World Central Banks Buying Gold

Commodities / Gold and Silver 2013 May 27, 2013 - 03:56 PM GMTBy: GoldCore

Today is a national holiday in the United Kingdom and the USA.

Today is a national holiday in the United Kingdom and the USA.

Friday’s AM fix was USD 1,385.25, EUR 1,068.95 and GBP 917.81 per ounce.

Gold climbed $5 on Friday and closed at $1,390.25/oz in London and silver closed at 22.482 in NY.

Gold rose 0.45% this morning in quiet European trading with UK and U.S. markets closed for holidays. Silver, platinum and palladium also advanced this morning.

Gold’s gains come on the back of the best week in a month last week when gold rose 2%.

Gold is being supported by continued diversification from central banks and signs of increased physical demand which is countering continued outflows in ETF holdings.

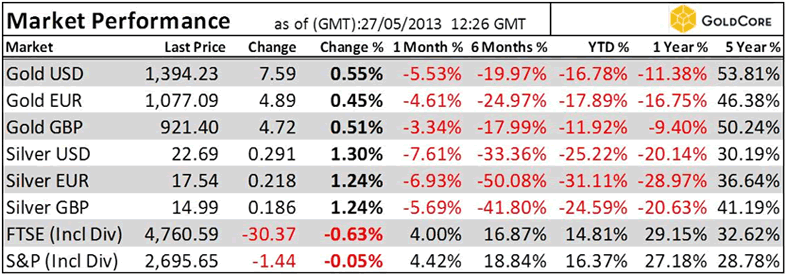

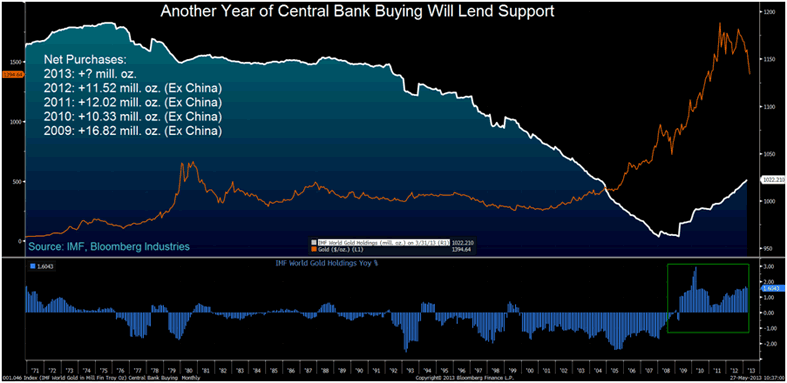

Gold Price (Nominal) and Central Bank Net Buying/ Selling (1971-2013)

Russia,Turkey, Kazakhstan and Azerbaijan expanded their gold reserves for a seventh straight month in April, buying bullion to diversify foreign exchange reserves due to concerns about the dollar and the euro.

Russia’s steady increase in its gold reserves saw its holdings, the seventh-largest by country, climb another 8.4 metric tons to 990 tons, taking gains this year to 3.4% after expanding by 8.5% in 2012, International Monetary Fund data show.

Kazakhstan’s reserves grew 2.6 tons to 125.5 tons, taking the increase to 8.9% this year after a 41% expansion in 2012, data on the website showed.

Turkey’s holdings rose 18.2 tons to 427.1 tons in April, increasing for a 10th month as it accepted gold in its reserve requirements from commercial banks.

Belarus’s holdings expanded for a seventh month as did Azerbaijan’s.

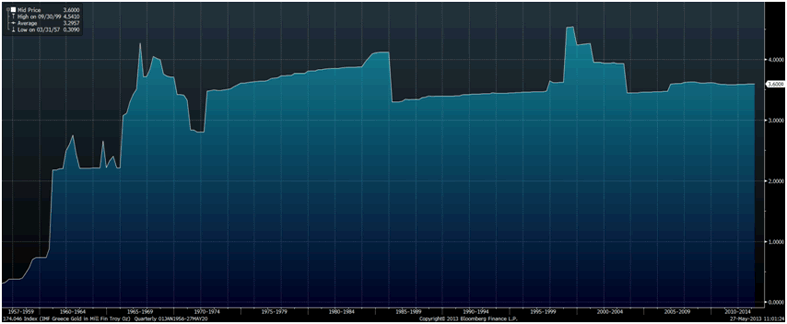

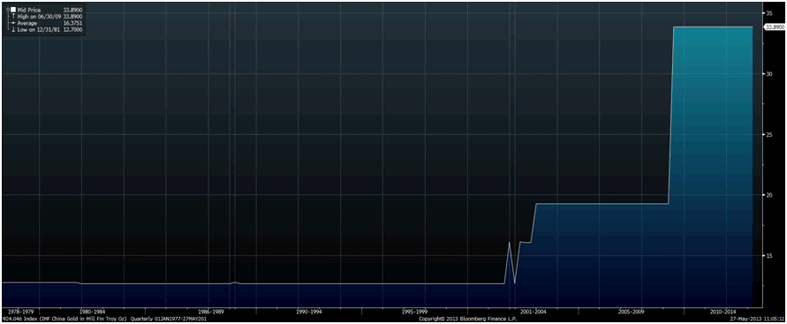

Interestingly, Greece’s gold holdings climbed for a fourth month, according to the IMF data.

This could be a sign of rising economic nationalism in Greece or that the Greek central bank realises that if Greece leaves the euro and is forced back onto the drachma that gold reserves will offer a modicum of protection. Only a modicum, because Greece’s gold reserves remain miniscule especially considering the scale of their debts.

IMF Greece Gold Reserves, in Mill Fin Troy Oz, (Quarterly 01Jan1956-27May2013)

Central banks are buying gold as an overall strategy of forex portfolio diversification and the recent price drop will not deter them from a long term policy of diversification into gold.

Central bank reserve managers are conservative rather than speculative and will ignore the day to day noise and price predictions emanating from certain banks in favour of passive allocations to gold as part of their foreign exchange diversification strategy.

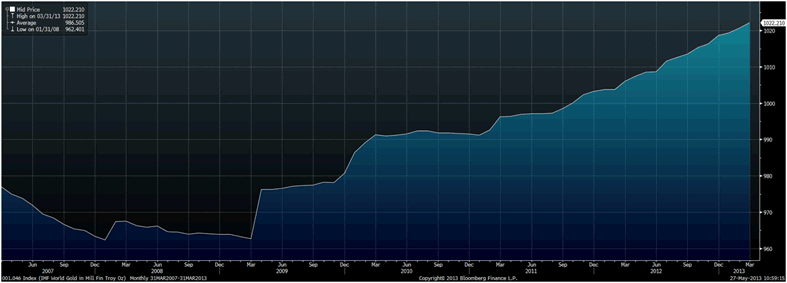

IMF World Gold Reserves, in Mill Fin Troy Oz, (Monthly 31Mar2007-31Mar2013)

While not driven by price, some central banks may have made the most of the lower prices by increasing their holdings by more than they would have if prices had risen in value.

The long term trend for central banks to increase gold reserves remains intact and will support gold.

Central banks bought 534.6 tons of gold last year, the most since 1964, and may add as much as 550 tons in 2013, the World Gold Council estimates. While central-bank purchases fell 5.2 percent in the three months through March, they totaled more than 100 tons for the seventh straight quarter, according to council data.

IMF China Gold Reserves, in Mill Fin Troy Oz (Quarterly 01Jan1977-27May2013)

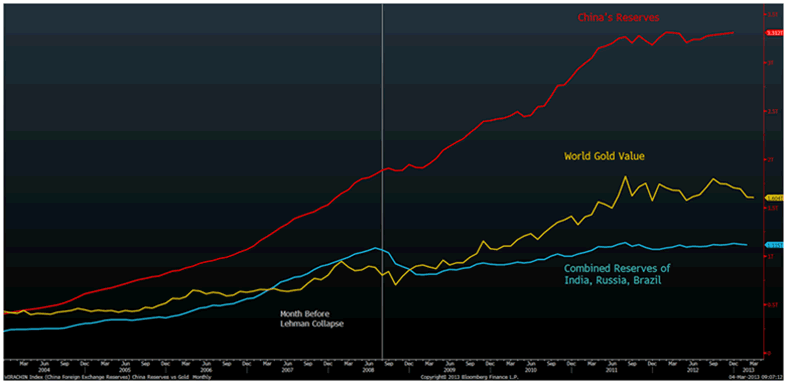

China’s foreign currency reserves have surged more than 700% since 2004 and are now enough to buy every central bank’s official gold supply - twice.

China’s foreign reserves surpassed the value of all official bullion holdings in January 2004 and rose to $3.3 trillion at the end of 2012 and are at $3.4 trillion today.

The price of gold has failed to keep pace with the surge in the value of Chinese and global foreign exchange holdings. Gold has increased just 54% in the last 5 years and 250% since 2004, with the registered volume little changed, according to data based on International Monetary Fund and World Gold Council figures.

China’s Foreign Exchange Reserves vs Gold Monthly (2004-2013)

By comparison, China’s reserves rose 721% from 2004 through 2012, while the combined total among Brazil, Russia and India rose about 400% to $1.1 trillion.

Continuing diversification into gold from the huge foreign exchange reserves by the People’s Bank of China and other central banks is a primary pillar which will support gold and should contribute to higher prices in the coming years.

We are confident that the PBOC is quietly accumulating gold and we expect another announcement from the PBOC, possibly this year, when they again disclose to the market that they drastically increased their gold reserves – possibly from 1,054 tonnes to between 2,000 and 3,000 tonnes.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.