Belgian Central Bank Loans Out 10% or 25 Tons Or 10% of Gold Reserves

Commodities / Gold and Silver 2013 May 28, 2013 - 06:56 PM GMTBy: GoldCore

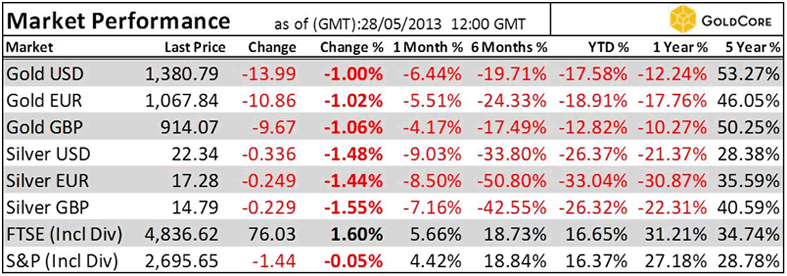

Today’s AM fix was USD 1,379.00, EUR 1,067.42 and GBP 913.43 per ounce.

Today’s AM fix was USD 1,379.00, EUR 1,067.42 and GBP 913.43 per ounce.

Friday’s AM fix was USD 1,385.25, EUR 1,068.95 and GBP 917.81 per ounce.

Yesterday a national holiday was observed in both the United Kingdom and the USA.

Gold is lower in all major currencies except the yen which is under pressure today due to ‘Abenomics’ concerns and concerns of further yen debasement.

A firmer dollar and buoyant stock markets may be contributing to gold being under pressure.

Gold is being supported by continuing currency wars and consequent diversification from central banks and robust physical demand which is countering continued ETF liquidations.

Gold Spot $/oz, Daily, 28May1995-28May2013 – (Bloomberg)

Technical analysts say that we have experienced a tradable bottom above $1,300/oz after the double bottom of April 16 and May 20. However, in the short term further weakness is possible and gold could test support at $1,300/oz.

The long term fundamentals remain sound and will support gold.

One of these fundamentals is central bank demand and gold will be supported by the news that

Russia, Greece, Turkey, Kazakhstan and Azerbaijan expanded their gold reserves again in April.

These central banks bought bullion to diversify foreign exchange reserves amid continuing concerns about the euro, the dollar and currency devaluations.

The Belgian Central Bank said yesterday that about 25 tons of the European nation’s gold reserves have been lent to bullion banks according to Bloomberg.

Nearly 10% or about 25 metric tons of the National Bank of Belgium’s remaining 227.5 tons of gold reserves are currently lent to bullion banks, Director and Treasurer Jean Hilgers told the central bank’s annual meeting in Brussels.

The proportion of gold reserves on loan declined from 84.3 tons on December 31, 2011, and averaged 48.1 tons in 2012 as loans matured and some gold loans were reimbursed early.

Hilgers said that the Belgian central bank sees gold lending decreasing further this year.

The National Bank of Belgium may be nervous regarding their gold loans and may be seeking their repayment early. They will be aware of the great difficulty that the Bundebank is having repatriating their gold reserves and the bizarre fact it will take the Federal Reserve seven years to return the German gold reserves stored in the U.S. to Germany.

Belgium is one of the central banks that sold substantial amounts of their gold reserves during the 1990’s – prior to the advent of the euro.

Belgium, Argentina, Australia, Canada, the Netherlands and of course the UK were the notable gold sellers of the period. These central banks disposed of gold in a variety of ways, including direct sales to other central banks or through bullion bank intermediaries using spot and forward sales, options, and derivatives.

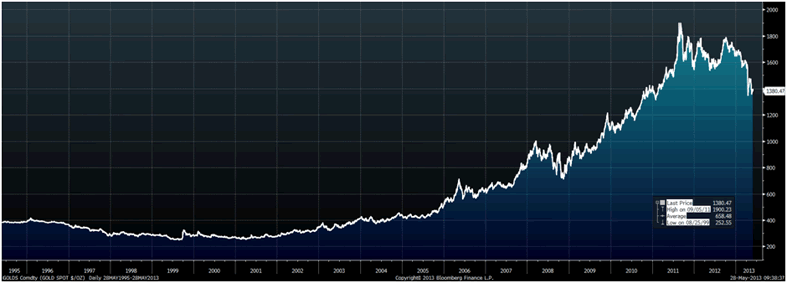

IMF Belgium Gold in Mill Fin Troy Oz, 1957 to May 2013 – (Bloomberg)

During the 1990’s, Belgium sold some 1,000 tons of gold into the market - more than three quarters of its remaining holdings. The Belgian gold reserves, which had already seen sizeable liquidation in late 1978, fell from 33.7 million ounces on 12/31/88, to just 5.7 million ounces on 03/31/98, or a fall of 83% in less than 10 years (see chart).

Since the start of 1996, when gold prices trended downward, some of the sharpest falls in prices coincided with central bank announcements of sales.

All except the UK announced their gold sales only after completion of their gold sales programmes.

This is in marked contrast to the Bank of England’s very public gold auctions and Gordon Brown announcing the sale of the UK gold reserves prior to the auctions thereby depressing the gold price and pushing it to multi year lows.

The Gold Anti-Trust Action Committee (GATA) allege that the gold sales were not simply about foreign exchange diversification, rather they were designed to manipulate gold prices lower and reduce public confidence in gold as a store of value so that there would be increased trust in the dollar, the coming euro and other fiat currencies.

The National Bank of Belgium sold gold on five occasions since 1989. Belgium announced on March 22, 1989, that it had sold 127 tons of gold. On June 17, 1992, it announced it had sold 202 tons of gold.

On April 24, 1995, it said it had sold 175 tons in order to increase its foreign exchange holdings.

Belgium announced another sale of 203 tons of gold on March 27, 1996, stating that the sale had reduced the share of gold in total reserves to a level which would facilitate the participation of the National Bank of Belgium in the process of European unification and which, corresponded to the proportion of gold in the total reserves of the Member States of the European Union.

Further sales of 299 tons of gold were announced on March 18, 1998 just prior to the introduction of the euro and the monetary union. The bank said at the time that the capital gain from the gold sales was used to repay government debt in foreign currencies.

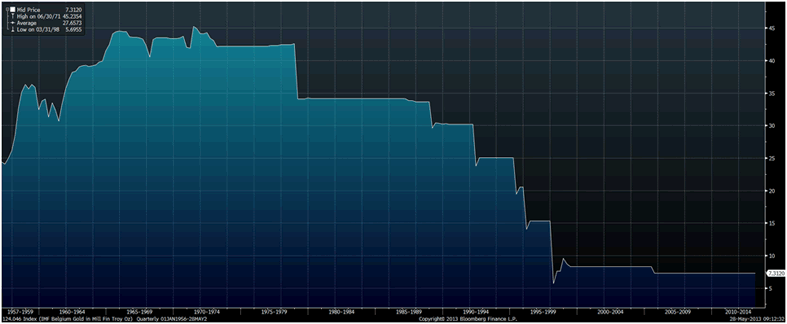

Cross Currency Table – (Bloomberg)

Separately, the Shanghai Futures Exchange (SHFE) is set to start gold and silver futures after-hour trading in 2 months according to Bloomberg.

Bloomberg quoted Yang Maijun, chairman of the exchange who said that at a meeting overnight. The SHFE is considering allowing foreign investors to trade rubber and base metal products and will make efforts to develop new products according to Yang.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.