Over Leveraged Hedge Funds Dancing with the Devil

Stock-Markets / Credit Crisis 2008 Mar 15, 2008 - 04:52 AM GMT

Hedge funds are now facing their worst crisis since the 1998 Long Term Capital meltdown. Banks are now raising their collateral requirements even on hedge funds with the best (AAA-rated) assets. Many hedge funds have made money for their wealthy investors by borrowing heavily to buy high quality mortgage securities. Their earnings were made by exploiting the spread between the interest paid on shorter-term loans and the interest earned on the longer-term mortgages. However, they figured if a little debt could magnify returns, then a lot of debt would be that much better. Until, that is, the subprime market caused a hiccup in higher-quality bonds, too. Carlyle Capital , which leveraged its portfolio 32-to-1, collapsed on Thursday after failing to come up with additional capital to protect itself from creditors seizing its assets. One domino after another is falling after the turmoil is forcing other hedge funds to come up with extra capital. The problem is, their assets are also deteriorating, as they cannot find a market, even for their higher-quality debt instruments.

Hedge funds are now facing their worst crisis since the 1998 Long Term Capital meltdown. Banks are now raising their collateral requirements even on hedge funds with the best (AAA-rated) assets. Many hedge funds have made money for their wealthy investors by borrowing heavily to buy high quality mortgage securities. Their earnings were made by exploiting the spread between the interest paid on shorter-term loans and the interest earned on the longer-term mortgages. However, they figured if a little debt could magnify returns, then a lot of debt would be that much better. Until, that is, the subprime market caused a hiccup in higher-quality bonds, too. Carlyle Capital , which leveraged its portfolio 32-to-1, collapsed on Thursday after failing to come up with additional capital to protect itself from creditors seizing its assets. One domino after another is falling after the turmoil is forcing other hedge funds to come up with extra capital. The problem is, their assets are also deteriorating, as they cannot find a market, even for their higher-quality debt instruments.

The Chicago Mercantile Exchange raised the margin limits for transacting five- and 10-year Treasury futures and currencies. Such action is to be expected whenever volatility increases, but it is a mark of the exceptional market conditions and will further add to the cost of trading. EDITOR'S CHOICE

Is the Fed taking bold steps or is it panicking?

The Bank of England, the key European central banks, and the Bank of Canada all joined in a co-ordinated move with the U.S. Federal Reserve in a mix of policies to halt the downward spiral in the credit markets, expanding on the "shock and awe" tactics used late last year.

The press is still under the impression that the Fed is soaking up subprime debt. This could not be further from the truth. Indeed, they are accepting AAA-rated mortgages from Fannie Mae and Freddie Mac as collateral for the loans that they are extending to the banks, even if it is being currently valued higher than what the market will bear. The intention of these short-term loans to the banks is simply to buy time until the market settles down.

Bernanke Flies his helicopter again.

The U.S. Treasury just released its latest paper on The President's Working Group on Financial Markets . Serious investors should read this update, which will tell you to what extremes Bernanke, Paulsen and Wall Street are willing to go to keep the markets afloat.

Jim Rogers, a prominent commodities trader says, “This man just goes from bad to worse…” in an interview at CNBC . He thinks we should abolish the Fed, because they only have one cure for all our ills…more debt.

WSJ – Recession confirmed.

The U.S. has finally slid into recession, according to the majority of economists in the latest Wall Street Journal economic-forecasting survey, a view that was reinforced by new data showing a sharp drop in retail sales last month.

The survey, conducted March 7 through 11, marked a precipitous shift to the negative from the previous survey conducted five weeks earlier. For example, the economists now expect nonfarm payrolls to grow by an average of only

9,000 jobs a month for the next 12 months--down from an expected 48,500 in the previous survey. Twenty economists now expect payrolls to shrink outright. And the average forecast for the unemployment rate was raised to 5.5% by December from 4.8% in the previous survey.

Treasuries Rally as market sells off.

NEW YORK ( MarketWatch ) – Treasuries soared Friday after news that the Federal Reserve and J.P. Morgan Chase agreed to provide funds for ailing investment firm Bear Stearns reminded investors of how deep the credit crisis is running.

NEW YORK ( MarketWatch ) – Treasuries soared Friday after news that the Federal Reserve and J.P. Morgan Chase agreed to provide funds for ailing investment firm Bear Stearns reminded investors of how deep the credit crisis is running.

The market takes the view that the Fed will aggressively cut interest rates next week by .75%.

The report on the Consumer Price Index was unbelievably low last month, mainly because of some quirky calculations on the price of fuel, which may show up in the following month. If the CPI numbers are being “staged,” then it appears that Bernanke now has permission to reduce interest rates aggressively again next week. Nothing like doctoring the numbers, eh?

Cashing in on the high price of gold.

Debt-laden consumers are cashing in on the high price of gold by selling their class rings, gold jewelry and knick-knacks for the gold content. "People are bringing in stuff their mother gave them, stuff they're not wearing, broken chains, broken rings, and walking out with $900, $1,000," says Richard Rozhko, owner of Howard Jewelry in Chicago. Silver, too. "They're bringing in knives, forks, spoons," Rozhko says. Sign of a top?

Debt-laden consumers are cashing in on the high price of gold by selling their class rings, gold jewelry and knick-knacks for the gold content. "People are bringing in stuff their mother gave them, stuff they're not wearing, broken chains, broken rings, and walking out with $900, $1,000," says Richard Rozhko, owner of Howard Jewelry in Chicago. Silver, too. "They're bringing in knives, forks, spoons," Rozhko says. Sign of a top?

The Nikkei hits a 2-½ year low.

Japan's Nikkei index hit a 2 ½ year low this morning. The main reason for the sell-off was that traders were unloading Japanese companies dependent on exports to the U.S. There is a slew of data due to be announced next week, so trading in the Nikkei was thin, as investors were waiting the economic announcements to see the direction of the economy.

Japan's Nikkei index hit a 2 ½ year low this morning. The main reason for the sell-off was that traders were unloading Japanese companies dependent on exports to the U.S. There is a slew of data due to be announced next week, so trading in the Nikkei was thin, as investors were waiting the economic announcements to see the direction of the economy.

China Shares fall on fears of a tighter economy.

SHANGHAI , China (AP) — Chinese stocks fell to nearly an eight-month low on Thursday as investors unloaded shares on fears over monetary tight-ening and lower corporate earnings growth.

The decline below the psychological level of 4,000 points prompted waves of panic selling, analysts said. They said the market would likely look to Wall Street for cues in coming days.

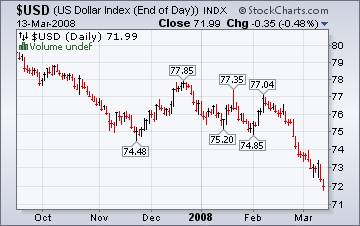

White House, Treasury support strong Dollar.

WASHINGTON ( Thomson Financial ) - US President George W. Bush and Treasury Secretary Henry Paulson today repeated their standard strong-dollar statements as the greenback continued its slide to successive record lows.

WASHINGTON ( Thomson Financial ) - US President George W. Bush and Treasury Secretary Henry Paulson today repeated their standard strong-dollar statements as the greenback continued its slide to successive record lows.

'A strong dollar is in our national interest,' Paulson said in response to a question after delivering a major speech on financial sector regulatory reforms. Yeah, right, uh-huh.

Fed's actions helping the banks, not the homeowners.

NEW YORK ( Fortune ) -- The government is showing considerable ingenuity in devising new tactics to fight the credit crunch. But some observers fear that the innovations risk making matters worse - by fueling inflation and insulating executives who made reckless bets from the full wrath of the market. The Fed's actions are keeping banks from having to show the true extent of their bad bets. Meanwhile, homeowners face foreclosure and savers see their purchasing power erode. This is a toxic combination for the economy.

Is the Midwest getting preferential treatment?

The Energy Information Administration's This Week In Petroleum asserts that, “The U.S. monthly average retail regular gasoline price is projected to peak near $3.50 per gallon in May and June. It is important to note, however, that even if the national average monthly gasoline price peaks near that level, it is possible that prices during part of a month, or in some region or at some stations, will cross the $4 per gallon threshold.” Even now, gasoline prices are at historically high levels.

The Energy Information Administration's This Week In Petroleum asserts that, “The U.S. monthly average retail regular gasoline price is projected to peak near $3.50 per gallon in May and June. It is important to note, however, that even if the national average monthly gasoline price peaks near that level, it is possible that prices during part of a month, or in some region or at some stations, will cross the $4 per gallon threshold.” Even now, gasoline prices are at historically high levels.

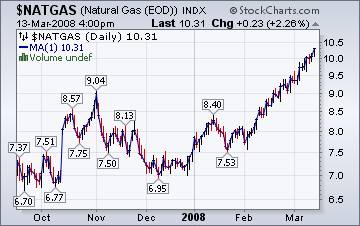

Cold weather alone wouldn't cause this spike.

The Natural Gas Weekly Update reports, “Even though the weather in much of the country has become warmer in the past several days, a significant winter storm moved through the middle of the country and buried the Ohio Valley in snow this report week, likely providing price support in consuming areas in the Northeast and Midwest .” At this point, I think it's more than just the weather causing higher natural gas prices.

The Natural Gas Weekly Update reports, “Even though the weather in much of the country has become warmer in the past several days, a significant winter storm moved through the middle of the country and buried the Ohio Valley in snow this report week, likely providing price support in consuming areas in the Northeast and Midwest .” At this point, I think it's more than just the weather causing higher natural gas prices.

Greenspan's Legacy

In his latest book, Bill Fleckenstein pints out that Alan Greenspan didn't do us any favors when he bailed us out of the stock market decline in 2002. Instead of curing the problem, in the attached article , Ian Pressley suggests that Bernanke ought to read about Greenspan's mistakes so that he can cure his own. Maybe we all should read the book Here's a quote,

``Greenspan bailed out the world's largest equity bubble with the world's largest real-estate bubble,'' he writes. ``That combination easily equates to the biggest orgy of speculation and debt creation the United States (and the world) has ever seen.''

Now Congress is trying to step in and offer $15,000.00 to all new home buyers to support the market. Fellas, why not do nothing at all and let the average price of a home drop by that much instead? Then we can keep the crooks trying to get a piece of the action out of the picture.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program starting in March.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . The first two show is archived. Look for Archives, March 6 and 13, segments 1 & 2.

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.