Don't Bet Against a Surging U.S. Dollar

Currencies / US Dollar May 15, 2013 - 03:53 PM GMTBy: Money_Morning

Ben Gersten writes:

In the midst of a brewing currency war, Japan's out-of-control monetary policy has caused the yen to fall to an almost five-year low against the U.S. dollar.

Ben Gersten writes:

In the midst of a brewing currency war, Japan's out-of-control monetary policy has caused the yen to fall to an almost five-year low against the U.S. dollar.

With an economy one-third the size of that of the United States, Japan has committed itself to a fiscal program that's almost double the U.S. Federal Reserve's current $85- billion a month stimulus.

Like any other war, this battle of monetary-easing measures won't end well, but fortunately for Americans, it's looking more and more likely that the dollar will emerge victorious.

"Right now, the U.S. dollar is the 'cleanest dirty shirt in the laundry,' so I'd buy it," said Money Morning Capital Waves Strategist Shah Gilani.

The dollar now stands at 101.93 against the yen, the first time it's broken the 100 mark since 2009, and is up 26.6% in the past six months.

Many experts are now predicting the dollar's climb has just begun and some analysts see the dollar hitting 105 yen this summer and possibly 110 by the end of the year.

"The turn in yen has been dramatic and has proven the importance of momentum when a multi-year cycle turns," Nomura currency expert Jens Nordvig wrote in a note to clients. "A similar dynamic could be in store for the dollar. In the scheme of things, the USD REER [Real Effective Exchange Rates] is still trading close to multi-decade lows. Once the turn is evident, we believe momentum could be powerful."

Here's why the U.S. dollar's run is just beginning.

Why You Need to Invest in the U.S. Dollar

In addition to Japan's spending spree, the dollar will likely gain strength because of uncertainties surrounding the euro, the fact that newfound domestic energy supplies should boost the U.S. economy, and an improving U.S. trade deficit.

"We've had back-to-back good news in U.S. figures and you have to wind the clock back six to eight weeks to find the last time we had that," Nick Parsons, head of market strategy at National Australia Bank, told Reuters. "Once we got through 100 (yen) and the Japanese bond buying data came out, that added fuel to the fire."

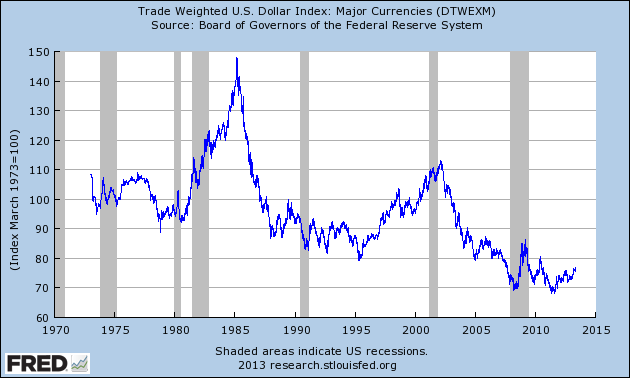

While the stock markets are at all-time highs, the trade-weighted U.S. dollar index, which measures the value of the dollar against a broad range of currencies, is in a near 20-year bear market.

Yet the dollar index has increased 5.3% since February, which could be the start of a long-term reversal.

"As other countries work to knock down their currencies, it's important to point out the U.S. has already done that," Gilani notes. "Uncle Sam was the first to engage in that policy, but on a very hush, hush 'we're not doing that' basis. But QE and keeping interest rates low here is how that's been accomplished, and our exports have been robust as a result."

One way to play a rising U.S. dollar is with the PowerShares DB US Dollar Index Bullish (NYSE: UUP). It goes up as the dollar gets stronger and currently trades at $22.62.

Gilani advises investors to buy around $22.50. If it falls, he says, buy more at $22 and some more at $21.50. And always, for caution use a trailing stop, here $20, to avoid getting hurt too badly hit if the dollar falls.

For other ways to invest in the greenback, check out the Forex market. There, you can make all sorts of trades on the dollar, and other currencies as well.

Further Reading:For more on how to profit from a stronger dollar, read How to Make a Fortune If the Currency Wars Go Atomic

Source :http://moneymorning.com/2013/05/13/dont-bet-against-a-surging-u-s-dollar/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.