tech bubble, which was followed by a stock market crash.

"Very Much a Danger Sign"

So how should investors view the latest figures on margin borrowing?

"They're very much a danger sign," Money Morning Chief Investment Strategist Keith Fitz-Gerald said. "From a technical perspective, margin borrowing has risen to levels that we know are consistent with major corrections."

But Fitz-Gerald pointed out, "Investors need to learn to review the figures just like a big road sign. It doesn't stop you from driving down the road. It just says 'potential hazard ahead.'"

In margin lending, investors who take out margin loans get cash from their broker, with their investments as collateral, and can use the cash to pay for other investments.

Brokers set a minimum value of equities an investor must keep in an account, and if the account dips below this level as stocks depreciate they can issue a margin call requiring the investor to put more money into their account - or force them to sell securities to cover the margin.

"The problem with margin is that it magnifies the risks you take," Fitz-Gerald said. "Your profit potential is huge but then so is your loss potential unless you know how to manage that risk properly.

"Most retail investors simply do not understand what it is they're getting into and they fall prey to these very seductive investment ads coming out of Wall Street that are designed for one purpose and one purpose only: to separate them from their money."

Depression-Era Margin Calls

Today, an investor's minimum margin requirement - set by the Federal Reserve - is 50%, much higher than margins that had been as low as 10% during the 1920s. This means today you can buy $10,000 of stock by borrowing $5,000 from your broker on margin.

Back then, when the market started to contract and investors got margin calls they couldn't cover, their shares were sold, leading to more market declines and more margin calls.

This phenomenon was a major contributor to the 1929 market crash and the Great Depression, Fitz-Gerald noted.

"Investors started taking assets that they needed and they started leveraging them into investments that they arguably didn't need," he said, "and when we had the big crash, people found out the hard way that it's awfully hard to pay back loans you have with assets that depreciate in value."

Source :http://moneymorning.com/2013/06/05/margin-buying...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.