Stocks, Gold, Bonds, Markets Looking For a Top?

Stock-Markets / Financial Markets 2013 May 12, 2013 - 02:55 PM GMTBy: Brian_Bloom

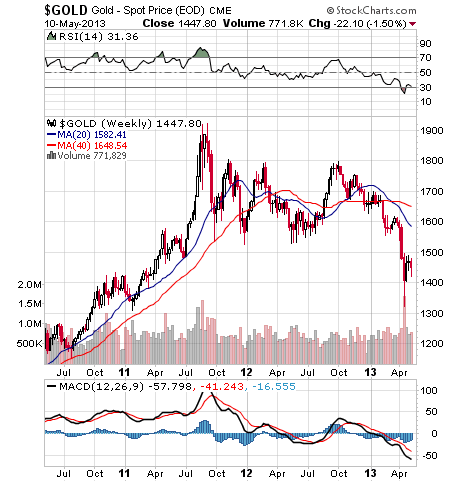

This is a chart (courtesy stockcharts.com) that is looking for a top, but it still has some room to overshoot in the next couple of weeks

This is a chart (courtesy stockcharts.com) that is looking for a top, but it still has some room to overshoot in the next couple of weeks

Maybe 100 point fall, maybe more, depending on what happens to the gold price – which “should” rise according the technical theory based on the oversold oscillators below:

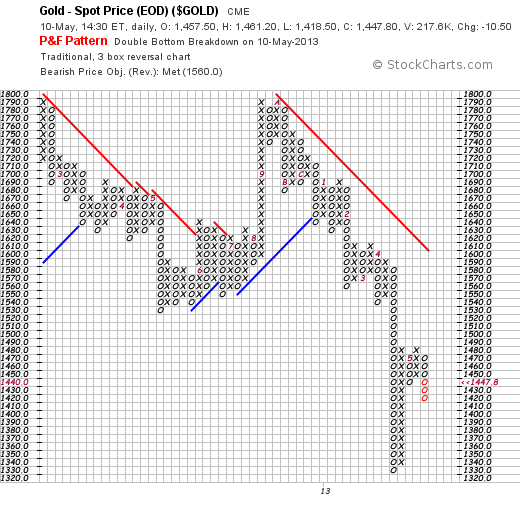

However, if we look at the gold price P&F chart, we see that another sell signal was given on Friday, May 10th:

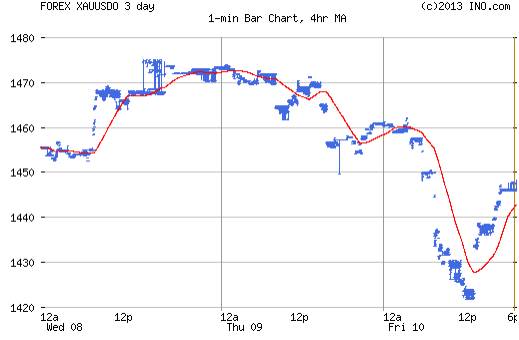

This sell signal might have been “forced”, given the series of downside gaps on the one minute chart below (source ino.com):

In my view, we are watching markets that are being artificially prodded by investors who currently have too much cash at their disposal.

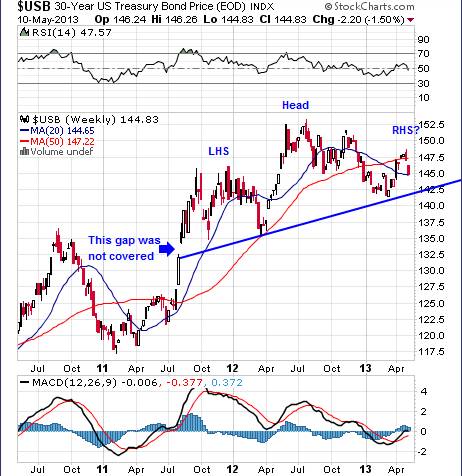

But there is a warning signal being given:

Note the “gap island reversals” on the 30 year bond price chart below:

Based on this next chart, the probability is high that the 30 year bond price will fall by at least 15.5 points to 127 – which implies that both preceding upside gaps will be covered.

Looking at all of the above together, it seems that liquidity is going to tighten in the weeks ahead. Which brings us to the following interview with Speaker Boehner that was reported on May 8th

http://thinkprogress.org/tag/debt-ceiling/?mobile=nc#

Quote:

“ Far from preventing default, the Full Faith and Credit Act would essentially ensure it. That wouldn’t just put paying China ahead of senior citizens and members of the military — it would also hammer economic growth both in the United States and across the world. (HT Huffington Post)”

As John Mauldin pointed out in his latest missive, when a system is unstable, it doesn’t take much of a force to cause it to cascade downwards.

Ultimately, the question that needs to be asked is this:

Regardless of how much cash the Fed injects into the system, if the Federal Government is precluded from accessing it and if the sequester starts to bite, then how stable can the system be? Right now, it is surviving because of faith, but when the temperature rises as the blowtorch is applied by various interest groups demanding to be placed at the head of the payments queue, faith can be like the morning mist: One minute its there, the next minute it’s gone.

So, with the integrity of the entire system at stake, what is the probability that the Fed is going to stand and watch as the gold price “skyrockets”? Anyone for a whiskey and soda?

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.