Interesting Development with Gold and Gold Shares

Commodities / Gold & Silver Stocks Mar 20, 2008 - 04:06 AM GMTBy: Brian_Bloom

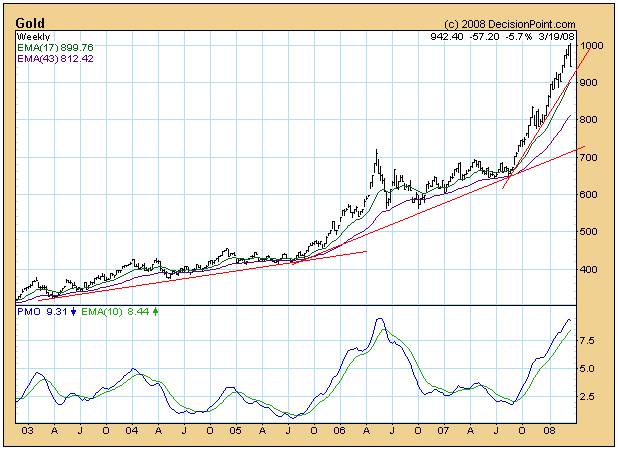

Have a look at the green Relative Strength Charts below. Either the shares need to (soon) start rising relative to gold or the gold price needs to start falling relative to the shares. If the gap in the gold price chart below (at around $850 per ounce) is covered, that will be a very healthy development.

Have a look at the green Relative Strength Charts below. Either the shares need to (soon) start rising relative to gold or the gold price needs to start falling relative to the shares. If the gap in the gold price chart below (at around $850 per ounce) is covered, that will be a very healthy development.

(weekly and monthly, courtesy decisionpoint.com )

Now look at the Relative Strength chart of the 10 yr vs 5 yr bond yield. Has the exponential blow-off peaked?

If so, will short dated yield rise or will long dated yields fall?

Now there's an interesting question!

Have a look at the chart below, in particular at the rising PMO trendline.

If I was a betting man, I would bet that the markets will come down in favour of rising long term yields.

Would this be a sign of inflation expectations, or fear of US Dollar collapse and withdrawal by foreigners of capital?

Can't answer that yet. Dollar looks due for a bounce.

My view is we're heading for a re ali sation that the credit crunch (at least in the USA ) is real. The US Fed can't reasonably expect on the one hand to keep behaving irresponsibly by just ‘printing' money whenever someone (like Bear Sterns) hits a speed wobble and, on the other hand, just expect foreigners to keep providing the funds by subscribing to Treasury Bonds.

I think that's why gold tanked. It was the only way for the Fed to “show” that the markets are still under their control – which, of course, they are not.

I can see the possibility of gold falling to $850 (maybe as low as $750 - $800 in terms of the chart below) in a nice, healthy pullback. I can also see the gold shares stabilising. If/when the gold price starts to rise from $850 THEN the share investors will re ali se that the rise is “real”. THEN the shares will start to seriously outperform the gold price.

Somehow, this scenario feels right. The gold price should really pull back given the high level of the PMO. That would be a healthy development from an international perspective – but would probably signal that the days of hedonism in the USA are over. The US Stock market is not healthy. I stick by my view that the Primary Direction is “down”

Have a look at the weekly chart of the SPX below. The actions of the Fed hardly made a dent in the grand scheme of things. We might have a (temporary) upward reaction, but it doesn't look to me as if the maginot line at around 1380 will be penetrated on the upside. There's time to breath. Time to sell out of industrials and buy into gold shares.

Cheers

By Brian Bloom

Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which is targeted to go to the printers within 4-6 weeks.

Interested parties will be emailed with a personal invitation to place their order/s for Beyond Neanderthal – which will be processed and delivered by Austr ali a 's largest independent book distribution group. To avoid disappointment, please register your interest to acquire a copy of the novel at www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.