Treachery, Fraud, Protection, Gold Mega-Action and Mega-Consequence

Commodities / Gold and Silver 2013 Apr 30, 2013 - 07:45 PM GMTBy: Jim_Willie_CB

The Fascist Business Model came into vogue in 2001. The merger of state with the largest of corporations, primarily the big banks, the big defense contractors, the big news media networks, and the big pharmaceuticals, has created a chokehold around the neck of the nation, without 5% recognizing the function of the model during the strangulation in progress. The merger with the deeply corrupted corporations in power became standard fixtures following the 911 attacks, an elaborate self-destruction of the fundamental structure of the nation and its priorities by the syndicate. Think a massive elaborate bank heist of gold bars, bearer bonds, and diamonds, but such discussion belongs in other venues. Let it be said that the events of September 2001 were the syndicate coming out party and the Patriot Act their Nazi Manifesto, with painfully little recognition of events by the sheeple masses or the subservient press talking heads. The national socialists are back in force after a 70-year hiatus, with far more toys and devices. Their telltale signals are bank welfare and a flag wrapped in a cross with unending press coverage of terrorism. During the last twelve years, financial treachery and banking criminality have run rampant in a true global spectacle, their stock & trade. However, treachery with permitted bank and bond fraud, rigged financial markets, naked short ambushes, flash crashes, and lawsuits that convert criminal procedures into standard low business costs all have resulted in profound consequences.

The Fascist Business Model came into vogue in 2001. The merger of state with the largest of corporations, primarily the big banks, the big defense contractors, the big news media networks, and the big pharmaceuticals, has created a chokehold around the neck of the nation, without 5% recognizing the function of the model during the strangulation in progress. The merger with the deeply corrupted corporations in power became standard fixtures following the 911 attacks, an elaborate self-destruction of the fundamental structure of the nation and its priorities by the syndicate. Think a massive elaborate bank heist of gold bars, bearer bonds, and diamonds, but such discussion belongs in other venues. Let it be said that the events of September 2001 were the syndicate coming out party and the Patriot Act their Nazi Manifesto, with painfully little recognition of events by the sheeple masses or the subservient press talking heads. The national socialists are back in force after a 70-year hiatus, with far more toys and devices. Their telltale signals are bank welfare and a flag wrapped in a cross with unending press coverage of terrorism. During the last twelve years, financial treachery and banking criminality have run rampant in a true global spectacle, their stock & trade. However, treachery with permitted bank and bond fraud, rigged financial markets, naked short ambushes, flash crashes, and lawsuits that convert criminal procedures into standard low business costs all have resulted in profound consequences.

The entire world has reacted, with some significant momentum having been generated in the last year. Back in 2009, repeated in 2010, the Jackass had stated that the nations who are first to move toward a non-USDollar system will thrust themselves into a global leadership position while at the same time permit a recovery from the cancerous fiat currency system led by the USDollar as reserve currency flagship. A basic tenet, the security forces are given more power when security is undermined, even if violent events are perpetrated by the security agencies themselves in great spectacles. The Western nations really truly sincerely need a wake-up call on reality, and it is coming as a paradigm shift with shock waves. But consequences have a way of developing out of natural systems in reaction. Some scientific types call it Newton's Law. Others call it the order of natural systems. The Jackass preference is to call it a defensive maneuver motivated by the survival instinct, whereby the cancer or pathology is isolated, trapped, then suffocated and extinguished, left to die on the vine or shed like bad skin.

TREACHERY, FRAUD, PROTECTION

The collection of treacherous practices, most of which emanate from the myriad USGovt offices, have invited stern reaction by the global players. These diverse treacherous practices, often implemented by the Wall Street banks and their ring leader the US Federal Reserve, have invited stern reaction by the global players. The broad cover for treacherous practices, provided protective cover by the USGovt regulatory agencies, have invited stern reaction by foreign nations in a powerful response. The disintegration of the financial foundation built of USDollar steel beams and USTreasury Bond cement blocks has been crumbling and collapsing for the last four years, ever since the Lehman Brothers failure and the integration of Fannie Mae & AIG under the USGovt roof, where their $trillion frauds are kept deeply hidden in the shadows and basement. While the Manhattan Made Men continue to attempt to hold things together, they struggle mightily, lacking sufficient fingers and toes to plug the vast leaky dikes. In response to predation and treachery, the rest of the world has not only been undergoing reaction, they have also been developing the reaction into organized structures. The main victim has been trust and security, for money, bonds, and bank accounts. All property not nailed down is at deep risk. The current wave of treachery and fraud follows the last wave, where most Americans saw their home equity vanish, many foreclosed and jettisoned from the homestead. The public should harbor no trust, while clinging to suspicion toward the leadership crew that undermined security with its own hands.

The list of acts steeped in treachery is long. The reactions are impressive. When viewed as the mosaic for actions coming to pass, the global response is indeed formidable. The micro events are important in their own right, as each hilltop must be retaken and restored. The macro events are what will en masse change the world, as a Paradigm Shift is underway. The United States and its fascist allies are not in control. They will not find a path to retain or regain control. They have no solutions. The most powerful element of the shift has been the movement of gold wealth from Western locations (New York, London, Switzerland) to Eastern locations (China, Russia, Singapore, Taiwan, Hong Kong). Most residents of the United States, the United Kingdom, and Western Europe are in shock, constantly distracted by the sweeping disruptive events led by a) unstoppable government deficits, b) the powerful crumble of sovereign bonds, c) the ruinous insolvency of the banking systems, d) the relentless reign of tax terror, and e) the tragic decline of the underlying economies. The West is sinking in a sea of fecal soup, stirred with the toxic paper spew, infected by the rot of acidic corrosion, weighed down by absent legitimate solutions, exploited by criminal activity in high offices. The treachery has brought on powerful consequences. The Western lords are being deposed. They can appeal for squire posts to the East, or else they can wreck the globe. The biggest question is whether new trade devices will win out over the chosen Western fascist predilection toward wider war, release of more virulent viruses, more obvious slavery pens, and louder propaganda.

MEGA-ACTION & MEGA-CONSEQUENCE

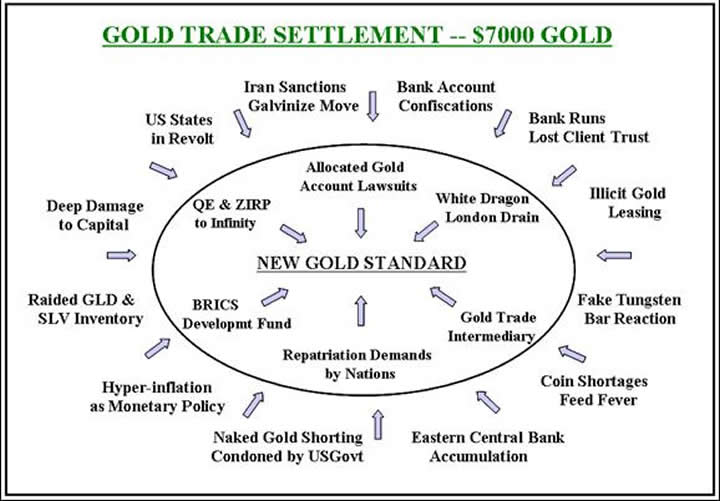

Break the Gold Standard of Bretton Woods Accord: The action has wrecked the entire global financial system, the destruction a slow burn. The banking leaders are caught in a monetary vise where monetary policy is stuck with ZIRP (0% forever) and QE to Infinity (endless bond monetization purchases). A constant wrecking ball has been applied to the capital structures. Deep damage has come to the financial markets from lost trust, vanished integrity, and no semblance of proper value. The world reacts by searching for a USDollar alternative, since the removal of the Gold Standard has crippled the world and permitted widespread fraud. The new standard will usher in the new Gold Trade Standard. Many are its forces. Many are its motives. Many are its devices. A picture says 1000 words. Observe the Concentric Rings of Death, the great implosion of the USDollar and fiat currency. The rebirth of the Gold Standard will be based in trade settlement, not the banking and currency systems. A grand sidestep is being undertaken under heavy risk. The West controls the banks and FOREX mart. The East has been controlling trade, the emerging economies who finally stand up to demand a voice, even a hand in architecture. They are learning new ways, building new roads, forging new paths.

ACTION & CONSEQUENCE

Quantitative Easing which is bond monetization: The action has unleashed hyper monetary inflation, known better as hyper monetary inflation by another less euphemistic name. The action constitutes a systematic undermine of assets held in reserve by angry foreign governments in the macro sense. The action debases the USDollar currency, in effect all currencies since they defend by competitive devaluations. Central banks around the world must debase their currencies, or else face economic hardship from lost export trade. The reserves held by governments, including sovereign wealth funds managed by government ministries, all lose value from the inflation effect by the USFed actions in debasement. The consequence is immediate. Eastern nations make decisions to diversify out of the USTBonds, the main US$-based vehicle. They have stepped up their accumulation of Gold bullion in reserves and wealth funds. They seek to discharge the USTBonds, and return them to sender. The owners of PIIGS sovereign debt can simply issue a sell order. But foreign nations must send USTBond back to their criminal underwriters and destructive central bank overlords. They must deploy more elaborate plans, like the Russians & Chinese building the Eurasian Trade Zone, who finance its infrastructure with USTBonds, sending the toxic bonds to London for digestion, then burial.

QE bond monetization which is pure inflation: The action is hyper monetary inflation, which works efficiently to cause rising prices in the broad micro sense. The design is to raise asset prices in a beneficial way by naive desperate hack architects. The reality is that the capital structures face severe threats. The deeply felt effects have been engrained in rising cost structure, shrinking profit margins, widespread job cuts, and powerful recession pressures within local economies. The stupidity is compounded by austerity measures, which would have had a positive effect 20 years ago, or even 10 years ago. Now they are a death spiral assurance. The consequence is simple survival. The world reacts by searching for and developing a USDollar alternative, a new standard upon which to build viable strong enduring systems with the requisite price stability. The Eastern nations work toward a new trade settlement system which will no longer see USTBonds paper chit exchanged for real goods, either bulk commodity and finished products.

Western central banks talk in empty terms about an Exit Strategy: The action is constant 0% in place (ZIRP forever) and endless bond monetization in redemption (QE to Infinity). No lessons have been learned by the Japanese monetary corner suffered for 22 years. In summer 2009, the Jackass called the Bernanke Fed a liar, after the pervasive deceptive talk of an exit strategy. They have none, proved each year. The consequence is that Eastern nations band together for a bonafide real Exit Strategy, as the vast array of nations, many led by the emerging economies giants, will depart the USDollar since the American toxic merchants and fraud kings cannot. The banking and FOREX standard out of the West has been the USDollar, steeped in longstanding hegemony. The trade settlement standard out of the East will be Gold, steeped in rebellion. The two fronts will clash for a monetary nuclear war.

Iran sanctions within the banking system: The story is such poppycock of Iran developing nuclear weapons. They have no weaponized plutonium. They have no missile delivery systems. What they did that was so objectionable was to sell energy products (crude oil & natural gas) outside the USDollar system. Such actions are considered usage of financial devices of mass destruction. The Saddam Hussein regime in Iraq committed the same banker sin. The sanctions are coupled by pressures against the UAE trade artery toward Iran, and pressures against the Turkish gold market working as intermediary to keep the Iranian supply chain filled. The usage of bank SWIFT code bans and lost credentials for Western banks that cooperate with Iran have backfired in a grand way. The resulting reaction in consequence is astonishing. The Iran sanctions have done more to galvanize the entire Eastern nations into workaround devices and elaborate platforms which are coalescing into promising emerging global systems. The Eastern reaction has brought about a global initiative to develop a workable USDollar alternative, but centered in trade. The Gold Trade settlement is the center piece. Its device platforms include the BRICS Development Fund. Its proving ground is the Eurasian Trade Zone.

LIBOR price fixing revealed, bank derivative fraud made public: The action has permitted the world to observe how the foundation of the entire Western banking system is a deep fraud. Worse, the world is able to observe how no prosecution, no justice, and no remedy will be pursued for banker crimes. The LIBOR and derivative frauds are the next to final exposure to happen. The effect is a stench, a vast distrust across the entire banking system and bank derivative product pricing. The big bank profits are all an illusion based on lies and price rigging. The reaction in consequence is a pervasive perception of a corrupt system in need of replacement, and a willingness to work toward legal avenues. The reaction will be distrust of all asset prices and profound confusion. The reaction will be a vast writedown of wealth in bank failures and financial firm failures.

Allocated Gold Account theft and malicious usage: In order to make bilateral trade account settlement easier, the New York and London banking centers encouraged settlement to be done on a net basis. They went further, to encourage holding Gold bullion in trust at the New York Fed and at the Bank of England, held on account as special untouchable elite accounts serving as treasury emissary substitutes. They were touched. They were stolen. They were replaced with Gold Certificates of dubious value, without permission. The reaction in consequence has begun as a strong wind, but now a powerful storm. The reaction has been defiance in stated demands for repatriation of Gold Accounts, a return to home locations. Germany is the leader in the movement, a respected nation with deep wealth, sturdy prestige, and a no-nonsense attitude. The extension of the consequence is that a gaggle of private Allocated Gold Accounts are under scrutiny. They were also touched, stolen, replaced with worthless paper certificates. The gathering storm is building force and power. It is the final bank fraud to reveal how over 40,000 metric tons of gold have been stolen, in need of replacement in the open market. The true Gold price will reflect the acute supply shortage. A $7000/oz Gold price might not bring the Demand versus Supply imbalance into proper equilibrium. The price might have to be higher, to offset the gargantuan growth of money supply. The missing gold from supposedly guarded sacred accounts exceeds the central bank holdings in reserve on a global basis.

Phony USGovt citation of gold reserves in form of Deep Storage Gold: The USGovt takes the public for fools in a global sweeping sense. After leasing and selling all 8500 metric tons from Fort Knox, the Clinton Admin began to put phony entries on the official statements. The arrival of Deep Storage Gold should evoke laughter, even deep guffaws. They are nothing but mountain ore deposits, with a hope of becoming gold bullion some day. If truth be known, the grand misfortunes experienced at Barrick Gold, with shutdown of their Pascua Lama mine on the Argentine Andes, will interrupt the process of bringing the deep storage gold to the COMEX. Also, whatever portion of the Kennecott Utah mine output was due to see the COMEX vaults, it will not arrive anytime soon either. The landslide will curtail delivery for at least a year. The reaction in consequence by Eastern nations is to build gold reserves. They realize the United States, the Canadians, and the British are liars on almost all matters of gold accounting in reserves. The USDollar, the Canadian Dollar, and the British Pound have no collateral. Neither does the Euro currency. The Eastern nations will accumulate much faster than they claim. The Chinese and Russians have an order of magnitude more Gold bullion held in reserves than they admit. They feel no urge to share the truthful proper count.

Big US bank gold & silver naked short positions: The practice of naked shorting (sales with no intention of ever delivering the metal bars on the loading ramps) is plain illegal and corrupt beyond description. Imagine selling Mercedes Benz cars to push the price down, never to delivery the cars. The incredible sham takes place every day in the COMEX market, supported by the LBMA in London. The so-called paper gold price has no bearing or connection anymore to the physical Gold price. The consequence has been a profound shortage of gold bullion, gold bars, gold coins, and gold talents, even gold jewelry. The Eastern nations have responded by building gold reserves in much greater volume, sensing massive shortage of precisely what would stabilize the monetary system, namely Gold. The global market for various gold products has responded by imposing a premium on the official gold price, since it has become a forced cocktail of meaningless rubbish with a slimy foam head. The other more heart felt consequence is the return removal of Eligible gold in COMEX within the JPMorguen vaults. They have fallen by a reported 65% in just two days of vacated metal. The JPMorguen crew have handled a reported 99% of all gold delivery requests in the last three months time. A bank run is occurring, not in the commercial banks, but in the JPMorguen vaults where Chased out are the gold bars.

Wide distribution of tungsten fake gold bars in the 1990 decade: The action was largely directed at Hong Kong, the port for China. The volume according to my sources is beyond a thousand fake gold bars sent to Hong Kong banks during the Clinton-Rubin era. The reaction is an unspeakable anger and resentment. The remedy pursued in order to keep the lid on the scandal appears to be a secretive drain of US gold sent East by refiners (not central bank). Doing so enables it to be classified as Industrial Gold Supplies in the official trade data. The big red thumb in the data is the arrival of an outlier of exports to Hong Kong that did not exist last year. The more profound consequence is the intense scrutiny over Allocated Gold Accounts and their demanded repatriation. The bars are being assayed, verified, even recast. The distrust of the vile New York and London bankers has reached high pitch on the global stage.

Slug US coins in usage since 1965, making official coins mere plated tokens: The action has revealed the shell game deployed by government officials in their management of money. In ancient times, money was metal held in hand. The sophisticated criminal bankers have been unable to conceal the duplicity in money beyond coins as bonded securities became the standard. In past Roman times, the practice was called sovereignty, whereby the leaders would skim small amounts of gold from coins for personal accounts and family wealth tucked away. The American trend setters have gone far beyond what ancient Romans did. They have removed over 90% of the precious metal in circulated coins. They went the rest of the way to 100% by making paper the recognized legal tender, with zero gold backing to the USDollar. By breaking the Gold Standard in 1971, the USDollar has no gold in support. The coins are a mere side show. The consequence is an exercise in Gresham Law. Good forms of money are removed from circulation, removed from the risk that others might recognize their higher value than the worthless slugs circulating among hands. The coin market has seen fit to call the pre-1965 silver coins a strange name, Junk Silver. Their value is multiples greater than face value, a great embarrassment and signal flare of corruption.

Raids against the GLD & SLV exchange traded funds: The entire design of these sham deceptive ETFunds is brilliant. The Wall Street and London City designers deserve credit for building a Trojan Horse that has been ridden for almost ten years by absolute morons and lazy dolts, the greatest dupes ever to walk within the gold community gates. The dupes include meatheads like Adam Hamilton and other supposed wise men. The consequence in this case is not a retaliatory deed, but rather a drainage of the inventory at a rapid rate. Officially known as the SPDR Gold Trust, the GLD gold inventory is enjoying a half-life of destruction. Spare the engineering details. Note that on or about April 22nd, a whopping 18.3 tons were removed. An acceleration is plainly evident over the last few months. The first 50 tons took 75 days to depart the vaults. The next 100 tons took 48 days to be loaded off and depart. The next 100 tons took a mere 13 days to vanish. The most recent 100 tons took under 7 days, as the acceleration continues apace. At the current rate of departure, the SPDR Gold Trust will be vacant in around two months time. The refill replenishment will be required by the Swiss castles and Roman catacombs, but not the Tower of London (since nearly bone dry). Forget the embarrassing negative premium inherent to the ETFund over the last three years. Zero inventory is far more an embarrassment. The big questions are whether the indescribably stupid investors will notice, and whether lawsuits will hit the scene to bite hard.

Bail-in solution for bank failure, Cyprus style: The action is devious and destructive, whereby banks will talk of recapitalizing within elaborate restructure events. However, when the dust clears, the evidence is plain that the change to be seen will be dead banks in dissolution with private bank accounts vacated. In other words, razed leveled banks with no functioning operating offices, and bank accounts showing zero balances. The consequence is ugly and powerful, lost client trust in the banking institutions. Faith is a key ingredient to stable systems. The US account holders will be treated with stock shares in conversion for the dead banks, whose value will converge quickly to zero. Same effect, lost accounts. Expect soon the result to be a climax with bank runs. The bank runs will coincide with bullion bank runs, the fast removal of gold held in inventory vaults at the bullion banks, including JPMorguen and the GLD exchange traded fund.

Phony big US bank accounting with FASB blessing: In April 2009 a seminal event occurred, whereby the big financial institutions were given permission legally to declare any value they wish for their assets held on balance sheets. What an incredible travesty, like giving children the authority to grade their own school exams. Or like giving Al Capone the authority to approve his own tax returns. Naturally, almost all the big US banks pass the Street Tests, those shams to put a second layer of phony legitimacy on balance sheet wreckage. The consequence is multi-sided. The big US banks have grown dependent upon the USTBond carry trade for rebuilding their balance sheets. They borrow for free and invest in 10-year or 30-year USTreasurys. They tend to have no profitable business segments, not from commercial lending, not from investment bank functions like bond and stock issuance, not from credit cards. The banks have in the process lost their commercial credit function within the USEconomy. They have become casinos for carry trade, derivatives, even money laundering.

Most Favored Nation status granted to China, with a Golden twist: The pact was secret but its ugly features finally became known. The Wall Street bankers shepherded a curious pact in 1999, whereby China would lease to the syndicate bankers a sizeable portion of the Mao Tse-Tung era gold. China would benefit from a wave of foreign direct investment starting in 2002, to build a critical mass of factories, enough to industrialize the nation. With trade profits, they would recycle the surpluses into USTreasury Bonds, just like the Saudis agreed to do, beginning in the 1970 decade. The Wall Street bankers were thus able to continue their gold leasing game. They had gutted Fort Knox and its ample tonnage. They continued with the Chinese gold, leasing it to support the price suppression. The Wall Street Boyz did not honor the pact, did not return the Chinese gold in 2007, thus the trade war heated up fiercely. The consequence has been a multi-lateral trade war, culminating in a deadly conflict that has the Beijing leaders motivated to kill the USDollar as global reserve currency on numerous grounds. It is not worthy, the object of monetary inflation decided upon unilaterally by the USFed central bank. It is the common denominator of wrecked banking systems. It is the credit card for consumption, even foreign aggressive wars. It compensates for what the United States lacks in industry. The ultimate consequence will be the United States losing its privileged global reserve currency USDollar, suffering imported price inflation, contending with supply shortages, and entering chaos. The Third World will be the death sentence, complete with a vast police state and utter brutality.

Reliance upon asset bubbles in USEconomy, dependence upon housing bubble: The decision to dispatch the bulk of US industry to China from 2001 to 2004 was a critical turning point in the USEconomy. It convinced the Jackass immediately of political and corporate sabotage of the nation. To forfeit industry and the legitimate income was to put the nation at systemic risk. Any dependence upon the housing and mortgage gigantic asset bubbles for the USEconomy consumption spending was a perilous step to lock in. At the time, the Jackass expectation was for the twin bubbles to bust around 2006 or 2007, sending the nation into an uncontrollable tailspin. The actual years were 2007 with the subprime mortgage bust and 2008 for the Lehman bust. The Wall Street mavens attempted to sell the clean industry plan of financial engineering within an advanced system and sophisticated economy. They failed, as did the phony offset risk structures. The consequence is the nation approaching systemic failure amidst unstoppable central bank hyper monetary inflation, with the Weimar nameplate on the overheated printing press. The consequence is the collapse of Europe in tandem, and a revolt among Eastern nations which seek a USDollar alternative for both trade settlement and banking reserves management.

The TARP Fund following the Lehman/ Fannie Mae/ AIG bust: A major turning point for the public to wise up to Wall Street criminality was the $700 billion TARP Fund designed for the big US bank system rescue. The USCongress and the public were told that $700 billion was urgently needed to keep the lending channels flush with cash, so as to avoid a systemic seizure in the entire credit system. The arrogant megalomaniac vile bankers instead funded preferred stock for the big US banks, and made sure executive bonuses were funded as well. The largest US banks quickly became giant hollow reeds without hope of remedy. The bankers in firm control of the USGovt realized that directing funds to the credit lending pipelines would not have avoided insolvency and ruin. So they filled their pockets. The consequence was the lost trust by the public of big US banks, which slowly they realize are crime syndicates immune from law. The Too Big To Fail banks are widely regarded as now Too Big To Jail, a big shift in perceptions. The popular movements began, alongside the scattered lawsuits.

Abuse of Petro-Dollar arrangement with accomplice OPEC Saudi leader: Claiming that the USTBond was our debt but your problem, stated to foreigners, was arrogant and callous. It invited a response. The many energy importing nations have been forced to pay for crude oil with USDollars for over four decades. They resent the stricture, since it means they must arrange for USTBonds to serve as the reserve foundation within their banking systems. Numerous fronts have been engaged with non-USDollar alternatives in response. However, Russia has a unique strategy as consequence, sure to weaken the OPEC cartel and possibly to force its crumbled path. The Russian energy giant Gazprom is working avidly to create a NatGas Cartel. Several large natural gas producers are already onboard, like Iran and Qatar. Their devices are pipelines and liquefied natural gas terminals. The zinger in the NatGas new coalition is Qatar, already a key OPEC crude oil player. The coffin nail in the new coalition could be Israel, whose Tamar floating natgas rig in the Mediterranean has promised to send surplus output through the Gazprom system to European customers. Add Cyprus to the Med mix, and Gazprom has captured Europe with its new cartel.

Criminal banking activity, with collusion and protected by USGovt ministries and agencies: Since the 1990 decade, the criminality has become deeply rooted. The gutting of Fort Knox by the Clinton-Rubin Admin was the main seminal event. It climaxed in the 911 false flag event that still confuses half the nation of sleepy dopey types. The 2000 decade featured the mortgage finance bubbles, laced with massive fraud. Its primary clearing house was Fannie Mae, which proved useful for several other fraud rings run by the USGovt, thus requiring its formal adoption and certainly not liquidation with prying eyes. Fannie Mae is the multi-$trillion fraud store that is linked to most every scummy seamy slimy game run by the USGovt. The consequence of the permitted and impervious banking sector criminality can be seen from the inside and from the outside. The domestic front saw the rise of Occupy Wall Street, which federal police and local police conspired to label as terrorist. The movement has been disbanded easily. The more powerful threat might be the secession movement combined with states pursuing gold for usage as legal tender, even applied for debt satisfaction. Those are critical points cited in the Constitution when defining MONEY. The US States have begun to exercise their independence via the Tenth Amendment with secession movements. The foreign response is more toward isolation of the United States, both for its governing bodies and its currency, which means the USTreasury Bond flagship will lose its reserve status. Numerous reports hit my desk of foreign corporations and even government ministries not returning phone calls in a grand global shun of US offices. They object to the arrogance and practiced hegemony on financial matters in a queer global kingdom manifestation. The USGovt acts like a global emperor, and foreign nations resent it. The recent FACTA test is worth watching for reaction. Generally the East ignores it, while the West dislikes it. Switzerland will not deal with US citizens in banks any longer, a cheaper alternative. The isolation has parallels in seeking non-USDollar alternatives.

The confusion of money, ordained debt backed money used as legal tender: The floating currency system used by the United States and the West has a pernicious undercurrent, whereby by default the Western currencies are deemed essentially as denominated debt coupons, designated for usage as money for managing transactions and settling debts public and private. The West thereby has confused money with legal tender for several decades. The Western money is not money, but rather denominated debt. The foundation of the monetary system is sovereign debt, in deed, in reality. Not 1% of the American public comprehends this subtle but highly important point. The super abundance of debt has reached crisis levels, and has been in writedown phase for over four years, since the Lehman Brother signal flare event. The phony debt based money has persisted. For decades the wealth accumulation process has been laced with the cancer of phony money. As the debt correction occurs in accelerated speed, the sovereign debt of the West undergoes deep losses. In the process, the nasty consequence is that entire national wealth vanishes as part of a debt writedown. It can be seen in the planned failures of systemically important financial institutions (SIFI), as the Bail-In features wipe out private accounts. The private accounts for savings, stock accounts, futures accounts, even pensions, are merely badly defined debt markers within the vast cockeyed skewed misaligned perverted system. Much of the US private wealth will vanish in the debt writedown and financial firm failures, one decade after phony home equity wealth vanished in a similar manner.

Ambush of the gold market in mid-April, reported as a massive selloff: The gold market selloff was as shocking an event as it was pathetic. It was as destructive an event as it was hilarious to observe. The bankers committed suicide on the global stage. Rather than permit a London and New York gold market default, they committed a grand illegal act by selling $20 billion in gold through paper certificates in two days. The grand sale was executed without benefit of any metal changing hands, without promise of any metal changing hands, with full protection by the USGovt for its criminal actions. The ambush attack did not net more than a handful of gold bars from margin calls, themselves mere paper entries. The consequence is vast and has brought huge changes to the entire monetary stage. A tremendous increase has been seen in gold demand, from Turkey to India to Mexico to the United States to Japan to China to Thailand to Singapore. The corrupt bankers avoided a default, but they assured a more unavoidable future default by lighting a fire of global gold demand, on the physical side with bars, coins, and jewelry. Gold contract defaults will spring up everywhere, lately even for the Chairman of the CME Group on his own contracts held. They exposed the paper gold sham based upon gold futures contracts. The most powerful consequence is that the banker syndicate has revealed the absent link between price discovery and gold delivery. They have therefore ruined the essence of the COMEX & LBMA gold market, rendering it a perverse playground for criminals. It has no gold in inventory sufficient to handle the delivery demands. The COMEX will soon be totally ignored, its price considered a meaningless sideshow that only lacks criminal prosecution.

QUICK CONCLUSION

Miscellaneous other deep dark deceptions have occurred, far too numerous to delineate in complete fashion. A general effect must be cited, since so pervasive and insidious. Gold and USTBonds aint a market. Their so-called official trading arenas are empty rooms with USGovt and USFed devices filling the empty space, creating a phony price. The false Gold price has no real supply. The false Bond price has no real demand. The claimed price is not where Supply meets Demand to clear the table on the market. Therefore the claimed price is not the real price. Neither Gold more the USTBonds are a real market. Witness pure heresy.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"I have been a Hat Trick subscriber since 2005. I consider your publication beyond excellent. It is indispensable to understanding the mega-trends of the past such as the housing bust, bank insolvency, monstrous US Government $trillion debt, the Fed's QE to infinity with no feasible exit strategy, and more. Essentially, your analysis exposes and documents the massive corruption ruining the future of young and old alike in America. A simple thank you is really not sufficient to express my deep appreciation of the time and effort you put into the Hat Trick Letters."

(ElaineW in California)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

"It has been my hope that the financial collapse would occur within a slower time frame, like a year from now. I have followed your articles on various sites for a while, and have to say that you are very perceptive and accurate as well as analytical. You have been more accurate, detailed and thorough than others, and your Big Picture analysis is usually spot on. I have noticed that it often becomes public news 3 to 6 months later. It is not easy connecting all the dots and understanding the implications one event has on everything else, then interweaving all the threads to grasp that big picture. I don't usually spend the money for a subscription,

but I feel your information is vital to know."

(KathyN from Arizona)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.