Putin’s Power Play to Change the Uranium Mining Sector

Commodities / Uranium May 15, 2013 - 04:06 PM GMTBy: Casey_Research

The last time Vladimir Putin was president, he laid the foundation to pull Mother Russia from the wreck of economic chaos to a world power once again. This time, he's ready to extend that influence to counter the West. His tools: Russia's abundant resources of energy, including uranium.

The last time Vladimir Putin was president, he laid the foundation to pull Mother Russia from the wreck of economic chaos to a world power once again. This time, he's ready to extend that influence to counter the West. His tools: Russia's abundant resources of energy, including uranium.

There's a new war developing on the continent, and the weapons this time will be oil wells, gas fields, and uranium mines, pipelines and ports, processing facilities, and supply deals.

Led by Russia's vast resource wealth and China's massive bank account, the countries of Asia and those along the Eurasian divide are realizing they do not want or need help from the West to achieve their goals. They are settling their differences, negotiating closer relations, and advancing their plans without as much as a phone call to Washington or Brussels.

After years of Western dominance in world affairs, they've had enough. And with Vladimir Putin back in as Russia's president, this emerging bloc has its leader.

Vladimir Vladimirovich is a man of remarkable intelligence, determination, and ruthlessness. In many Russian eyes, that last attribute is far from a fault – they see him as a man's man who restored their country's pride, economy, and position of influence after a humiliating period they'd rather forget. If that has required trampling some citizen rights along with much of the country's new capitalist class… well, nothing comes for free.

From the chaos of financial collapse and political turmoil in 1998, Putin increased GDP by an average 7% annually, cut in half the number of Russians living below the poverty line, grew industry by 75%, and doubled real incomes.

He's achieved these accomplishments largely though development of energy resources. Under his guidance, Russia became a global energy superpower. Today, with a much-strengthened country under his feet, Putin will use his control over natural resources to pull leverage away from the United States and Europe.

It's no secret that Putin disdains America's self-appointed role as global policeman and holds Europe in equal contempt for generally supporting US foreign policy. The NATO campaign in Libya was perhaps a final straw: After Russia vetoed a UN motion to intervene in the civil war there, the US and its European allies turned to their military club NATO to further the regime change they desired. To Russia, at least, it was a snub intended to suggest that Russian opinion still doesn't matter.

Now Putin's primary goal is to prove that view wrong.

And he has the tools to do so. Among other things, he's working to corner the uranium market – his country already controls 40% of global uranium enrichment capacity, the lion's share of the world's downblending facilities, and a fair chunk of the world's uranium resources.

On top of that, the country's nuclear power giant, Rosatom, builds more nuclear power plants than any other company in the world, with deals for 21 international reactors currently on the books.

The era of Putinization is about to begin, and we investors need to understand where it's coming from and what it means. What's on the table are investment trends and profits along with the balance of world influence.

Russia: Key Player in the Uranium Market

Russia is bestowed with immense resource wealth, in large part because Mother Russia is simply the biggest country in the world. The nation covers 17 million square kilometers, upwards of twice the size of the next largest country, Canada. Even if its lands and waters were only moderately imbued with resources, Russia would have a lot of natural wealth.

Russia was the sixth-largest uranium producer in the world in 2010, behind Kazakhstan, Canada, Australia, Namibia, and Niger. But that ranking only includes uranium produced from mining operations. When we include production from the downblending of its decommissioned nuclear weapons, Russia jumps to second.

It's hard to overstate Russia's dominance of the world's capacity to process uranium. Australia, Kazakhstan, and Canada rely on Russia to enrich the uranium they mine, while for the last 18 years the United States has relied on Russia's downblending capability. The Megatons-to-Megawatts agreement provides fully half of the uranium fueling America's nuclear reactors, or 10% of its electricity.

The agreement is scheduled to end in December 2013, at the same time as global demand for uranium is rising. The US will have to go on the hunt for new uranium suppliers just as the race to secure those supplies heats up… and Putin knows it.

Not only will he not renew Megatons, he will encourage the world's uranium-needy nations – China, India, the US, France, South Korea, and Japan – to outbid each other for the opportunity to secure stable supplies of Russian uranium.

We've said it before: Putin is working to corner the global uranium market. He already has a strong grip over Europe's gas needs and holds considerable sway over the continent's oil supply. Why wouldn't he want to also control the world's supply of nuclear reactor fuel?

Uranium – a Hot Commodity

Today there are no fewer than 60 nuclear plants under construction in 14 countries, with another 163 planned and 329 proposed.

Many countries without nuclear power are on the cusp of building their first reactors, including Vietnam, Turkey, Indonesia, Egypt, Kazakhstan, and several among the Gulf emirates. And while many countries with nuclear reactors took a moment to pause and reassess safety standards in light of the Fukushima disaster, almost all have reasserted their support for nuclear power as a major component of their energy strategies.

Uranium is simply the only fuel right now that can reliably produce large amounts of electricity without the release of greenhouse gases and other hydrocarbon pollutants.

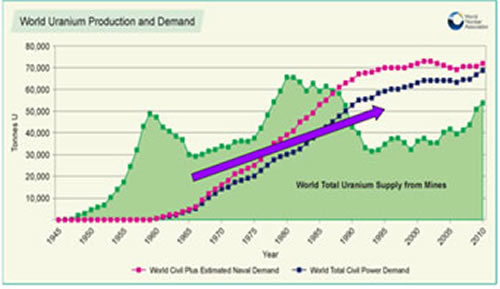

Demand is clearly ramping up, and the world is already short on uranium. In 2011, world industry consumed 165 million pounds of U3O8 but produced only 143 million pounds.

Indeed, the world hasn't produced enough uranium to meet demand for some two decades.

Secondary supplies have been filling the gap to date. For example, since 1993 the Megatons-to-Megawatts agreement between Russia and the United States has been working toward the goal to recycle 500 tonnes of highly enriched uranium (HEU) from Russian nuclear weapons into the LEU that reactors use to produce electricity. But remember, that deal is set to end next year.

The end of Megatons-to-Megawatts will eliminate 24 million pounds of uranium supply just as demand starts surging. The World Nuclear Association predicted global uranium demand will have increased 33% by 2020, and will then climb almost that much again in the next 10 years.

Those are huge increases. In 2011, the world consumed about 70,000 tonnes of uranium. By 2024, we are expected to need 100,000 tonnes. Can production keep up? Not likely.

If every potential uranium mine on the horizon were approved, built, and commissioned on schedule, supplies might just keep up with demand. But current uranium prices are rendering many potential mines uneconomic, and global economic uncertainty is making it very difficult for uranium companies to obtain the cash they need to build mines. It all adds up to one conclusion: a supply gap is looming.

A Near-Monopoly on Downblending

The global race to secure uranium resources is on. Russia already produces a fair bit of uranium; on top of that, Putin carries a lot of clout in neighboring Kazakhstan, the world's top primary uranium producer. So Russia already controls a lot of primary production.

But that's just the start. Since primary production won't be able to meet demand, secondary sources will become extra important. And there is only one significant secondary source: downblended Russian warheads.

One American company, WesDyne International, has facilities in the US to downblend HEU, but its capacity is limited to roughly 8 tonnes a year. Russia can churn through 30 tonnes annually. It means the US has little choice but to send its old warheads to Russia for downblending.

So Russia has that secondary production well in hand, too.

And Russia isn't just the world leader in downblending – the country also operates 40% of the world's enrichment capacity, giving the Russian leader another avenue of control over the nuclear fuel market.

Control over so much LEU production capacity gives Putin the ability to ink supply deals with countries desperate to secure nuclear fuel for the future. For example, a new bilateral agreement between Russia and Japan is about to take effect, paving the way for Japanese utilities to secure uranium enrichment services from Russia.

Putin also finds long-term uranium customers in the countries that have asked Russia's state nuclear utility, Rosatom, to build their reactors.

Rosatom is an absolute giant in the global nuclear sector. The company builds more nuclear power plants worldwide than anyone else, with builds currently underway in China, Vietnam, India, Iran, and Turkey. The 21 new builds in Rosatom's order book are worth US$50 billion.

And how handy is it that many of those new builds include a lifetime fuel supply contract, such as the contract Rosatom signed with Bangladesh to build and fuel that country's first nuclear reactor.

Rosatom is also the conduit through which Russia exports uranium, a trade currently valued at US$3 billion per year. One-fifth of those exports go to the Asia-Pacific region, a market growing so quickly that Rosatom is building a new Vostok complex for uranium-products transportation and logistics to better serve the region.

Nuclear power has been the world's fastest-growing major source of energy every decade since 1960. That's not going to change. Putin is acutely aware that uranium will be one of the most closely contested battlegrounds in the global race for resources.

Unfortunately for everyone else, he's given Russia a significant head start.

The coming uranium supply crunch will lead to a bull market for the history books… with spectacular profit potential for early investors. To discuss uranium's future, and the investment implications, some of the world's foremost energy experts – among them a former US secretary of energy and the chairman emeritus of the UK Atomic Energy Authority – will gather for an unparalleled Webinar on May 21, 2013. Registration is free – click here to learn more.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.