Apple Stock Sells Record $17 Billion of Corporate Debt at Just 1.81%

Interest-Rates / Corporate Bonds May 01, 2013 - 06:38 PM GMTBy: Richard_Shaw

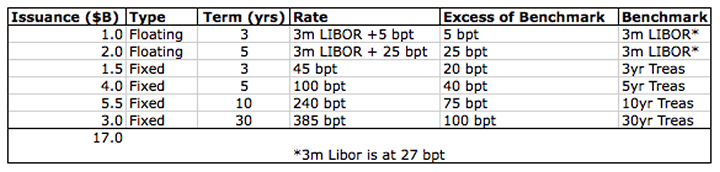

Apple borrowed $17 billion today in various maturity tranches, some floating rate and some fixed rate. The offering was oversubscribed by about 3 times.

It was the largest bond offering in history.

The current blended rate for their debt is 181 basis points, and consists of these floating rate and fixed rate tranches:

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2013 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.