Gold Price to Re-Test $1350 Low

Commodities / Gold and Silver 2013 May 14, 2013 - 10:56 AM GMTBy: Bob_Kirtley

Gold prices have started the week weaker in the southern hemisphere, dropping around $18.00 to trade at $1429.00/oz, despite the amount of physical buying that is taking place the paper market still calls the shots, for now at least. After what looks like a capitulation gold prices did bounce back, however, they have failed to break through $1500 and challenge the 50dma and now look set to test recent lows.

Gold prices have started the week weaker in the southern hemisphere, dropping around $18.00 to trade at $1429.00/oz, despite the amount of physical buying that is taking place the paper market still calls the shots, for now at least. After what looks like a capitulation gold prices did bounce back, however, they have failed to break through $1500 and challenge the 50dma and now look set to test recent lows.

The Gold Chart:

As we can see from the chart above the $1475.00/oz level has become a resistance level that gold has been unable to break. One possible reason for gold not doing so well is that the US dollar has improved over the last few days and now looks set to challenge its recent high in an attempt to form a new higher high.

Gold has an inverse relationship with the dollar so as one goes up the other tends to go down. The improvement in dollar could well be due to the Japanese yen falling as the Japanese government print more Yen in an attempt to boost economic activity. We have also had a rate cut which was announced last week by the European Central Bank (ECB) heralding a weaker Euro. The recent unemployment figures were good enough to suggest that there would be no increase in QE any time soon, another factor that has dampened the enthusiasm for gold. These events are positive for the dollar right now but will soon be absorbed by the market and when that happens the dollar will once again head south.

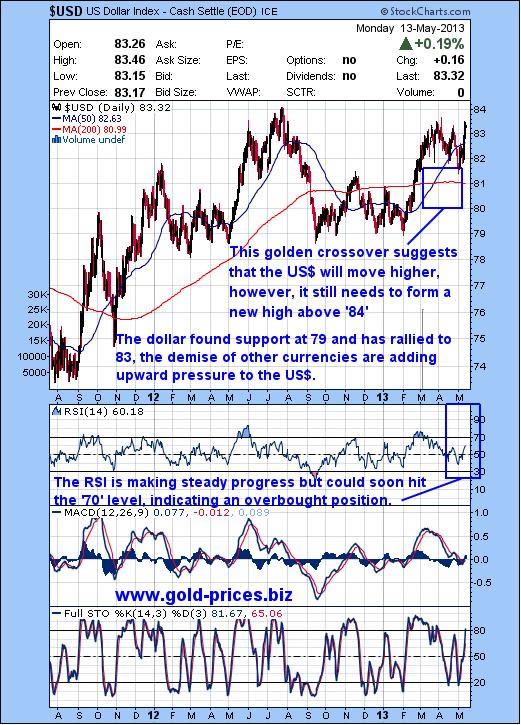

The Dollar Chart:

Holders of such currencies as the Yen and Euro face a future of their currencies declining thus reducing their spending power. As an alternative the dollar may have some appeal even if it is used as a stop gap measure giving them some breathing space before moving on. As the chart indicates the dollar found support at ‘79’ and has rallied to ‘83’, the demise of other currencies has added upward pressure to the US$. Also note that the RSI is making steady progress but could soon hit the '70' level, indicating an overbought position and a possible reversal for the dollar.

Conclusion

We are in the merry month of ‘sell in May and go away’ so we could experience a sell-off in the general stock market which in turn would take the mining stocks lower. We also need to be aware that the summer doldrums are upon us and gold tends drift lower until August. Labor Day this year falls on Monday 2ndSeptember, usually a time when gold commences its ascent doing its best work over the northern winter period.

So, if you are a short term trader you may want open a short position in order to take advantage of this seasonal lull. However, you will need to be nimble as when gold changes direction it can move quickly and wipe out those profits. If you still believe in the precious metals bull market then the next few months should present you with some very low entry levels indeed. The selection of quality mining stocks will be as important as ever as a number of stocks will perform poorly and some will disappear altogether. Your individual profitability will depend largely on identifying the real stars of this sector, so do the work now, it will be worth it.

Long or short, you need to stay awake and keep your finger on the pulse if you wish to profit from this tiny sector of the market.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.