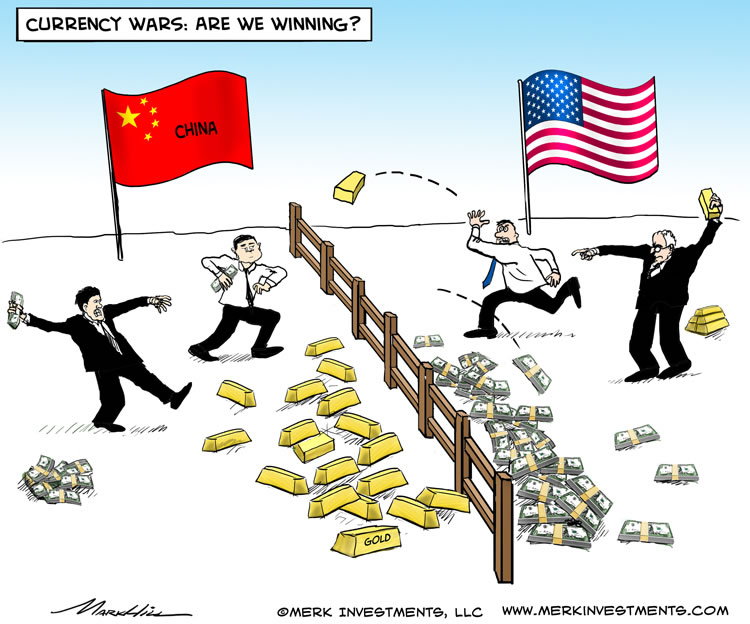

Currency Wars Winners and Losers

Currencies / Fiat Currency May 08, 2013 - 12:16 PM GMTBy: Axel_Merk

Who is winning the “currency wars”? Our take on the greenback, yen, sterling, euro and gold:

Who is winning the “currency wars”? Our take on the greenback, yen, sterling, euro and gold:

The U.S. dollar. All the great things a couple trillion dollars in quantitative easing can buy:

- The stock market is reaching new highs. Except that investors have a rather difficult time diversifying as stock prices are highly correlated to the perception of more quantitative easing. Or shall we say Bernanke’s health?

- The average yield on US junk-rated debt falls below 5 per cent for the first time. Except that our bubble indicator is screaming: in our assessment, investors should be concerned when any asset or asset class exhibits volatility below its historic norm. Think stock prices “always” going up in the late 90s. Housing “always” going up pre-2007. Or Treasuries in recent decades until now. Or junk bonds.

- The economy is “healing” with unemployment down. Except that the “improving” employment picture is masking the fact that companies hire more workers, so that they can cut the average hours worked per employee to under 30 per week to avoid having to provide healthcare under the incoming Patient Protection and Affordable Care Act (Obamacare). Indeed, U-6 unemployment, which includes persons employed part time for economic reasons, just ticked up for the first time since July of last year.

- In our assessment, the U.S. dollar may be as vulnerable as ever, with economic growth possibly the biggest potential threat to the dollar. That’s because should growth be priced into the markets, the bond market might be at serious risk. Aside from then causing major headwinds to the consumer, what we believe is an unsustainable U.S. government deficit might come into focus. We don’t need to wait for the cost of borrowing to move higher; what’s relevant is whether the market’s perception will change. And should the Federal Reserve double down by keeping borrowing costs low, it might make the greenback all the more vulnerable. This isn’t about whether the dollar will fall; it’s about whether there’s a risk that the dollar will fall and what investors do to prepare for it.

Yen. If we think the dollar is the risky proposition, then the Japanese yen may be outright toxic. Did I say that we are short the yen (and generally put our money where our mouth is)? The one thing going for the yen is that neither Prime Minister Abe’s government, nor the Bank of Japan (BoJ) have doubled down in recent days, but that “rally” the yen had, veering away from 100 versus the dollar appears to have already broken down. For those looking for a catalyst, Japan’s upper house elections are coming up in July. While Abe already enjoys a two thirds majority in the lower house, his populist policies might get him a majority in the upper house as well, paving the way for changes to Japan’s constitution. Having said that, such changes may mostly be symbolic, as Japan has long found ways around Japan’s pacifist constitution to ramp up military spending. The only good news for the yen is that the currency’s rapid decline may temporarily halt the deterioration of its current account deficit. The current account matters, as once it is firmly in negative territory, Japan can’t rely on financing its huge debt to GDP ratio domestically anymore.

British Pound. The final straw in the glass half empty category may be the British pound. Mark Carney, outgoing head of the Bank of Canada, will lead the Bank of England (BoE) starting this summer. That may be great news for the loonie (Canadian Dollar), but not so much for the sterling. While Carney’s greatest achievement at the Bank of Canada might have been his ability to compete with former Federal Reserve Chairman Greenspan’s obfuscating talk, he has made it clear that he might engage in nominal GDP targeting or introduce a higher inflation target at the BoE. Moving the inflation target may simply be an admission of reality, as the UK has suffered from stagflation for some time.

Euro. The European Central Bank (ECB) President appears desperate of late: the euro’s persistent strength may be one of the many reasons holding back growth in the Eurozone. Whereas “everyone” is “printing” money, the ECB has been mopping up liquidity. They can’t help it, as their printing press is more demand driven than the presses of the Fed, BoJ or BoE. As banks in the Eurozone return loans from the ECB, there is little the ECB can do about it. Last week, the ECB cut interest rates. And, sure enough, for about a day, rates fell. But after a few days, short-term German Treasury Bills, as well as longer-term Bonds are roughly about the same. Similarly, spreads in the Eurozone, i.e. interest rate differentials between periphery countries and Germany, are roughly the same. A rate cut was nonsensical as one has to buy two year German Treasuries to get a zero yield; anything shorter and investors pay a negative yield, i.e. pay the German government for the honor of lending them money. There are many problems in the Eurozone, but a low benchmark interest rate isn’t one of them. We continue to believe the euro is cursed to move higher, destined to be the “rock star”, albeit it is likely to continue to be a rocky road.

Gold. Is the ultimate currency the ultimate winner in Currency Wars? So as to ensure that no good deed goes unpunished, gold had a rather volatile ride of late. And not surprisingly: as the price of gold moved up 12 years in a row, speculators decided that a good thing is even better when leverage is employed. And, as such, good things come to a screeching halt when margin calls force selling. We now have many investors sitting on paper losses. Some that bought gold because of a meltdown in the Eurozone are selling their positions. On the other hand, not everyone buying gold because of future inflation is on board. Our reason to buy gold has always been motivated by what we believe is too much debt in the developed world. While Eurozone members are trying to address their debt loads through austerity – with rather mixed results – we believe the U.S., U.K. and Japan are more likely to resort to their respective printing presses. In that environment, we believe gold should perform rather well over the coming years.

So why not hold only gold? Any investment depends on that investor’s perspective on opportunities, but most notably also on risk tolerance. Just as investing in a single stock, investing in a single currency or in gold alone can be quite volatile. What we like about investing in currencies is that currency wars can be tackled at the core, without taking on equity risk and while trying to mitigate interest and credit risk. We may or may not like our policy makers’ decisions, but more importantly, those decisions may be rather predictable. As asset prices appear to be chasing the next perceived move of policy makers, the currency market may be the right place to express such views. Gold can play an important part in such a strategy, but as the recent past has shown, one needs to have a good stomach to get through the patches when there is substantial volatility when gold is measured in U.S. dollar terms.

Please make sure you sign up for our newsletter to be the first to learn as we discuss global dynamics affecting the dollar. Please also register to join our Webinar; our next Webinar is on Thursday, May 23, expanding on the discussion herein.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.