Rising Stock Market Investor Fear

Stock-Markets / Stock Markets 2013 May 24, 2013 - 02:50 PM GMTBy: Brian_Bloom

Typically, volatility rises when emotions run high. Low volatility is associated with investor complacency.

Typically, volatility rises when emotions run high. Low volatility is associated with investor complacency.

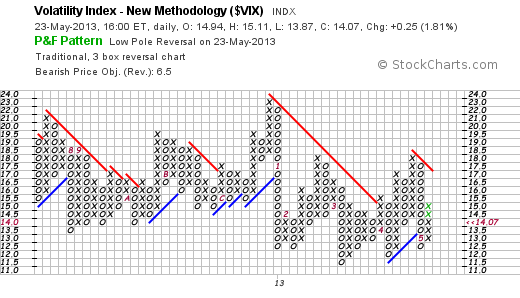

On May 23rd (yesterday in the US), a signal was given on the Point & Figure charts that points to a possible rise in volatility (fear). (Courtesy stockcharts.com)

A “low pole reversal” occurs when a sustained fall (or rise) is followed by at least 50% recovery. This implies that the fall (or rise) is over and that the direction “might” change. At least, the price might be expected to retrace 100% of the previous fall (or rise) – in this case, back to 17.5

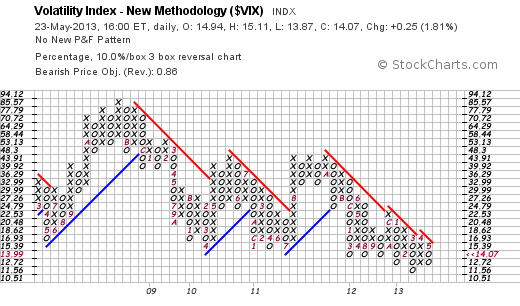

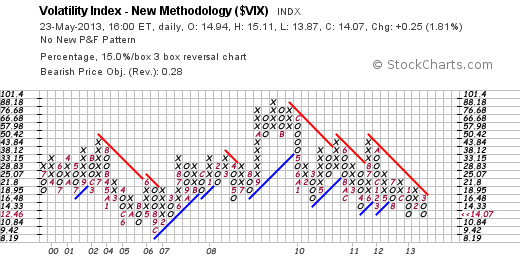

The VIX is historically characterised by protracted periods of calmness and short periods of extreme volatility. I had to factor in a 10% (ten percent) X 3 box reversal to get any history going back more than a year; and 15% to get history going back to 2000

Note how a rise in volatility began to manifest in late 2006/early 2007 – which finally culminated in the GFC. (Blue trend lines)

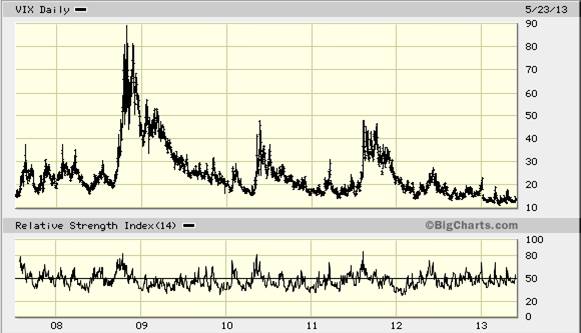

The chart below is the longest dated bar chart I could find: (courtesy Bigcharts.com)

In context of the lack of volatility since early 2012, it seems that the low pole reversal signal given today should be taken very seriously.

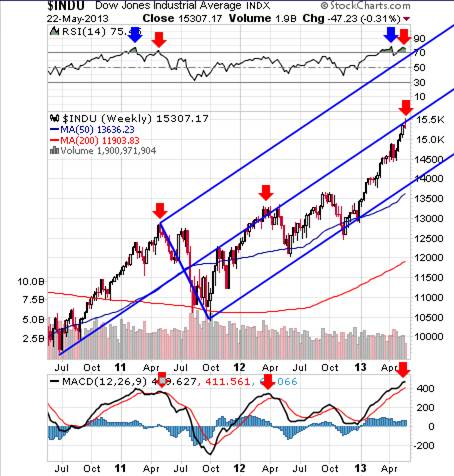

In particular, this volatility should be seen in context of the chart I sent out a couple of days ago:

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.