Japan Debt Crisis Is 30 Times Bigger Than Greece!

Interest-Rates / Global Debt Crisis 2013 May 21, 2013 - 04:58 AM GMTBy: Graham_Summers

Japan has fueled much of this latest rally in stocks, driving the marketing first with promises of money printing by the Prime Minister in November 2012, and then a massive $1.2 trillion QE program announced by the Bank of Japan last month.

Japan has fueled much of this latest rally in stocks, driving the marketing first with promises of money printing by the Prime Minister in November 2012, and then a massive $1.2 trillion QE program announced by the Bank of Japan last month.

The result of this has been a collapse in the Yen and a 70%+ rally in the Nikkei in the last six months.

This has been the fundamental driver of this latest risk on rally. Remember that the US Federal Reserve has begun changing its language regarding QE and has even hinted at tapering QE before the year-end. So it’s the Bank of Japan who’s in the driver’s seat for asset prices today.

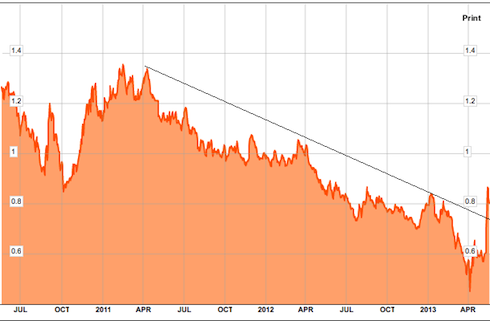

If Japan has been bad for the Yen and good for stocks… it’s been an absolute disaster for Japanese bonds. Since the Bank of Japan announced its latest QE program, Japanese Government bonds have triggered circuit breaks no less than four times due to incredible volatility.

And last week, they briefly violated their multi-year trendline.

Many investors are probably looking at this chart and thinking, “who cares what happens to Japanese bonds… why does a trendline violation matter here?”

First and foremost, Japan is the second largest bond market in the world. If Japan’s sovereign bonds continue to fall, pushing rates higher, then there has been a tectonic shift in the global financial system. Remember the impact that Greece had on asset prices? Greece’s bond market is less than 3% of Japan’s in size.

For multiple decades, Japanese bonds have been considered “risk free.” As a result of this, investors have been willing to lend money to Japan at extremely low rates. This has allowed Japan’s economy, the second largest in the world, to putter along marginally.

So if Japanese bonds begin to implode, this means that:

1) The second largest bond market in the world is entering a bear market (along with commensurate liquidations and redemptions by institutional investors around the globe).

2) The second largest economy in the world will collapse (along with the impact on global exports).

Both of these are truly epic problems for the financial system. But even worse than any of them is the following

If Japan’s bond market implodes, then global Central Bank efforts to hold the system together will have proven a failure.

Japan is truly the leader amongst global Central Banks when it comes to progressive and accommodating policy. The Bank of Japan has kept interest rates at ZERO for nearly two decades. It’s also launched NINE QE plans adding up to an amount equal to nearly 25% of Japanese GDP. So far it’s managed to do this with minimal consequences.

Central Bankers around the world have monitored these efforts and believed that they can implement similar plans. So if Japan’s bond market begins to collapse, then it’s Game. Set. Match. for Central Banker policy. And what follows will make Lehman look like a joke.

Investors, take note… the financial system is sending us major warnings…

If you are not already preparing for a potential market collapse, now is the time to be doing so.

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.