Silver Surges From Lows After Being Slammed 10% Lower In 4 Minutes

Commodities / Gold and Silver 2013 May 20, 2013 - 06:19 PM GMTBy: GoldCore

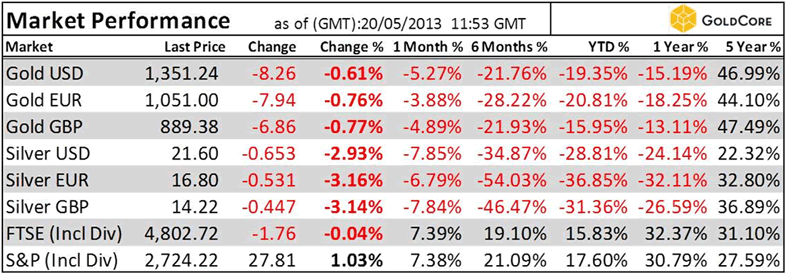

Today’s AM fix was USD 1,353.75, EUR 1,051.95 and GBP 890.86 per ounce.

Today’s AM fix was USD 1,353.75, EUR 1,051.95 and GBP 890.86 per ounce.

Friday’s AM fix was USD 1,376.75, EUR 1,069.15 and GBP 903.62 per ounce.

Gold fell $22.20 on Friday to $1,364.90/oz and silver closed at $23.632.

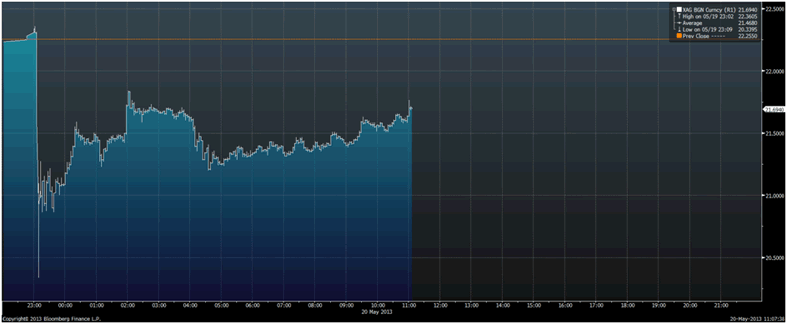

Silver fell victim to heavy, concentrated selling overnight in thin, illiquid Asian trading. Silver was slammed by 10% and fell from $22.36/oz to $20.30/oz in just four minutes - from 23:05 GMT to 23:09 GMT.

XAG/USD Spot Exchange Rate – 1 Day (Tick)

Silver has recovered 7% of the price plummet and is now down 2.7% today at $21.60 an ounce.

Silver’s weakness may have contributed to gold falling 1% to $1,354/oz.

It is likely that the very aggressive selling in illiquid Asian markets overnight was by a large hedge fund or bank or a combination of hedge funds and banks with deep pockets. Reuters quoted an analyst at a Japanese bank who said that silver’s price falls were due to one “unidentified investor”.

XAG/USD Spot Exchange Rate – 3 Day (3 Minute)

Heavy concentrated selling likely led to stop loss orders being triggered at technical supports – particularly at the $22/oz level.

There is some confusion regarding pricing as different pricing feeds are showing different lows in spot silver. CNBC reports that at one point silver hit a low of $20.30, down 8.8% from the start of trade on Monday while Bloomberg report that silver for immediate delivery fell as much as 8.6% to $20.3395 an ounce.

The losses come after silver had fallen sharply last week. Silver futures for July delivery retreated 1.4% to $22.352 an ounce on the Comex Friday, extending the week’s decline to 5.5%, the biggest in a month.

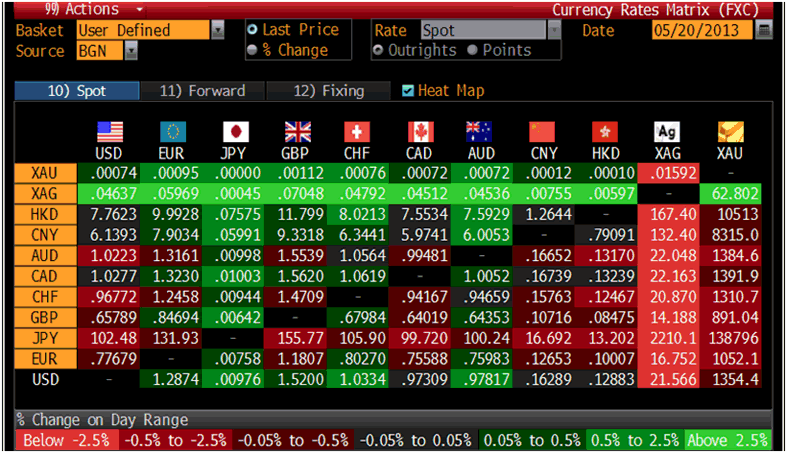

Cross Currency Table – (Bloomberg)

Hedge-fund managers and other large speculators decreased their net-long position in New York silver futures last week, according to the U.S. Commodity Futures Trading Commission (CFTC) data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 10,794 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 2,857 contracts, or 21 percent, from a week earlier.

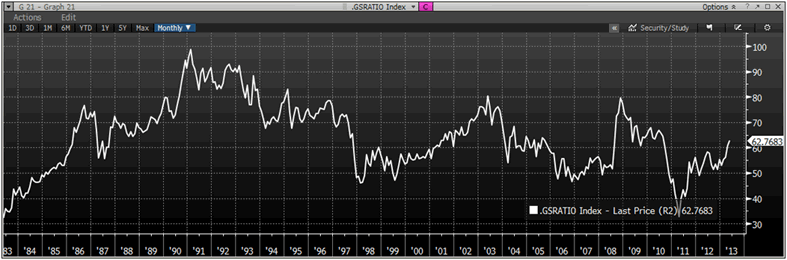

The gold-silver ratio is at its highest level since September 2010 with an ounce of gold currently buying 63 ounces of silver. That is twice as much as in April 2011, when silver was trading considerably higher.

Silver in USD, 5 Year – (Bloomberg)

This is silver’s lowest price since September 2010 which will lead to continuing and possibly increased demand for physical silver.

While speculators such as hedge funds have reduced long positions and increased their short positions, store of wealth physical demand remains robust internationally.

Premiums for coins and bars remain elevated and there continue to be delays in securing physical silver coins and bars in volume. These lower prices could exacerbate these supply issues as higher prices will be needed to increase supply.

Gold/Silver Ration Index, 1983-Present – (Bloomberg)

Contrarian silver buyers are rubbing their hands with glee and will continue to accumulate physical silver coins and bars in expectations of silver surpassing the nominal record high of $50/oz in the coming months.

Further weakness may be seen today and this week but the long term outlook remains positive due to robust industrial, investment and most importantly store of value demand.

Nothing has changed regarding the very bullish fundamentals in the silver bullion market and we continue to expect silver to surpass its inflation adjusted high of $130/oz in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.