The Silent Killer of Every Bull and Bear Market

Commodities / Gold and Silver 2013 May 31, 2013 - 06:59 PM GMTBy: Clif_Droke

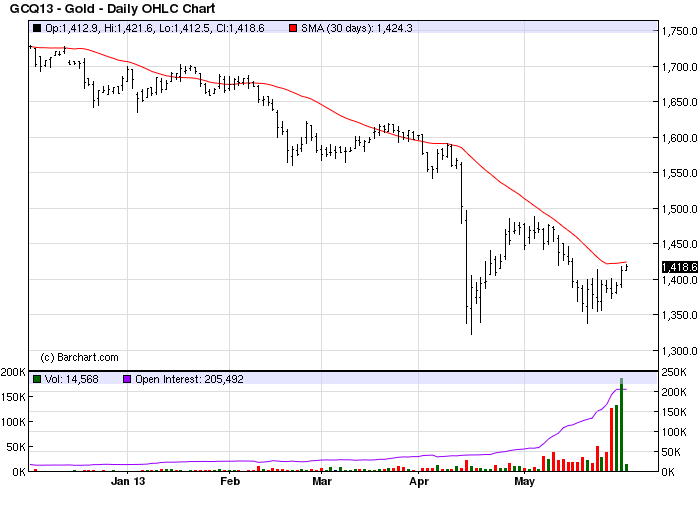

Stocks have reached record levels thanks in large part to a coordinated central bank stimulus. The current financial market-led recovery is unlike previous recoveries in that the economy, unlike the stock market, has been painfully slow to respond to the stimulus. Gold also hasn’t benefited this time around, which is partly attributable to the fact that it’s still deflating some of the excess from its speculative bubble of previous years.

Stocks have reached record levels thanks in large part to a coordinated central bank stimulus. The current financial market-led recovery is unlike previous recoveries in that the economy, unlike the stock market, has been painfully slow to respond to the stimulus. Gold also hasn’t benefited this time around, which is partly attributable to the fact that it’s still deflating some of the excess from its speculative bubble of previous years.

Gold also has failed to capture investor interest this time around owing to the mini-mania for dividend yielding stocks. “Gold doesn’t pay a divided” is the mantra these investors chant when confronted with the metal’s long-standing safe-haven status. At some point, however, gold’s declining fortunes will reverse and the investors currently ignoring gold will come to see its value again.

Overlooked in the analysis of what makes –and breaks – an asset bubble is the single most important indicator: price. Rising prices is what ultimately attracts most investors’ attention, more so than valuation and other fundamental concerns. Price is a double-edged sword, however; while it serves to entice investors on the upside, it eventually evokes its own reversal if it continues rising long enough. When an asset becomes too pricey, investors begin to lose interest simply because the asset becomes unaffordable or otherwise undesirable at such lofty levels. This truism applies in all cases to all markets, whether stocks, bonds, commodities or even gold itself.

In the typical lifecycle of a bull market the small investor will join the party at some point, unable to resist the allure of rising prices. The average investor has fun while watching his investment grow. He tends to move in and out of the market during the bull run, which explains why at some point he can no longer justify buying back in at extremely high levels. It’s the big-money institutional investors who stick out a bull market to the end, mainly because they’re the only ones who can afford it. But a bull market’s days are numbered when only the big-money players are involved. The big money, after all, has to have someone else to sell to – they can’t keep a bull market alive for very long by selling among themselves. This is one reason why gold peaked in 2011, although the end was definitely aided by the tightening of margin requirements.

A bear market is much like a bull market in its psychological allure – only in reverse. Just as the institutional crowd is the last to leave the party in a bull market, they’re among the first to get things moving at the end of a bear market. Attracted by low prices and valuations, they’re early (and at time premature) buying paves the way for the commencement of a new cycle. The rising prices generated by their collective buying eventually captures the attention of the public and before long a new bull market is underway.

At what point does gold become attractive, then, to institutional investors? One way of discerning this is by staying abreast of the research reports and commentaries of top flight analysts and fund managers. They’ll often throw out hints as to what downside price targets they’re watching for buying opportunities. In recent weeks I’ve read more than one analyst mention $1,250-$1,300 as an area where gold purchases would become attractive to them.

Meanwhile there is talk in the financial press that both stocks and bonds have entered a “bubble” phase. These concerns are increased with the fear that the Fed will taper off its QE stimulus program sooner than anticipated. PIMCO, the world’s largest bond investment company, recently warned of a sharp drop in risk assets if economic growth turns out to be much worse. The bull market in stocks will be especially vulnerable to bad news and economic shocks later this summer when a series of weekly Kress cycles is scheduled to peak. This could portend a turning point both for stocks and for gold.

As Barclays pointed out, the strength in gold’s physical demand has somewhat mitigated recent outflows in gold-backed ETFs. The outflows have amounted to some 39 tons during the first week of May and nearly 380 tons for the year to date. Barclays believes, however, that there is a bigger risk of the physical demand slowing down instead of the ETF flows bouncing back in the near term. “Nevertheless,” as Sharps Pixley points out, “central banks will again be the supporter of gold prices at lower prices.” I would add that if gold does indeed reach the $1,250-$1,300 area by summer, we should also see institutional support come to the rescue.

According to CFTC data, speculative short positions for gold – the so-called “dumb money” – remain at its highest level since 1999, the previous long-term low for the yellow metal. By contrast, the commercial interests – the “smart money” in the gold market – have built up a large net long position in gold since 2008. This is another future potential support for gold as major short covering will ensue at some point.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the year 2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.