UK Savings Catastrophe - Best Cash ISA? There Isn't One!

Personal_Finance / Savings Accounts May 14, 2013 - 03:01 AM GMTBy: Nadeem_Walayat

The consequences of the Quantum of Quantitative Easing (QQE) is one of systematic theft of wealth from savers / bank depositors by the government and banking sector, unfortunately this trend is intensifying and unlikely to change for at least another year as illustrated by announcements every other month such as the extension of the funding for lending fraud, that looks set to continue to bleed depositors dry in the run up to the May 2015 general election as an desperate, fractious Coalition government will first attempt to bribe the electorate by spending money the country does not have or in the final analysis given a poor standing in the opinion polls decide to follow follow Labours example of 2009 (Labour Governments Bankrupt Scorched Earth UK Economy for the Conservative Government ) by handing the next Labour-geddon government an even more scorched earth bankrupt economy.

The consequences of the Quantum of Quantitative Easing (QQE) is one of systematic theft of wealth from savers / bank depositors by the government and banking sector, unfortunately this trend is intensifying and unlikely to change for at least another year as illustrated by announcements every other month such as the extension of the funding for lending fraud, that looks set to continue to bleed depositors dry in the run up to the May 2015 general election as an desperate, fractious Coalition government will first attempt to bribe the electorate by spending money the country does not have or in the final analysis given a poor standing in the opinion polls decide to follow follow Labours example of 2009 (Labour Governments Bankrupt Scorched Earth UK Economy for the Conservative Government ) by handing the next Labour-geddon government an even more scorched earth bankrupt economy.

The banking crime syndicate has been busy these past few weeks by just about pulling virtually every deal that would have beaten even the highly suspect official rate of inflation which is jokingly being reported by the ONS as being at 2.8%, when every household knows through experience that it is actually north of 4%!

Cash ISA Interest Rates Crash

The new tax year gave a small window of opportunity to lock in rates that just barely beat inflation after the interest rate crash of 2012-2013 as a year earlier, Cash ISA savers could have fixed at as high as 4.5% for 5 years, but as the below table shows of the rates offered by the Halifax that the savings rates have crashed directly in response to the Bank of England's Funding for Lending Scheme that was announced in July 2012 which sought to provide the Banks with cheap money to entice lending to the general public that originally would total an estimated £80 billion over 18 months which has now been indefinetly extended. The effect of which is that the Banks are able to rely on Bank of England / UK Treasury for funding for loans instead of savings and thus savings interest rates continue to crash.

| Halifax ISA's | May 2012 | Sept 2012 | Nov 2012 | Mar 2013 | % Cut |

|---|---|---|---|---|---|

| Instant Access | 3% |

2.75% |

2.35% |

1.75% |

-41% |

| 1 Year Fix | 2.25% |

2.05% |

2.05% |

-9% | |

| 2 Year Fix | 4.00% |

3.25% |

2.25% |

2.5% |

-37% |

| 3 Year Fix | 4.25% |

3.75% |

2.35% |

3.00% |

-29% |

| 4 Year Fix | 4.35% |

3.80% |

2.40% |

3.05% |

-30% |

| 5 Year Fix | 4.50% |

4.15% |

2.60% |

3.10% |

-31% |

In my last article on Cash ISA's at the start of this tax year I warned that savers only had a short window of opportunity to lock in rates before they once more resumed their crash - 06 Apr 2013 - Best Cash ISA Savings Account for New Tax Year 2013-14.

Therefore cash ISA savers have perhaps a 4-6 week window to pickup tax free savings accounts before probability favours the rates being cut once more as occurred during 2012 as the Bank of England and government continue to funnel tax payer cash into what still mostly remain bankrupt banks that await the next domino (Slovenia? Spain? Portugal? Italy? Greece? France?) to tip them over the edge once more.

And right an cue the Banks have followed through by taking a meat clever to savings interest rates by slicing over 25% off the rates available barely a few weeks ago as illustrated by the updated table for the Halifax Cash ISA rates -

| Halifax ISA's | May 2012 | Sept 2012 | Nov 2012 | Mar 2013 | May 2013 | % Cut |

|---|---|---|---|---|---|---|

| Instant Access | 3% |

2.75% |

2.35% |

1.75% |

1.35% | -55% |

| 1 Year Fix | 2.25% |

2.05% |

2.05% |

1.75% | -22% | |

| 2 Year Fix | 4.00% |

3.25% |

2.25% |

2.5% |

2.10% | -48% |

| 3 Year Fix | 4.25% |

3.75% |

2.35% |

3.00% |

2.25% | -47% |

| 4 Year Fix | 4.35% |

3.80% |

2.40% |

3.05% |

2.30% | -47% |

| 5 Year Fix | 4.50% |

4.15% |

2.60% |

3.10% |

2.35% | -48% |

So whilst the mainstream press blindly continues to pander to its banking advertisers by promoting 'Best' saving accounts, the reality is that there aren't any best rates out there, and nor have been for many years, in fact the last best rates were way back in October 2008, which at the time I warned to lock into for several years before they disappeared -

08 Oct 2008 - UK Interest Rate Forecast 2009

Savers - To reiterate what I have been saying over the last 6 months, savers still have a a golden opportunity to lock in high fixed savings rates which in the UK are above 7% . These rates won't stay around for much longer, were talking perhaps in the days rather than weeks or months. So the time for action is now ! - Yes, banks can go bankrupt but savings are protected which includes accumulated interest. In the UK the protection is for the first £50k per banking group.

Instead we have seen rates that at times have barely been able to beat official inflation (2.8%) let alone real inflation (4%) and today's rates are just plain outright fraudulent. If you have have money in the bank then it is being systemically stolen.

Walk into any bank, deposit your money and then when turn your back the staff will snigger at the fools who will have their hard earned deposits stolen, even more foolishly as gamblers that frequent book makers are guaranteed to lose their money over the long-run, though at least there is some small chance of a win, but not with money deposited in the banks.

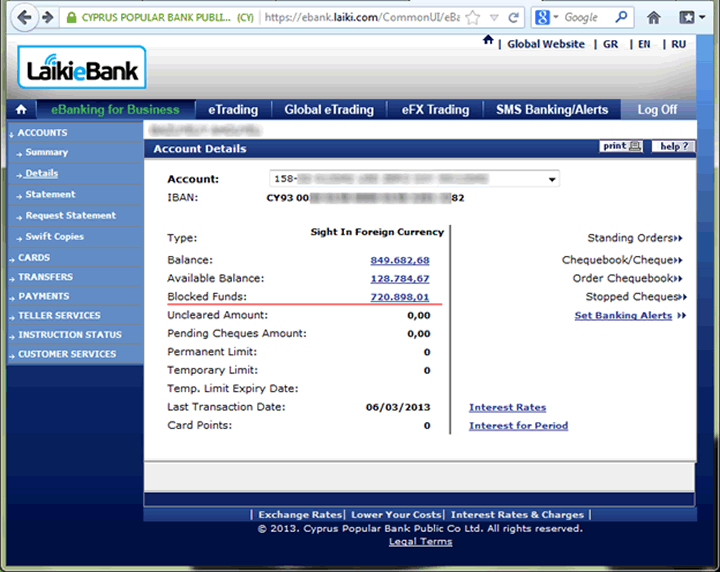

Furthermore Cyprus shows that when push comes to shove, if the Government is squeezed into a corner, then it will outright steal your bank deposits, not just 20%, or 40% or with real life examples of Cyprus bank customers haveing 85% stolen (as illustrated below), but ALL of your money - 99.9%, as the Banking system would be closed whilst the Bank of England worked out the mechanism of how your money would be stolen by means of seizure and high inflation (more than 20% per month!).

At this point you may start wonder that this is all conspiracy theory nonsense but consider this that the Bank of England has already paved the way for how your bank deposits will be stolen during a future banking crisis as the following excerpt illustrates from a document dated 10th of December 2012 - http://www.bankofengland.co.uk/publications/Documents/news/2012/nr156.pdf

Resolving Globally Active, Systemically Important, Financial Institutions Federal Deposit Insurance Corporation and the Bank of England

Executive summary

The financial crisis that began in 2007 has driven home the importance of an orderly resolution process for globally active, systemically important, financial institutions (G-SIFIs). Given that challenge, the authorities in the United States (U.S.) and the United Kingdom (U.K.) have been working together to develop resolution strategies that could be applied to their largest financial institutions. These strategies have been designed to enable large and complex cross-border firms to be resolved without threatening financial stability and without putting public funds at risk. This work has taken place in connection with the implementation of the G20 Financial Stability Board’s Key Attributes of Effective Resolution Regimes for Financial Institutions. The joint planning has been productive and effective. It has enhanced the resolution planning process in both jurisdictions, tackled key issues in relation to crossborder coordination, and identified potential challenges that will be addressed through further work.

This paper focuses on the application of “top-down” resolution strategies that involve a single Such a strategy would involve the bail-in (write-down or conversion) of creditors resolution authority applying its powers to the top of a financial group, that is, at the parent company level. The paper discusses how such a top-down strategy could be implemented for a U.S. or a U.K. financial group in a cross-border context.

In the U.S., the strategy has been developed in the context of the powers provided by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Such a strategy would apply a single receivership at the top-tier holding company, assign losses to shareholders and unsecured creditors of the holding company, and transfer sound operating subsidiaries to a new solvent entity or entities.

In the U.K., the strategy has been developed on the basis of the powers provided by the U.K. Banking Act 2009 and in anticipation of the further powers that will be provided by the European Union Recovery and Resolution Directive and the domestic reforms that implement the recommendations of the U.K. Independent Commission on Banking. at the top of the group in order to restore the whole group to solvency.

Both the U.S. and U.K. approaches ensure continuity of all critical services performed by the operating firm(s), thereby reducing risks to financial stability. Both approaches ensure activities of the firm in the foreign jurisdictions in which it operates are unaffected, thereby minimizing risks to cross-border implementation. The unsecured debt holders can expect that their claims would be written down to reflect any losses that shareholders cannot cover, with some converted partly into equity in order to provide sufficient capital to return the sound businesses of the G-SIFI to private sector operation. Sound subsidiaries (domestic and foreign) would be kept open and operating, thereby limiting contagion effects and crossborder complications. In both countries, whether during execution of the resolution or thereafter, restructuring measures may be taken, especially in the parts of the business causing the distress, including shrinking those businesses, breaking them into smaller entities, and/or liquidating or closing certain operations. Both approaches would be accompanied by the replacement of culpable senior management.

The above text clearly implies that a bail-in of all creditors will be involved in the case of bankruptcy to recapitalize the bankrupt banks.

I won't post the whole document but again refer to an excerpt that makes it clear that only insured depositors will be protected i.e. holdings of less than £85,000 per banking licence.

U.K. regime 17 In the U.K., the Banking Act provides the Bank of England with tools for resolving failing deposit-taking banks and building societies.5 Powers similar to those of the FDIC are available, including powers to transfer all or part of a failed bank’s business to a private sector purchaser or to a bridge bank until a private purchaser can be found. The Banking Act also provides the U.K. authorities with a bespoke bank insolvency procedure that fully protects insured depositors while liquidating a failed bank’s assets. These powers have proved valuable; for example, during the crisis they allowed the authorities to transfer the retail and wholesale deposits, branches, and a significant proportion of the residential mortgage portfolio of a failed building society to another building society.

This further reinforces the fact that savers have to take some risk with their capital be it in the stock market or the housing market or commodities because as things stand you are guaranteed to lose at least 1/3rd of the real value of your bank deposits during this decade, with the ever prevalent risk that in a worse case scenario the Government WOULD Cyprus style outright steal near ALL of your money in the bank.

As a guide of what one could consider doing to protect themselves from the ongoing fraud, the following table illustrates how my portfolio is trending in terms asset classes to protect both against inflation stealth theft and possible outright theft.

| Jan 2012 | Mar 2013 | Dec 2013 | |

|---|---|---|---|

| UK Property | 0% |

50% |

60% |

| Cash & Bonds | 60% |

32% |

18% |

| Stocks | 40% |

18% |

22% |

The bottom line is that as a saver, just like you I have no choice, I either take risks in dividend paying stocks and the UK housing market or all of my hard earned wealth will be stolen by the government and the banks. Off course one of the main objectives of ZIRP is to force everyone to spend their savings, then we will all be in the same boat, become reliant on state benefits because the government's stealth tax - inflation will have eroded the purchasing power of our earnings away.

Ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis which will be on the UK housing market.

Source and Comments: http://www.marketoracle.co.uk/Article40436.html

Nadeem Walayat

Copyright © 2005-2013 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of four ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.