The Macro Economic Story as Told by Gold, Copper and Oil

Commodities / Global Economy May 22, 2013 - 02:38 PM GMTBy: EconMatters

Gold’s been on a wild ride. After reaching a peak of $1,920 an ounce in September 2011, gold has tumbled 28% to the current ~$1,380 level forcing John Paulson to take a 47% loss in his gold fund during the first four months of this year, according to Bloomberg.

Gold’s been on a wild ride. After reaching a peak of $1,920 an ounce in September 2011, gold has tumbled 28% to the current ~$1,380 level forcing John Paulson to take a 47% loss in his gold fund during the first four months of this year, according to Bloomberg.

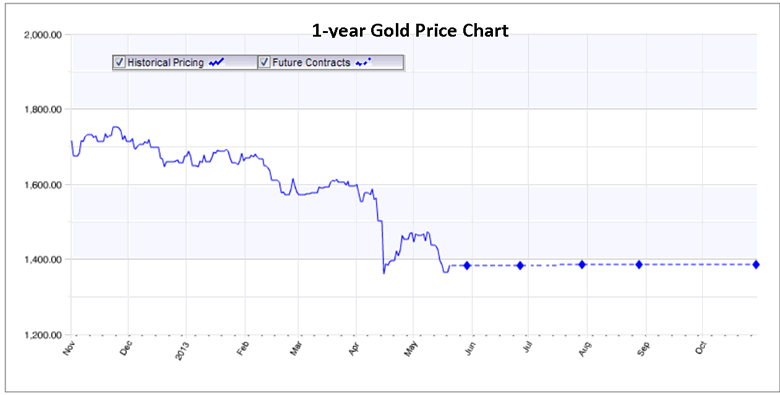

Unlike Paulson who maintained his positions in gold, other big players like George Soros and BlackRock cut their gold ETF holdings, while Goldman Sachs issued a sell recommendation on gold right before the yellow metal plunged 13% through April 15, the biggest drop in three decades. And by looking at the futures curve (chart below), market does not seem to expect gold to come back roaring any time soon.

Chart Source: S&P Capital IQ

QEs Not Hitting the Real Economy

Historically, gold is regarded as a good inflation hedge and store of value, typically thriving in an environment of high inflation, and/or weak U.S. dollar (currency debasement). With U.S. Federal Reserve’s three rounds of QE, the never-ending debt crisis in the Eurozone, hyperinflation and dollar debasement seem inevitable and supportive of gold for the long run, right?

Theoretically, Fed’s QE and near zero fed funds rate is supposed to encourage borrowing and spending from the private sector thus injecting money into the real economy. However, theory and reality don’t always see eye to eye.

Since the 2008 financial crisis, banks have significantly tightened the credit standard and are reluctant to lend. On the other hand, corporations are making money mostly from “streamlined” headcount and structure, but instead of the intended wealth distribution effect expected by the Fed such as investing back to the economy, or increase employee pay which would in turn increase consumer spending, most corporations are hoarding cash or use profits for dividend, share buybacks, or mergers & acquisitions with limited impact on the real economy.

Copper & Oil Indicating Weak Demand

The weak demand is also reflected in part of the commodity market fundamental. WTI crude oil inventory climbed to 82-year high and copper inventory at LME hit a 10-year high in April, while Goldman Sachs cut its “near-term” outlook for commodities.

Although some have argued oil and copper have lost their significance primarily due to increasing domestic oil production, and “temporary” excess copper supply. While the abundance of domestic shale oil production may have distorted the historical supply and demand relationship, but with the U.S. becoming the world’s largest fuel exporter, the fast and furious oil inventory build is nevertheless still an indication of a weak world economy. And I can’t imagine how the “temporary” buildup of copper inventory is not a sign of weak global economic condition?

Further Reading - Oil Market Manipulation Reaches Absurd Levels

Massive QEs, Limited Inflation?

On top of the overall weak spending and demand in the private sector, most of the developed countries are undergoing some shape or form of austerity with reduced government spending. China, the growth engine of the world, is having some problems of its own. The old-fashioned massive infrastructure building QE program got China through the 2008 financial crisis, and was the main driver behind commodity prices. But Beijing can’t afford another QE due to inflation concern (plus China has probably run out of things to build). Low wage levels means China consumers can’t really pick up the spending slack, coupled with bad credit problem (i.e., NPL: Non-Performing Loans), and recent capital flight, had many analysts worried enough to downgrade China’s growth prospect.

The simultaneous pullback from both the private and government sectors in U.S. Europe, and China is a major factor why Fed's massive QEs have resulted in only limited inflationary pressure and increasing signs of deflation.

Dollar and Carry Trade Kills Gold

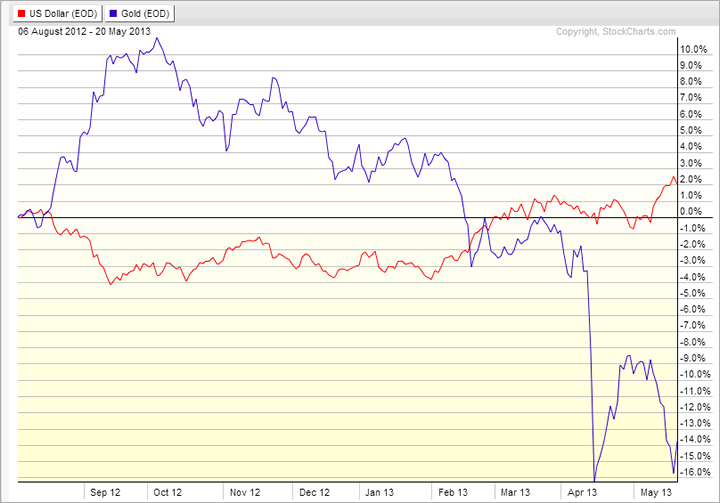

Nonetheless, when compared with Europe, China or any other regions in the world, the U.S. seems relatively more stable, and has been able to retain the “safe haven” status despite its own debt problem. With investors pouring money into U.S. equity and bond propping up the dollar, and weak demand suppressing inflation, two of the main conditions for a strong gold price -- high inflation and a weak US dollar -- are basically non-existent in the current macro environment.

Furthermore, there was already a bit of disconnect between gold and the other commodity prices such as copper, and oil. So eventually, gold had to come to grip with the macro reality.

Chart Source: Stockcharts.com

Another major factor against gold right now is that gold has no yield and is out of favor with the huge yield-seeking yen carry trade crowd (borrowing yen to invest in higher yield options) since bond and equity now are offering much better returns. Unless there's a shock to the system such as a war breaking out in the Middle East, or an eventual debt crisis in Japan when people start seeking safety, there's not much upside momentum for gold.

Gold's Volatility Game

For now, the prevalent view is that the Fed will slow or exit QE3, and gold is out of favor under the the current macro trend. For example, Lim Chow Kiat, the chief investment officer of the Government of Singapore Investment Corp (GIC), thinks gold still looks overpriced as the usage of gold for industrial or consumer products doesn't quite justify the prices. GIC is one of the world's largest sovereign wealth funds.

As long as dollar maintain its strength and inflation remains tame, gold prices most likely will see considerable volatility swinging between rumors and speculation (e.g., some central banks may need to unload some of their holdings due to debt crisis), and Asia retail buying on the dip (South China Morning Post reported that many shops in Hong Kong were running out of the precious metal for the first time in decades.)

Technically speaking, gold's next support level should be $1,330 range with $1,320 as the major support when most physical retail buyers would rush in. If gold breaks below $1,300 hard, expect a major liquidation when even Paulson could be forced to sell and everybody piles in.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.