Paul Krugman - The Most Dangerous Man in the World

Economics / Economic Theory Apr 30, 2013 - 12:35 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: When it comes to spending or saving, it's always a contentious debate.

Keith Fitz-Gerald writes: When it comes to spending or saving, it's always a contentious debate.

But the risks are rarely as high as they are now for the U.S. and most major industrial nations. Such fundamental economic decisions will move a country forward (or backward) for decades, not months, and can't be undone quickly.

So let's choose the "winner" and "loser" of this debate carefully.

Yahoo's Daily Ticker host Henry Blodget pronounced last week that Nobel Prize winning economist Dr. Paul Krugman "won" the vicious argument fought between those who want to increase government spending as a means of rebuilding our economy, and those who want to cut spending and reduce deficits as a means of restoring confidence (and rebuilding our economy).

Really?

The United States has gone from being the world's biggest creditor to the biggest debtor nation in human history. The net present value of our current obligations - money we already owe ourselves - is $222 trillion, and that's up $11 trillion last year alone. Total public debt outstanding is nearly $17 trillion. Our nation has spent trillions more than it's made for years.

We've spent so much money at this point that we cannot pay it back...ever. The United States is permanently indebted to our trading partners both literally and figuratively. Not only do they own broad swathes of our debt, but their growth puts yet more downward pressure on our employment and wages.

Private investment is down and companies from the smallest to the very largest are hoarding capital because they fear the negative correlation between rising government debt and business cycles.

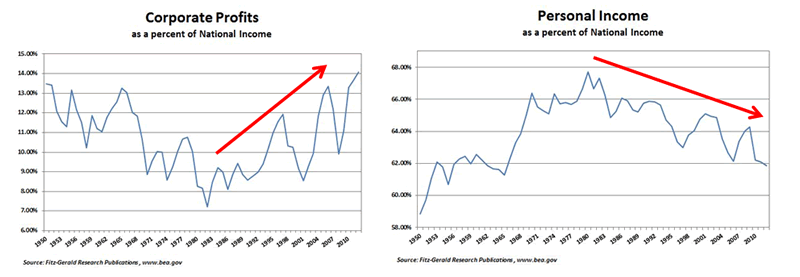

Income is being stripped from the American public and being diverted to corporations. According to The New York Times, the share of national income going to corporations is the highest in 63 years, while the share going to individuals is the lowest in 50 years.

Meanwhile, top line growth is slowing and bottom line expectations are being lowered still further to laughable levels almost without exception.

Millions of Americans are still treading water as prices rise faster than their income. I see graphic differences in the costs of everything from medicine to insurance to entertainment, especially when I've been out of the U.S. for a while and return. Inflation is not the benign influence the Fed maintains.

Low Interest Rates = High Risk Behavior

The Fed's artificially low interest rate policies have diverted money into higher risk assets that have, in turn, pushed the stock markets to new all-time highs.

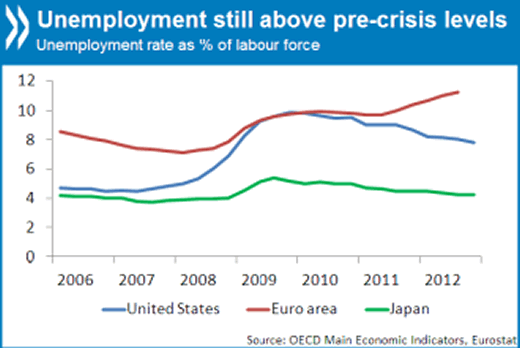

Employment is now firmly below 8%, but so many people have given up looking for work that the statistics are hopelessly cooked. When you add the disenfranchised and underemployed back into the numbers, the true state of the union is between 14-17% unemployment.

This isn't limited to the United States, either. Unemployment is still above pre-crisis levels in Europe and Japan as well, according to the OECD.

We have more Americans on food stamps than ever before. Enrollment in the Supplemental Nutrition Assistance Program (SNAP) is up 70% and now includes approximately 15% of our countrymen to the tune of nearly $75 billion last year. That's more than double Great Recession levels and nearly double what America experienced in 1975 during the throes of double-digit inflation, the gas crisis and a recession thrown in just for good measure.

I'd hate to see what losing looks like. Where's Charlie Sheen and his warlocks when you need "em?

Right for Now, But Things Change

Dr. Krugman, though, is right at the moment and, truth be told, I can understand intellectually why Blodget would say so using a very narrow set of criteria. Many nations are moving beyond debt thresholds that were thought to be unsustainable, led not only by the United States, but by Japan and several European nations. Stock markets are generally rising, derivatives markets are calming down, housing prices seem to be stabilizing.

Longer term, though, things will play out very differently.

Debasing a currency - whether by literally reducing the amount of quality in a coin, as in the traditional use of the term, or by printing so much money as to call into question the integrity and purchasing power of fiat currencies, as is the case in modern markets - ultimately reduces purchasing power to the point where the system fails catastrophically.

Just because people cannot see the forest for the trees does not mean the forest is not there.

People forget that the Roman Empire took 200 years to fail and they went blithely along until it did. People forget that the Byzantines collapsed because of a lack of sound currency. They forget the lessons of the Weimar Republic. They forget that dozens of other nations have failed in the last thousand years because they tried to debase their currency in an effort to stimulate their way out of the hole they dug for themselves.

Though he applied the lesson differently, Vladimir Lenin understood the concept, observing that, "there are decades where nothing happens; and there are weeks where decades happen."

How to Prepare for Catastrophic Failure

My fear is that the financial systems, which have taken decades to get to this point, are fast approaching the point of catastrophic failure much like a tree bending in the wind. Initially supple, it gradually bends until it can bend no further before suffering sudden failure with no warning whatsoever.

We live in a finite world governed by immutable natural laws that keep things in line. Over the longer term, the argument advanced by the "Austerians" stands. At some point somebody is going to have to either a) pay everything back or b) default.

There are still significant unanswered questions related to how and when the government will cut spending, and what will happen to the economy when it does.

Highlighting Japan's experience over the past 22 years, as many pro-spending folks do, and its outrageous debt levels as evidence of success is not an excuse for America to do the same thing. Japan's now into its third lost decade when its experience was supposed to be limited to a singular "Lost Decade."

Japan is a culture of savers. America is not. There aren't remotely the same parallels culturally or politically.

Further, whereas the Japanese Yen once represented strength in global markets, each new Yen minted takes away that advantage just as each new dollar here weakens every other dollar already in existence. Contrary to what politicians would like to believe about the inevitability of a stimulus-driven recovery, markets are already figuring this out. China's actively diversifying away from the U.S. dollar. So are many other nations.

When the Yuan truly steps onto the world's stage in 2015, the game will change forever because there will be a fourth currency that has enough liquidity to absorb global capital flows. The sacred triumvirate of the U.S. Dollar, the Yen and the Euro will shatter.

Those who favor spending frequently argue that growth hasn't really taken off because we haven't spent enough...yet. Well, then, how much is enough? One trillion? Three? Four? Ten trillion dollars?

Avoiding Tough Decisions Is Costly

Even if we accept for a minute that Dr. Krugman has truly "won" and is absolutely correct in his thinking, America will have to undergo a traumatic series of adjustments that include all manner of cuts in a staggeringly wide swatch of things ranging from Social Security to Medicare to defense, lest we fail under the weight of our own fiscal avarice.

It's fashionable to think that these are new problems, or that things will be different this time because of "modern" finance. Nothing could be further from the truth. In reality, the monetary problems we are dealing with today have been understood for thousands of years and argued about for at least as long.

Cicero, for example, observed in 55 BC that "the budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled and the assistance to foreign lands should be curtailed lest Rome become bankrupt. People must again learn to work, instead of living on public assistance."

I believe that the sooner we begin to put aside the petty anti bickering on both sides of the aisle the better. I'm challenged all the time on this by people who gasp once the lights come on and they start doing the mental math. "But this would be terrible" they argue.

Yes...it would. But not facing the music is worse.

This crisis was caused by too much debt in the first place. Piling on more is like giving an alcoholic another drink to cure him.

Why can't we try living within our means?

Answer: Because we don't want to make the tough decisions now, even though the consequences of not doing so grow more acute with each passing day. Our leaders lack the political willpower and large swathes of our population lack the personal conviction needed. Saying we had to do "something," as many argue, is a cop-out because there's no way to disprove the statement.

Personally, I'd rather make the effort than have the system blow up and do it for us, which is the risk we're running today.

That's why I don't believe we can assess who has "won" or "lost" until that point in time when we can all answer the question of whether or not going into debt for the sake of consumption was "worth it."

And, we've all got to make the very best decisions we can when it comes to our money...

...because the government sure as hell won't.

Source :http://moneymorning.com/2013/04/30/the-most-dangerous-man-in-the-world/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.