Stock Market SPX, VIX Winding Up For Bearish Punch

Stock-Markets / Stock Markets 2013 Jun 04, 2013 - 10:50 AM GMT The SPX moves may appear disappointing at first glance. However, there is a lot of coiled up energy stored in these moves. All of these waves are impulsive and no matter how much they are being fought against, the waves are grinding down the opposition.

The SPX moves may appear disappointing at first glance. However, there is a lot of coiled up energy stored in these moves. All of these waves are impulsive and no matter how much they are being fought against, the waves are grinding down the opposition.

I have found that, when estimating the length of Wave threes, they are often a multiple of the cumulative wave ones. In this case, the cumulative value is 65 points, so the next wave down (assuming it’s a three) may have a minimum length of 130 points.

That may give SPX enough downside energy to break through both Intermediate-term support at 1618.21 and the 50-day moving average at 1601.54.

The downside target may be in the range of 1499.00 to 1510.00, below the smaller Orthodox Broadening Top. The bounce from that low may be contained by the Weekly Diagonal trendline, just below 1575.00. Remember, the SPX is still in throw-over territory in the weekly Ending Diagonal.

Once below the 50-day moving average, the speed of the decline may pick up. Those that are still bullish (there are many of them) may have a change of heart at that point.

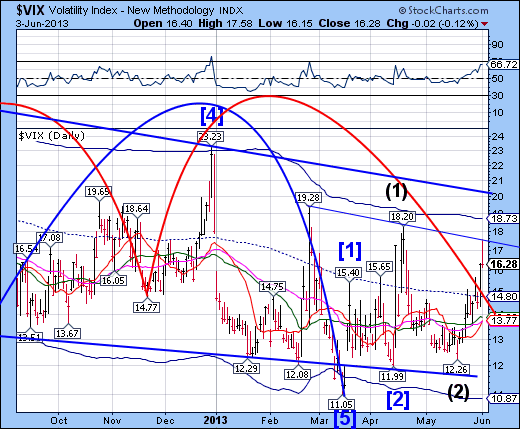

VIX has nearly made its Head & Shoulders target and it has not completed its pattern yet.

What seems to be holding the VIX from going higher at the moment is a small Diagonal formation that must be broken through. Once accomplished, the larger Diagonal formation must also be dealt with. The coiled up energy in the VIX may just do that very soon.

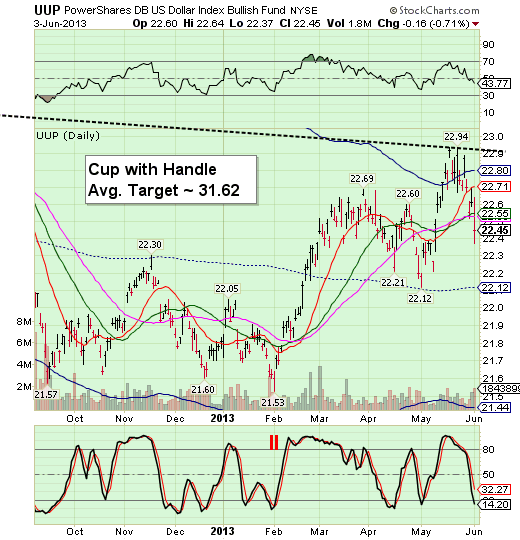

UUP is just completing a Trading Cycle low. The turn date for the new rally is tomorrow. There is a high correlation between the USD/UUP and the VIX. It appears that UUP/USD may have a breakout above the Lip of its Cup with Handle, which portends to be a very powerful move.

It just occurred to me that this may be the catalyst for the breakout in VIX and breakdown in SPX.

Good luck and happy trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.