The Case for Stock Market Being at a Major Turning Point

Stock-Markets / Stock Markets 2013 Jun 03, 2013 - 02:41 PM GMTBy: Simit_Patel

Last Friday I shared some thoughts regarding the potential turn in the US Treasury bond market. As many markets are correlated, it would be worth looking for reversal signs in other markets. And in fact, I believe such signs are in place in the S&P 500.

Last Friday I shared some thoughts regarding the potential turn in the US Treasury bond market. As many markets are correlated, it would be worth looking for reversal signs in other markets. And in fact, I believe such signs are in place in the S&P 500.

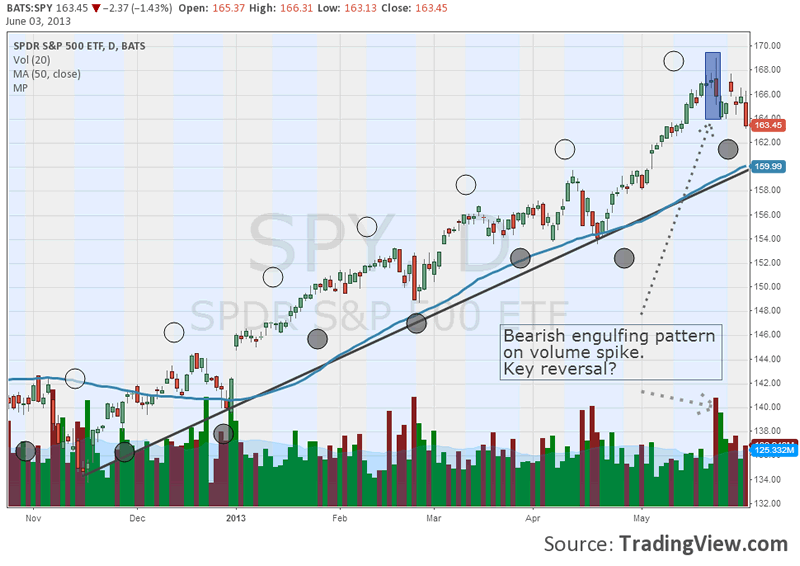

See the chart below. We see a bullish engulfing pattern and a volume spike, which signals to me potential exhaustion of the upwards trend.

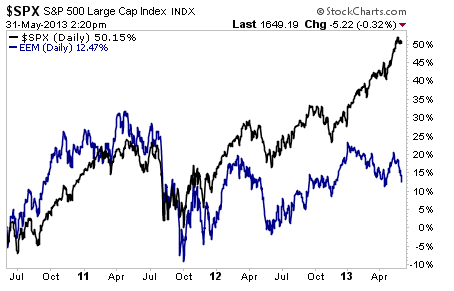

Also worth noting is the divergence between emerging market stocks and the S&P 500; emerging market equities have already turned, as the chart below illustrates. (via ZeroHedge)

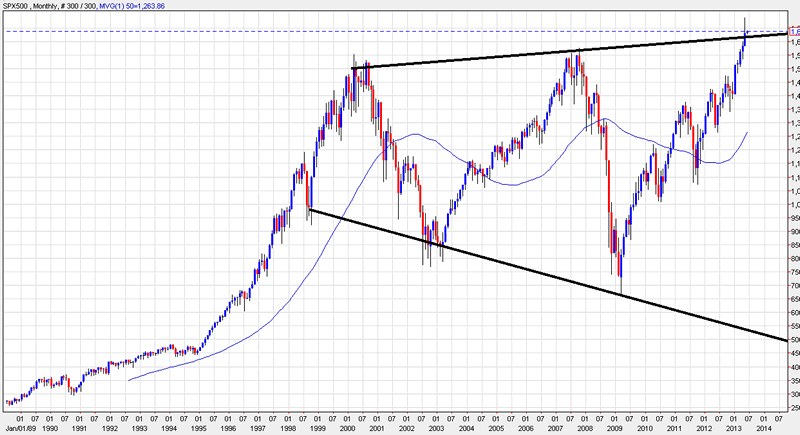

Lastly, I think it is worth mentioning that we are still in the vicinity of the potential long-term megaphone pattern.

What do you think?

By Simit Patel

http://www.informedtrades.com

InformedTrades is an online community dedicated to helping individuals learn to trade the world's financial markets. Members earn prizes for sharing their knowledge, and the best contributions are compiled into InformedTrades University, the largest collection of free organized

learning material for traders on the web.

© 2013 Copyright Simit Patel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.