Bank Depositors Beware, Deposits Over €100,000 Are At Risk!

Commodities / Gold and Silver 2013 May 07, 2013 - 02:52 PM GMTBy: GoldCore

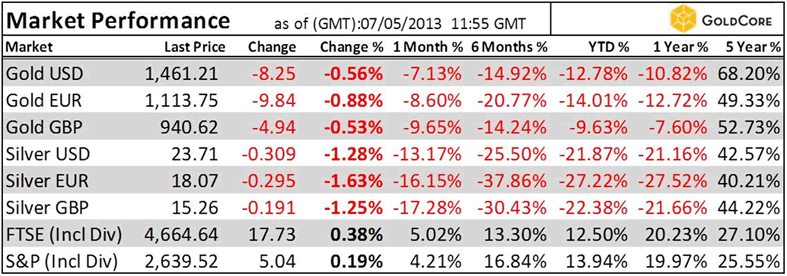

Today’s AM fix was USD 1,463.00, EUR 1,118.67 and GBP 941.74 per ounce.

Today’s AM fix was USD 1,463.00, EUR 1,118.67 and GBP 941.74 per ounce.

Friday’s AM fix was USD 1,476.50, EUR 1,124.95 and GBP 949.34 per ounce.

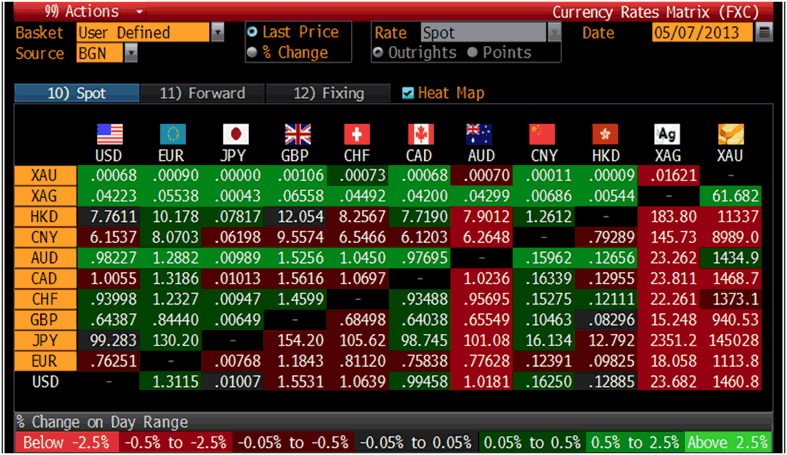

Cross Currency Table – (Bloomberg)

Gold rose $0.70 or 0.05% yesterday to $1,469.90/oz and silver finished down 0.37%.

A bank holiday was observed in the U.K. and Ireland yesterday.

Ireland’s Finance Minister, and current European Council President, Michael Noonan, is introducing a proposal to European finance ministers that will hit depositors that hold over €100,000 in the event of future bank collapses.

The Irish know a bit about bank wind-downs, and maybe have realized sticking it all on the tax payer, severe austerity, doesn’t leave citizens with many euro’s left to consume and jump start the economy.

Noonan is proposing at Tuesday’s meeting in Brussels that large depositors (over €100,000) are “bailed in” as part of future bank wind-downs.

According the The Irish Times, “Under a compromise text proposed by the Irish presidency, uninsured deposits of over €100,000 would be “bailed in” in the event that a bank is resolved, but depositors would rank higher than other creditors in the event of a wind-down.”

In this set up there would be “deposit preference” where creditors would first assume losses and bank depositors would accountable at the end of the process.

Not all European countries agree, some of them believing that uninsured depositors under €100,000 would incur losses even though they should be protected by the deposit guarantee scheme.

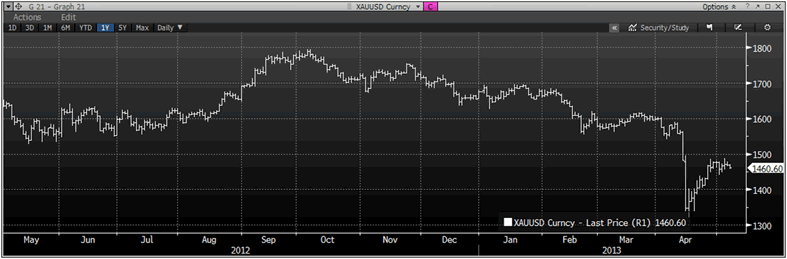

XAU/USD, 1 Year – (Bloomberg)

There is currently no Eurozone bank resolution process in place and after the Cyprus disaster EU lawmakers want transparency for the future.

The European Commission proposes that by changing from “bailouts” to “bail-ins” the losses incurred would not be worse than the losses that shareholders and creditors would have suffered in regular insolvency proceedings that apply to other private companies, noted The Irish Times.

European Central Bank president Mario Draghi and EU economics affairs commissioner Olli Rehn are to introduce a working plan by 2015. The Irish presidency of the European Council is hoping to reach a consensus amongst council members by the end of next month.

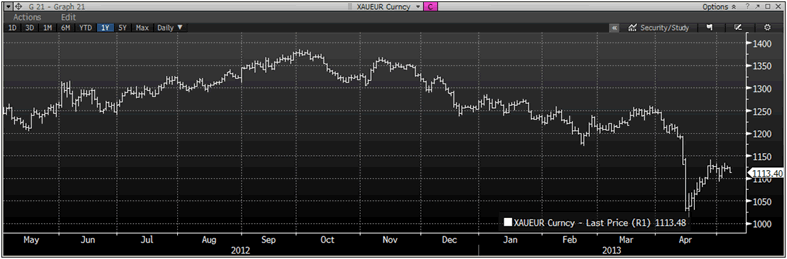

XAU/EUR, 1 Year – (Bloomberg)

The poor results from Danske Bank in Ireland show that bad news is not just from domestic but also foreign owned banks operating here.

Irish Finance Minister, Noonan, knows that the Irish government will need another €30bn above the €64bn which the Irish taxpayers have already shelled out to bail out the banks.

It seems even the number crunchers at U.S. Investment powerhouse BlackRock who conducted stress tests on Irish banks in March 2011 have fallen short of what is need to bail out the Irish banks. AIB, BOI, Permanent TSB, and ESB initially needed €24bn plus the money poured into Anglo and Irish Nationwide it then ballooned to €64bn.

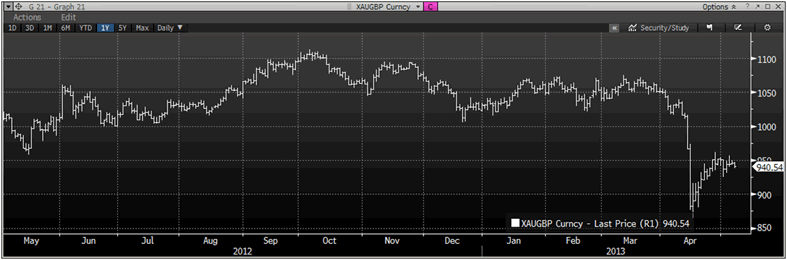

XAU/GBP, 1 Year – (Bloomberg)

The Irish Independent states that this gigantic sum the equivalent of almost half of our economic output as measured by GNP, will not be enough.

In these uncertain times while our politicians are hopefully looking out for us honest taxpaying citizens, even though our services are being cut with every budget, we recommend 5-10% in physical “safe haven" gold to protect against systemic risk.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.