Stock Market Sell in May… Please Go Away

Stock-Markets / Seasonal Trends May 08, 2013 - 06:31 PM GMTBy: Investment_U

Joe Martinson writes: I firmly believe blindly jumping in and out of the market is a fool’s game. That’s why I dread the annual flood of articles preaching the virtues of “Sell in May and Go Away.”

Joe Martinson writes: I firmly believe blindly jumping in and out of the market is a fool’s game. That’s why I dread the annual flood of articles preaching the virtues of “Sell in May and Go Away.”

I hardly have time to shower… let alone sell all of my stock positions. But the experts tell me sitting on my hands each May 1 costs me money.

The idea behind Sell in May is that the market typically takes a breather six months of each year. So according to the proponents, the way to strike it rich is to blindly exit the market at the end of May and jump back into stocks in October.

This scheme goes by several names: The Seasonal Switching Strategy, The Best Six Months and The Halloween Indicator. Whatever the name, the concept is simple: Only hold stocks during the period from October through April and go to cash the rest of the year.

Bad Timing

Last year, Ned Davis Research published a sensational chart going back to 1950 that showed the difference between holding the S&P 500 during the hot half of the year compared to holding it during the dog days when the market typically slows.

The pumpkin lovers who load up each October then go to cash and stuff it under the mattress six months later enjoyed a 7,453% increase in price over a 62 year period – an annualized gain of 11.3.

The May Day crowd, who did the opposite, wasn’t as fortunate. Their strategy earned a mere 3% over the same period.

The chart made me feel like I was missing out. I had to ask myself… was it time to switch to seasonal investing?

What the chart didn’t show, though, is that merely holding the S&P 500 during the same period (and not selling) did better than an in-and-out strategy. Better yet, the buy-and-hold types avoided all those short-term capital gains tax the in-and-outers had to pony up each year.

Furthermore, these studies ignored dividends.

Why look at stock appreciation only? That’s like buying a house to rent then only look at the change in the price of the house as your return. Doesn’t the rent count as something?

Last year Alex Dumortier, a Princeton-educated economist, decided to see what seasonal investing looks like when dividends are factored into the equation. He looked at the annualized return of the S&P 500 including dividends from 1926 to 2012.

The results were interesting. When an investor sells in May then buys back in October the return was 8.4%.

On the other hand if he buys in May and sells in October the return is a surprising 5.1%, far more than the flat-line results that Ned Davis’ sans-dividend results show.

But the real shocker was the fact that a buy-and-never-sell strategy clocked in with a gain of 10%. This demonstrates that reinvesting dividends is a fantastic way to harness the power of compounding.

It bothers me that Ned Davis went back to the ’50s and Alex’s research went went back to 1926. It’s an apples-to-oranges comparison.

Custom Research

That’s why I asked Alex if his findings changed with shorter time horizons. Perhaps the shorter holding periods of most portfolios in the last decade skewed the results.

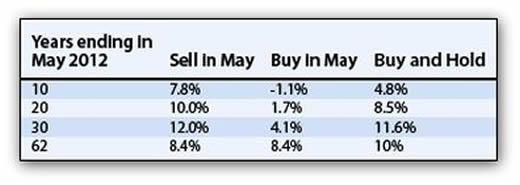

Per my request, he performed the calculations over the last 10-, 20- and 30-year periods. Alex concedes that the findings did change over shorter holding periods.

As you can see, holding time affects the outcome. And I’ll admit recent history favors a sell-in-May strategy. Perhaps something has changed in recent years that favor selling in May over a buy-and-hold strategy (an idea Matthew Carr expands on in the next issue of The Oxford Club Communiqué). Or maybe the events of the last five years have temporally skewed the data.

I asked Alex how he explains that October through May beats May through October, but buy-and-hold is best over the long run.

His reply was straightforward.

“It may well be that there is a seasonal component to stock returns that corresponds to a certain natural rhythm in our economic lives,” he said. “People tend to go on vacation during the summer months, for example. August, in particular, is very slow across many industries.”

There you have it… with the numbers to back it up.

Sell-in-May could be a good strategy for day traders, but those with a longer-term view should think twice before jumping in and out of the market. In the long run, sitting on your hands may be good for your wallet.

Good investing,

Joe

Editor’s Note: A lot of you are probably asking the same questions. Who’s Joe Martinson? And what in the world is an Oxford Club Member Advocate?

In case you weren’t aware, Investment U is published by a savvy group of investors known as the The Oxford Club. There are more than 60,000 Members spread across the globe. Joe’s role as a Member Advocate is to ensure Members understand the very best ways to take advantage of the opportunities and connections afforded to them by The Oxford Club.

Joe plays a very active role in the Club… and often, that includes sending Investment U readers his latest thoughts and research.

Source: http://www.investmentu.com/2013/May/sell-in-may-please-go-away.html

Copyright © 1999 - 2011 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.