We Are All Going to Die! Looming 6th Major Extinction

Politics / Environmental Issues May 15, 2013 - 11:22 AM GMTBy: Bill_Bonner

Today, we interrupt our regular coverage of markets, morons and mush-head economics to give you a heads-up:

Today, we interrupt our regular coverage of markets, morons and mush-head economics to give you a heads-up:

We may all be doomed!

Not just you... not just us... but the whole friggin' human race may soon be on the endangered species list. Boohoo! We're going extinct. So says an article in Newsweek. (More below...)

Okay... so you don't care, right? After all, we all have to go sometime. But think of the poor voters with no one to lie to them... the poor stockbrokers with no suckers to call... the empty bars... the jails left idle and abandoned after their prisoners have paid for their crimes.

It brings a tear to our eye. No illegal aliens to mow our lawns. No lobbyists to stab us in the back. And no one to watch reality shows. Reality will no longer exist!

Just when everything was going so well, too. The Dow had climbed above 15,000. Everybody said it was going higher. The New York Times:

"It seems we're somewhat ahead of schedule, but I think we're still on track for Dow 20,000 by the end of the decade," Mr. [Seth] Masters [the chief investment officer of Bernstein Global Wealth Management] said last week. "The odds have just gotten better." And despite the stock market's recent meteoric rise, he said, stocks still look relatively cheap, certainly compared with bonds.

"It's not that the expected return on stock right now is really that high," he said. "It's that the return on government bonds is indubitably very low."

That unfavorable verdict on bonds is no accident. In a sense, it's the policy of the Federal Reserve. Ben S. Bernanke, the Fed chairman, says he is trying to make traditionally riskier assets like stocks relatively attractive, increasing investors' wealth and in that way stimulating the economy.

Well, that's one thing we won't miss. Mr. Bernanke wants people to buy stocks, rather than bonds. What's he got against bonds? And who cares what he wants? If people want to buy bonds, why not let them?

Get Ready for the Sixth Major Extinction

No need to ask those questions... not when human beings are disappearing down the rathole of history. We just hope Bernanke goes extinct before we do!

The last major extinction took out the dinosaurs; 76% of all species alive at the time died out. And that was nothing, compared with the one that came before it, known as the Great Dying – 185 million years earlier. That wiped out 95% of all species. Like a stock market crash, an extinction takes out the most successful, most ubiquitous species.

So far, the planet has suffered five major extinctions. Newsweek says we may already be into the sixth:

Over the past four years, bee colonies have undergone a disturbing transformation. As helpless beekeepers looked on, the machinelike efficiency of these communal insects devolved into inexplicable disorganization. Worker bees would fly away, never to return; adolescent bees wandered aimlessly in the hive; and the daily jobs in the colony were left undone until honey production stopped and eggs died of neglect. Colony collapse disorder, as it is known, has claimed roughly 30% of bee colonies every winter since 2007.

If bees go extinct, their loss will trigger an extinction domino effect, because crops from apples to broccoli rely on these insects for pollination. At the same time, over a third of the world's amphibian species are threatened with extinction, and Harvard evolutionary biologist and conservationist E.O. Wilson estimates that 27,000 species of all kinds go extinct per year.

Are we in the first act of a mass extinction that will end in the death of millions of plant and animal species across the planet, including us? Proponents of the "sixth extinction" theory believe the answer is yes...

The climate change that occurred during the Great Dying – most likely involving megavolcanoes that erupted for centuries in Siberia – was similar to the one our planet is undergoing right now. Regardless of whether humans are responsible, the sixth mass extinction on Earth is going to happen. We have ample evidence that Earth is headed for disaster, from elevated rates of extinction among birds and amphibians to superstorms and the recent Midwestern drought, corroborating the idea that we might be living through the early days of a new mass extinction.

Bummer. The bees are starting to act like Republicans: hopelessly disorganized... desperately short of ideas. And if they can't get their act together, we are all going to hell.

But it was bound to happen, wasn't it? Whenever there is a chart with a line that goes vertical... it invariably leads to a line that goes vertical in the opposite direction. What goes up must go down. What lives, dies. Bear markets follow bull markets. Busts follow booms. And ants follow picnics.

If it were up to us, it wouldn't work that way. Neither death nor taxes would be inevitable. But we're not the Decider. And whoever is the Decider seems to prefer symmetry over immortality. That's just the way it is.

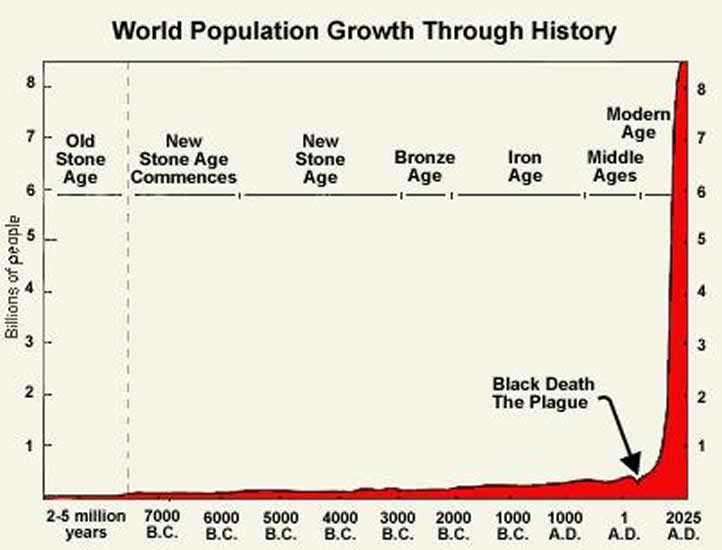

As you can see below, when you look at a chart of the growth of the human population over the centuries, you see a long, nearly flat line stretching from about 1800 back to the beginning of time. But after 1800, the line suddenly goes vertical.

What gives? Better food, better medicine, indoor plumbing. People stopped dying the way they used to. And the number of humans on Earth multiplied. Even in our lifetimes – from 1950 to today – the population of the planet has doubled.

Now comes the blowback... the bust... the downswing. If we're lucky, 75-95% of the human population will die off. If we're unlucky, it will be 100%.

But seriously, this is another reason for staying out of the stock market. We wouldn't want to own a portfolio of growth stocks, not when a major extinction approaches. It would be embarrassing.

Bill BonnerBill Bonner is a New York Times bestselling author and founder of Agora, one of the largest independent financial publishers in the world. If you would like to read more of Bill’s essays, sign-up for his free daily e-letter at Bill Bonner’s Diary of a Rogue Economist.

© 2013 Copyright The Daily Reckoning, Bill Bonner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.