On the Verge of the Biggest Bond Market Implosion of All Time

Interest-Rates / Japanese Interest Rates May 11, 2013 - 11:28 AM GMTBy: Graham_Summers

Japan should serve as a lesson to central planners around the world.

Japan’s stock market/ real estate bubble burst in the early ‘90s. Since that time Japan has launched NINE QE efforts equal to roughly 25% of its GDP. And GDP growth has worsened despite these efforts from 2% to 1%. Ditto for employment.

Japan elected a new Prime Minister Shinzo Abe in September 2012. Since that time, his primary belief has been that Japan hasn’t engaged in enough stimulus. He threatened the Bank of Japan to get working… and it did, announcing a $1.4 trillion stimulus last month.

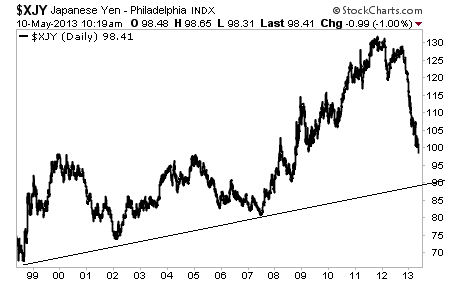

Since that time, the Yen has positively imploded. It broke below 100 yesterday for the first time in years. It’s now fast approaching the long-term trend line. When we take this out, it’s GAME OVER for the great monetary experiment of Japan.

Japan has a Debt to GDP of over 200%. Japan’s demographics are terrible (the country sells more adult diapers than child diapers). Its economy has been imploding for 20 years, and now its truly epic bond bubble is on the verge of collapse as well.

If you thought Greece was bad for the financial system, wait until you see what Japan will do to it.

If you are not already preparing for a potential market collapse, now is the time to be doing so.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.