Stock Market Nosebleed Rally

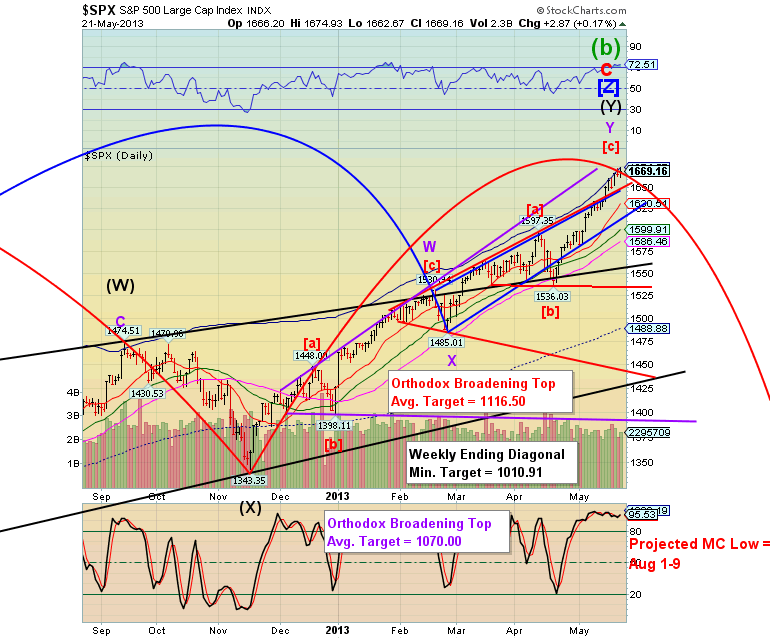

Stock-Markets / Stock Markets 2013 May 22, 2013 - 02:33 PM GMTI just wanted to comment on the extremes to which this market has gone. The normal standard deviation used to mark the top of a cycle is 2.0 above the six-month moving average price. Normal market tops will either touch the upper Cycle Top line and almost immediately will be repelled. Thus, I call it Cycle Top resistance. In a very few rare instances the price of the SPX will briefly move above it, but drop back beneath the resistance area quickly.

There are some rare instances when The price goes above for more than a day or two, and they are noteworthy. The first one I found was the peak before the 1987 Crash, where the SPX had achieved a level of 2.3 standard deviations above the 6-month mean. On March 24, 2000, the SPX had reached a level of 2.5 standard deviations above its 6-month mean. The 2007 peak was only 2.1 standard deviations above the 6-month mean.

The SPX has been bumping against the 2.5 standard deviation line for the past week, currently at 1674.57. This is certainly the longest time that this has occurred and the highest relative peak (referring to standard deviations) that I have on record. I have an economist friend who does his calculations from the 90-day moving average and he claims that we are approaching 3 standard deviations on that basis.

This is a market that is clearly out-of-hand and dangerous. I am not interested in calling a top, since my efforts have been thwarted by a market that is clearly out of control. Let’s just say that the turn will be easily recognized but leave most investors trapped at the top. There have been a dozen “liquidity events” suggesting that we are in a rarified atmosphere when it comes to liquidity to bail out all the sellers. It simply won’t happen.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.