Why You Should Short Gold

Commodities / Gold and Silver 2013 May 19, 2013 - 06:24 PM GMTBy: Submissions

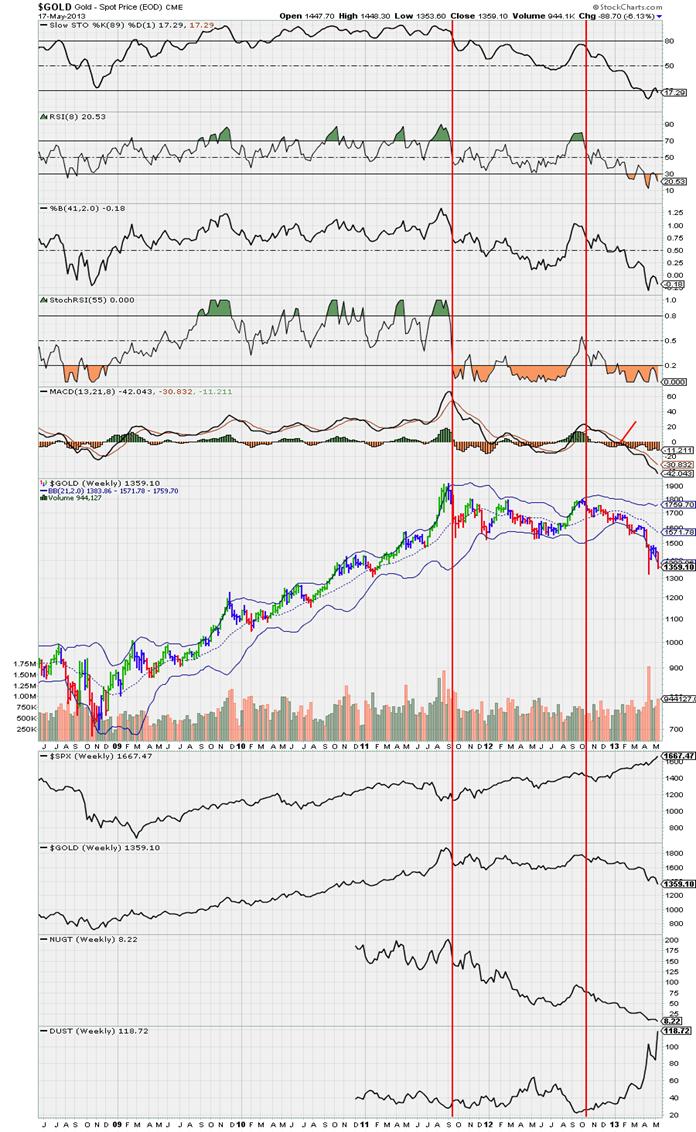

Tom Clayton writes: Short Gold is at the top of my list of a possible continuous of the deterioration in the $Price of Gold. Using the the Charts, It is easier to visualize. With the stockmarket making new highs weekly, why own gold. With Inflation under control, according to Fed figures, if you can believe after eliminating the Volatile Prices of Food and Energy.. which is the heart of Inflation..Right? The rate of inflation is reported at 3.1% but if you include Food & Energy.. it would be over 10% and unemployment would be 15% after eliminating those who have given up looking for a job, according to John Williams of Shadow Statistics. Anyway, inflation of 3.1% is “no reason to own Gold”?

Tom Clayton writes: Short Gold is at the top of my list of a possible continuous of the deterioration in the $Price of Gold. Using the the Charts, It is easier to visualize. With the stockmarket making new highs weekly, why own gold. With Inflation under control, according to Fed figures, if you can believe after eliminating the Volatile Prices of Food and Energy.. which is the heart of Inflation..Right? The rate of inflation is reported at 3.1% but if you include Food & Energy.. it would be over 10% and unemployment would be 15% after eliminating those who have given up looking for a job, according to John Williams of Shadow Statistics. Anyway, inflation of 3.1% is “no reason to own Gold”?

With Ben Bernake ever increasing printing more $Money through now QE3 to the tune of $85Billion a month, Gold still goes down.. so what will happen to Gold when the Feds start “Easing”. All Hell is going to breakout in the the Stock Markets and Gold will just accelerate to the downside. There is no easy way.

If any of you can build a case why Gold will go up currently..Please let me know. But all know eventually Gold will reach a price with the Value of the U.S. Dollar deteriorating..BUT the U.S. Dollar is now on a tear UP. Yes, the Time for GOLD will come, but not at this moment.

The Double Bottom approaching doesn´t appear very significant on the Weekly 5 Year Chart. It could pierce through that on the downside with no significant support until $1000 an Oz. ,maybe $1100 and Oz.

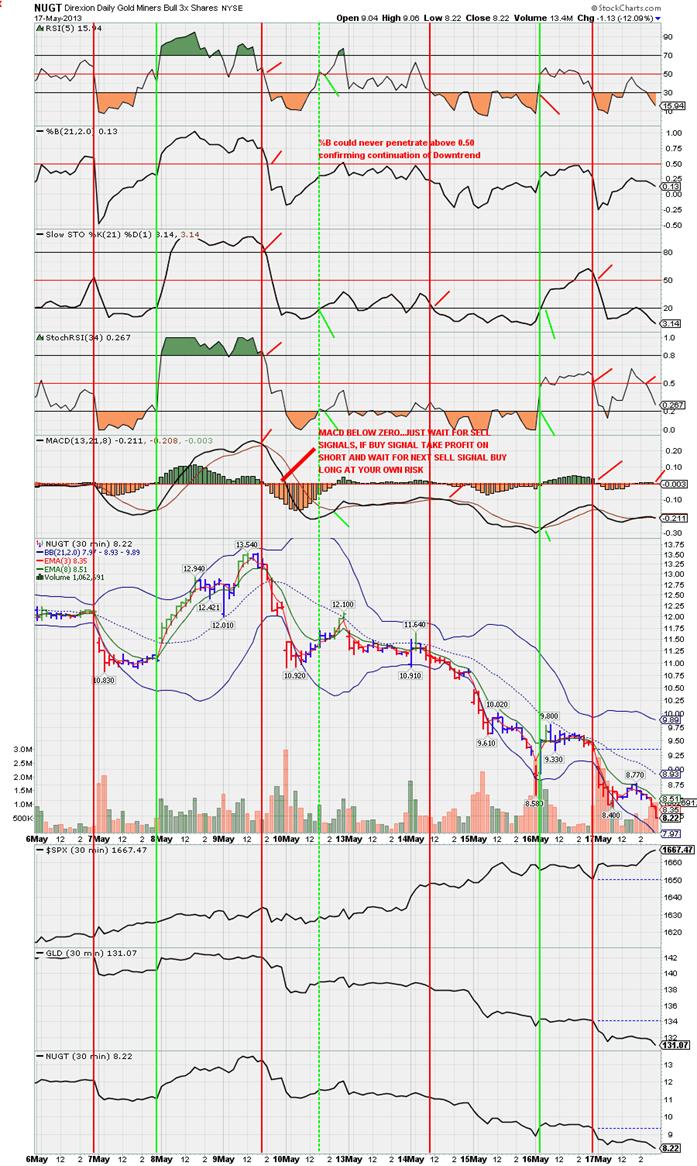

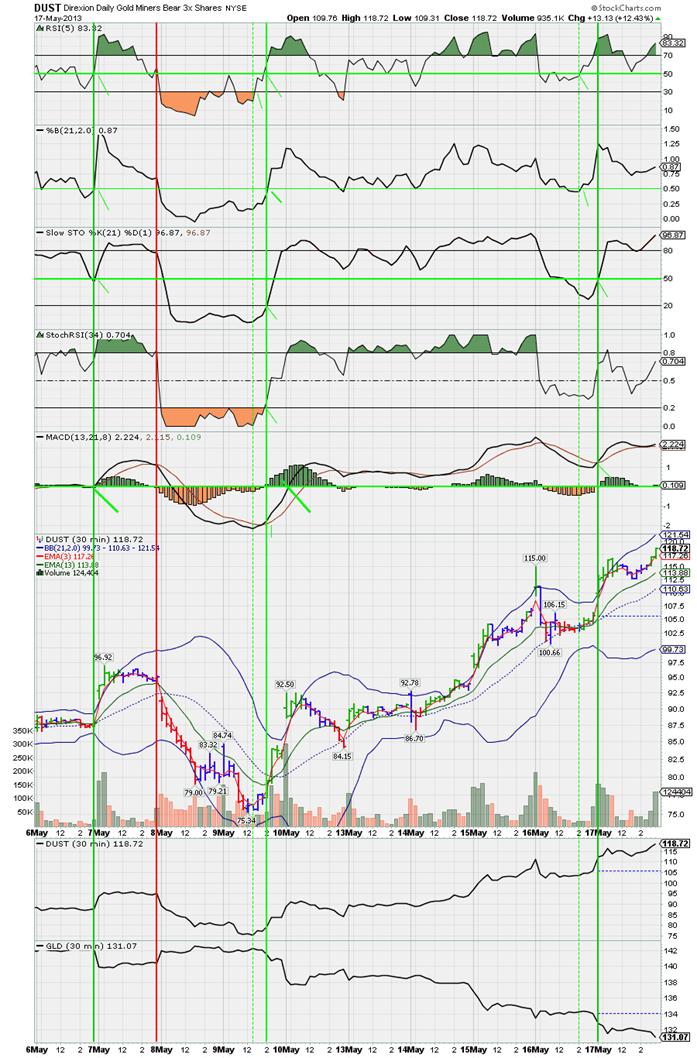

See Charts Illustrations

Tom Clayton

Submitted by Clayton.. Former Account Executive with Dean Witter.. 1968 to 1971. Currently doing Technical Analysis as a pastime which can be seen at stockchart.com, PublicLists, EASY MONEY is my blog.

© 2013 Copyright Tom Clayton - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.