Gazprom Backs Down And Cuts Its Prices

Companies / Natural Gas May 02, 2013 - 08:17 AM GMTBy: Andrew_McKillop

THE SLIPPERY SLOPE - FOR GAZPROM

THE SLIPPERY SLOPE - FOR GAZPROM

Gazprom has a deserved reputation for price gouging, but only little different from Qatar, Norway and Algeria, all of which have endlessly delayed biting the bullet and accepting to cut gas export prices to Europe, by abandoning "oil indexation" of prices. As some economists say, how would it be if world wheat prices were "indexed" to cotton, rice, or iPhone prices? Would that be "rational" or as Gazprom, and Qatargas, Statoil and Sonatrach have said in the recent past, "transparent"?

If Gazprom's gas was indexed to coal energy for Europe - also for producing electricity and increasingly so - the gas price would need to fall 60 percent after shipping costs, and more than 70 percent pre-shipping. Dictating prices, and in some cases victimising heavily-dependent countries with headline grabbing gas supply cutoffs - in winter - Gazprom has forced customers to tap new sources of supply. These are growing. Shale-gas production in the US is only one example. The near-total abandonment of plans to import LNG to the US, decided only 5 - 7 years ago but now reversed to plans for LNG gas exports from the US, has freed vast quantities of both gas and coal from around the world, including American coal no longer needed at home and offered at prices literally defying Gazprom and the other gas-supplier countries to Europe. With new leverage, Gazprom's European customers are now squeezing billions of dollars off the price of their gas imports - which are also declining in volume.

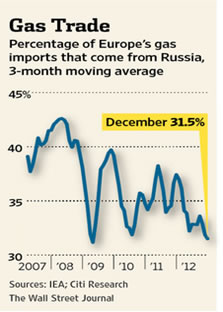

At one time, before 2007-2009, Europe seemed transfixed by its dependence on Gazprom. Europe was, and still is Gazprom's most lucrative market. Dependence on Russian gas, pre-2009, reached about 42.5 percent of all European gas imports, themselves covering more than 65 percent of total gas used in Europe. Since then, both numbers are in decline, in large part driven by gas price gouging.

GAZPROM RETREATS

GAZPROM RETREATS

Today, roughly a quarter of all Europe's gas is covered by imports from Gazprom, through a Madman's Macrame of gas supply pipelines and projected pipelines spanning East Europe and western Russia, that tell a sorry tale of pre- and post-Soviet geopolitical relations with Europe. Locked-in to extreme high cost new gas lines, especially North Stream and South Stream, if the latter is built, and heavily involved in rival-but-allied gasline projects such as TAP and Nabucco West, if they are built, Gazprom needs cashflow. Gazprom said this week that its net profit declined by $6.5 billion, or 15 percent in 2012, as sales to the EU fell by about 9 percent and unit tariffs fell by around 7.5 percent.

Showing how times change, before 2009 Gazprom could curtly reject any attempt at negotiating lower gas prices by its most dependent Eastern European importers, countries including Poland, Hungary, the Czech Republic, Roumania and Bulgaria. In late 2012, despite very cold winter, Bulgaria was able to squeeze a 20 percent price cut out of the wounded giant. Gazprom now needs its customers - not the other way around, creating new worries for Russian leader Vladimir Putin in his drive to make Russia an energy superpower, using Gazprom, and its oil-producing assets, in his strategy of dominating Europe's energy trade. Gazprom is presently the only Russian company permitted to export gas.

With no surprise, due to Gazprom revenues supplying about 10 percent of Russia's total export revenues, Putin has started criticizing Gazprom for letting exports decline, cutting the Kremlin's skim from the pie. This has had a knock-on to the outlook for Russian economic growth, with government officials warning that stagnant gas exports will make it hard or impossible to attain Mr. Putin's target of 5 percent growth in 2013, and following years - unrealistic targets even with high gas prices.

From October 2012, Putin and Gazprom CEO Alexei Miller have increasingly mentioned the keywords "shale oil and gas". Putin has publicly called on Gazprom to "adapt its strategy" in response to this baleful revolution for Greedy Gazprom. The Kremlin is considering breaking-up the company's monopoly on exports, to allow rival domestic producers who have moved faster to develop shale gas "fracking" and LNG export capacity to sell gas and oil outside Russia. Outside of Europe, however, Russia has only a 5 percent share of global gas export sales.

At least as important, Putin's new coldness towards Gazprom sets a question mark under its pricing model—which values high prices more than high sales volume. This model worked with captive customers in Europe, and growing European gas consumption but is much less sure and certain to work now, and anywhere else. Gazprom counters that Europe will need large extra gas import supplies by or before 2020, so there is no reason for it to cut prices too deeply. This is far from sure.

THE GAZPROM BUBBLE - OR SHALE GAS AND LNG BUBBLE?

Gazprom CEO Miller is often shown alongside Vladimir Putin in the media, but Miller's stance on shale gas and oil is redolent of schizophrenia. Gazprom has major projects under way to utilise gas and oilfield fracking in Russia, to either raise production from new resources or slow the decline of existing fields, but speaking on Russian state television, March 30, Miller had few qualms repeating the one-liners from "Artists Against Fracking" in the US, headed by ex-Beatle wife Yoko Ono. Her near-hysterical one-liners include claims that fracking is a "concentration camp technology". In his March 30 interview, Miller said that output from US shale fields using hydraulic-fracturing techniques was a "bubble that will burst very soon. We are skeptical about shale gas. We don't see any risks [to Gazprom] at all." Nevertheless, Gazprom intends to use all the fracking it can! Miller decorated his blast against shale gas with claims that Russian gas is an "ally in the fight against climate change".

Miller's economic claim regarding gas is that Gazprom can supply high volumes of gas for long periods of time - but only at high prices.

Gazprom was able, in late March, to say its its first-quarter exports to Europe were up 5 percent from the year-earlier period, but only due to an "unexpected cold snap" which boosted energy demand, while higher Asian prices for LNG dragged LNG supplies away from Europe to Asia. This caused European spot prices for gas to spike, which Gazprom says demonstrated the value to customers of its pricing model. High prices, always, for supplies that Gazprom can cut when it likes.

When he took office in 2000, Mr. Putin made Gazprom the centerpiece of his new state-led capitalism model, under which all leading companies in strategic sectors will be controlled by the state. Used openly as a tool of Kremlin foreign policy, Gazprom's then-dominant position in natural gas supply to Europe was a lynchpin of this "post Soviet" strategy. As experience since 2000 shows, the Putin strategy also included muscling international energy companies and European governments, using the blunt instrument of gas cutoff threats, and always-high prices.

Gazprom was able to price it gas at highs of more than $18 per million BTU of energy, pre-2009, and still today it can force its customers to pay $15 and over. This can be compared with US natural gas prices which, also due to a long and lingering cold winter, have experienced what analysts call a "miraculous recovery", to reach about $4.15 per million BTU, today, from below $3.50 in 2012.

Unfortunately for Gazprom and Putin, their "pricing model" is rearview mirror history, not only because of the shale gas revolution, onshore, but also due to epic-sized offshore stranded gas discoveries, multiplying and continuing since the 2005-2007 period. Still today (April 18, 2013) explorer Anadarko Petroleum Corp continues reporting additional gas finds at fields discovered since 2009 in Mozambique's Rovuma Basin. This single super-giant deep offshore basin holds at least 30 trillion cubic metres of gas reserves. At end 2011, Gazprom's total gas reserves as stated in company reports were 22.8 trillion cubic metres. With little surprise, Gazprom is actively attempting to buy-into the Rovuma Basin play. LNG exports from the Rovuma Basin will start by about 2020, joining other world class new LNG-stranded gas projects, worldwide

PUTIN COULD CUT SUPPLY - GAZPROM WILL CUT PRICES

At the height of its near-monopoly powers before 2009, Gazprom dictated prices to clients in Europe and especially in former Warsaw Pact nations. The first shock for customers came in 2006 when Gazprom cut off supplies to Ukraine in the depths of winter during a dispute over pricing, overdue payments, and alleged non-payment of gas pipeline royalties and upkeep charges. Cutting off Ukraine also disrupted shipments to clients "further down the line" in East and Central Europe. On the back of soaring, broker-manipulated Nymex oil prices in 2008, CEO Miller was able to crow that gas and energy prices would go even higher, and Gazprom would become "the largest company in the world", beating even Apple by market capitalization.

At the time, Putin on several occasions dazzled the international press with talk about creating a gas-OPEC cartel, to keep gas prices high.

The 2008-2009 finance crisis, and the collapse of both equity and commodity markets did little to faze Gazprom. By January 2009, Gazprom had again cut gas supplies to Ukraine for the same reasons as before. Bulgaria, at the end of the same pipeline, had a complete cutoff and was left to freeze for days until Russia-Ukraine negotiations patched a deal. Today, Gazprom spokesman Sergei Kupriyanov says that cutting off gas to Europe during the Ukraine disputes "did serious damage to our reputation". From 2009 however, as already noted in this article, things began to fall apart for Gazprom's self-image of undisputed power to supply gas - always at high prices. The world's now 380-strong fleet of cryogenic liquid gas tankers can ship LNG anywhere, and suppliers can reach any importer with the maritime terminals and local onshore gas grid interconnectors. Through 2008-2011, European imports of LNG quadrupled and presently stand at about 10 percent of total European consumption - but have radically shrunk since late 2012 on the back of high Asian prices for LNG imports.

To be sure, Putin cut supplies when he wanted - but other suppliers can supply. Today's global gas context is complex, amid plentiful supply and weak demand outside of Asia, but Gazprom's stubborn determination to peg its gas rates to the also-stubborn high price of oil is a dangerous refusal to accept reality. Both Norway's Statoil and Algeria's Sonatrach have cut gas rates for pipeline supplies to Europe, at Gazprom's expense.

They have also done this for reasons as basic as commercial survival, shown by Europe's total gas consumption contracting, in several major countries at double digit percentage rates in 2012. In part this is due to the extreme high price of gas in Europe - but is also due to the extreme low price of world coal export supply, combined with a collapse in EU carbon allowance prices, set by the ETS, which kicked away the last major prop to using gas for power production, in Europe. The US "fast forwarded" its shale gas revolution while European ecologists whined. The US then shifted from coal to cheap, lower carbon shale gas-fired power generation which drove US coal exports to Europe, where power producers switched away from expensive Russian gas to imported coal from anywhere else.

Gazprom's contribution to fighting climate change!

DIVIDE AND RULE

At this stage in time Gazprom is clearly on the defensive and resorting to divide-and-rule with its gas customers in Europe - which it badly needs due its failure to develop pipeline or LNG export capacities to serve Asian markets. It has consented gas price cuts to some European countries, but not others. It claims that it cannot switch to the Asian market because of lack of infrastructures, and is facing stiff competition from coal energy in Europe. As its spokesman said about competition from coal in March 2013: "It hurts us as a gas supplier, and it hurts the climate and environment".

Among Gazprom's first favoured countries and corporate customers, for early price cuts, both Finland and Ukraine have been accorded cuts. After corporate and EU anti-trust legal action, Gazprom has backed down and reduced tariffs on supplies to corporate customers including German utility E.On, Italian energy conglomerate ENI, Austrian gas distributor OMV, and Czech Republic utility CEZ.

Poland's state gas firm PGNIG, which in the years before 2009 was a favoured target for Gazprom price gouging, but is now probably sitting on one of the largest shale-gas reserves in Western Europe, and has begun building a LNG maritime terminal on the Baltic Sea, has won out against the wounded bear.

In 2011 it was forced to file a complaint against Gazprom with an international arbitration panel, but in late 2012, at the final round of negotiations in Warsaw, Gazprom officials signed off a price cut of nearly 20 percent for PGNIG, worth about $1 billion-a-year.

Gazprom's divide-and-rule pricing is the butt of jokes among analysts, due to it having no internal logic of the type dictated by which countries are most dependent on Gazprom gas, or on gas for their national energy needs. Since 2011 the EU's agencies and Commission directorate regulating competition have Gazprom's pricing model in their crosshairs. In Autumn 2011, EU authorities conducted early-morning raids at the offices of some Gazprom offices and major customers in Europe. Formal anti-trust action started in September 2012, accusing Gazprom of using its dominant position to suppress competition and set unfair prices in Central and Eastern Europe.

Putin immediately denounced the investigation as political, hitting back with a Soviet-style decree banning all state companies, like Gazprom, from cooperating with foreign regulators. The European Commission says its investigation remains active. Potential fines levied by the Commission could reach 10 percent of Gazprom revenues in the affected countries - which were about $15 billion in 2012. The "oil price indexation" of Gazprom is a major theme of the anti-trust action.

Gazprom can back down, or it can fall down. Its previous high-handed action such as total gas supply cut-offs have produced country reaction such as that of Bulgaria - now determined to never again be left freezing in winter. Bulgaria has pledged to boost energy production from renewable sources and has offered offshore-gas exploration rights to large European and international energy companies. Bulgarian officials have also linked with their Polish counterparts to coordinate strategy against Gazprom. Able to use South Stream gasline land rights as a bargaining chip, knowing that Putin has said he wanted South Stream construction to start by the end of 2012, Bulgaria was able to lever a gas price cut reaching 20 percent over the present decade - and the promise from Gazprom to sponsor one of Bulgaria's top soccer teams.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.