Singapore and Indian Gold Brokers Sold Out

Commodities / Gold and Silver 2013 May 29, 2013 - 11:29 PM GMTBy: GoldCore

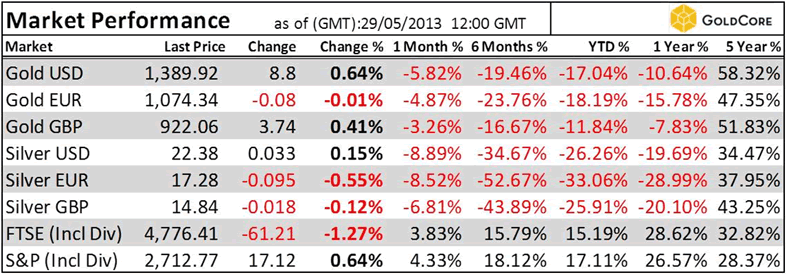

70 or 0.98% yesterday to $1,381.00/oz and silver finished down 1.59%.

70 or 0.98% yesterday to $1,381.00/oz and silver finished down 1.59%.

Gold edged higher today supported by strong physical demand internationally and especially in Asia.

Demand in the physical market continued to hold prices near $1,400/oz as the recent drops in the spot market encourage buyers internationally to accumulate bullion.

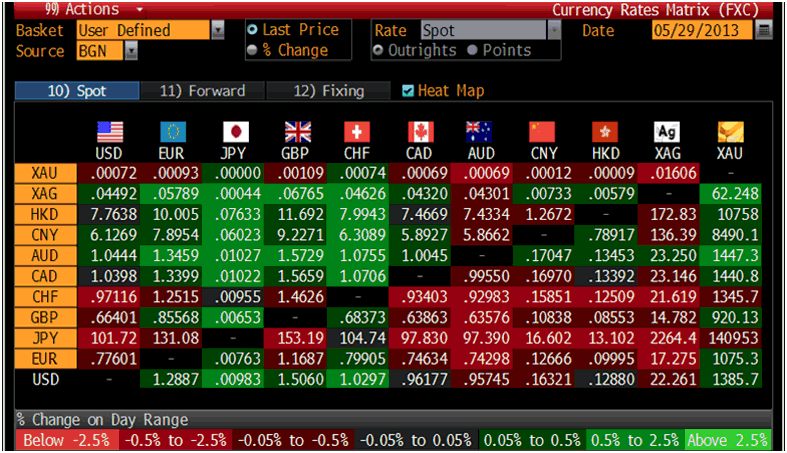

Cross Currency Table – (Bloomberg)

The paper gold market remains volatile and is likely to get more volatile but this is not deterring physical buyers and premiums remain strong in most markets.

Premiums in India and Hong Kong have fallen from the very high premiums of recent days but Singapore, Shanghai, Dubai, Turkey and western markets continue to see high premiums.

Overnight the volume for the Shanghai Gold Exchange’s cash contract surged 55% to 15,641 kilograms from a two-week low of 10,094 kilograms on May 27.

The Shanghai Futures Exchange announced yesterday that they will begin after-hours trading for gold and silver futures within one or two months.

In Singapore, gold coins and bars are being sold at high premiums compared to the spot price as there is not enough supply in the market to meet the strong demand.

Reuters quoted one broker who said that most of the bullion dealers in Singapore were sold out of bullion and that "everybody is buying and no one is selling."

In India, certain states have either seen coin stocks fall to very low levels and others have actually run out of gold coins.

The drop in gold prices in April led to a surge in bargain hunting in India and globally which is continuing with prices below $1,400/oz.

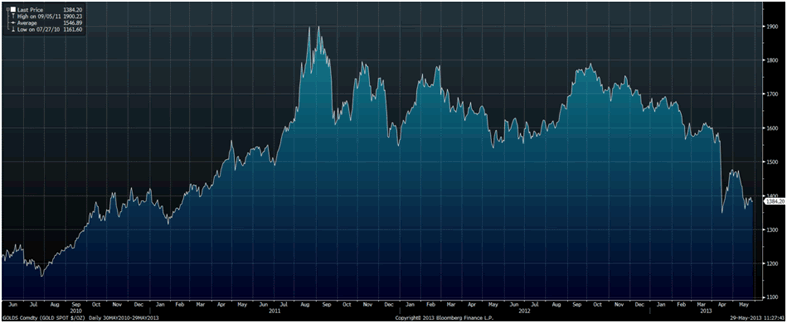

Gold Spot $/oz, Daily, 3 Year – (Bloomberg)

In Hyderabad, a city of nearly 7 million people , gold and jewellery shops in the city have dwindling stocks of gold coins and bars. Some have completely run out of stock of the best-selling gold coins while others are having to ration their remaining stocks.

The gold rush is expected to continue for some time, due to delays in jewellery and coin shops receiving supplies of coins from banks and bullion brokers.

This is creating a delay in the entire supply chain.

The U.S. Mint sales of gold coins were the highest in 3 years after demand surged on the recent price drop.

Yesterday, the U.S. Mint resumed sales of their 1/10th ounce gold coin after the mint ran out of inventory last month and suspended sales amid record demand.

In the U.S., there are difficulties in sourcing British Sovereigns (0.2345 oz), Chinese Pandas (1 oz) and Australian Kangaroos (1 oz) in volume.

The Royal Mint (UK), The Perth Mint in Australia and other mints are seeing record levels of demand.

This morning The World Gold Council confirmed the very strong demand being seen globally and especially in Asia.

Asian gold demand from this April to June will reach a quarterly record as bullion buyers in China, India and the rest of the region take possession of supply freed up by selling from exchange-traded funds (ETFs), the WGC said.

"Asian markets will see record quarterly totals of gold demand in the second quarter of 2013," WGC Managing Director Marcus Grubb said in a report released this morning.

Gold demand in India, the world’s largest buyer, is heading for a quarterly record after prices fell to a two-year low in April, The World Gold Council said.

"Even if ETF outflows continue in the United States, it is quite likely that the gold previously held in ETFs will find a ready market among Indian, Chinese and Middle Eastern consumers who are taking a long-term view on the prospects for gold."

A long term view remains vital to protecting and growing wealth today.

It remains prudent to ignore the poorly informed analysis of the speculators who have been responsible for much of the destruction of wealth in recent years.

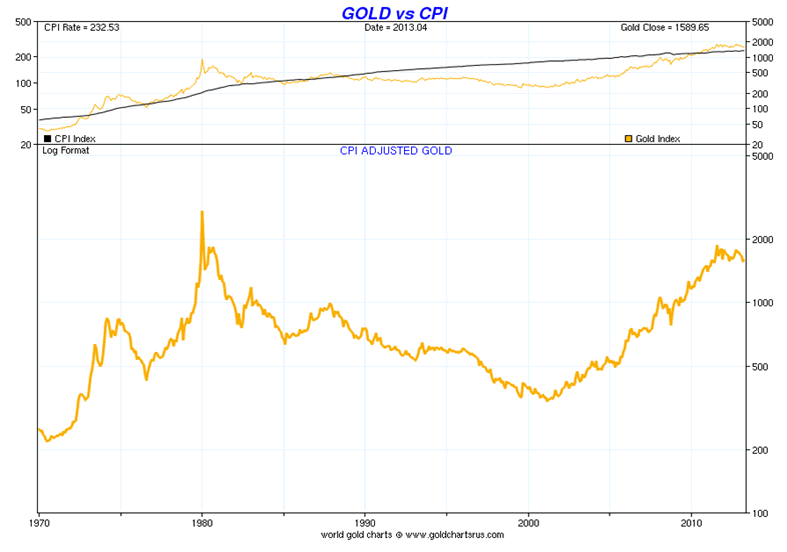

Few of them predicted this crisis and most do not understand the importance of diversification and the importance of gold as a safe haven asset. Nor do they know that gold remains nearly half its inflation adjusted high of $2,500/oz seen in 1980 (see chart) and the ramifications of that for the gold market in the coming months and years.

Those who continue to focus on gold’s academically and historically proven safe haven qualities as an important diversification will again be rewarded in the coming months.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.