Gold And Silver Coin And Bar Global Shortage

Commodities / Gold and Silver 2013 Apr 29, 2013 - 12:41 PM GMTBy: GoldCore

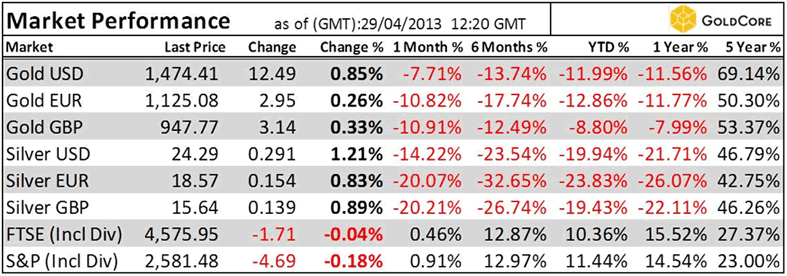

Today’s AM fix was USD 1,472.50, EUR 1,125.51 and GBP 947.80 per ounce.

Today’s AM fix was USD 1,472.50, EUR 1,125.51 and GBP 947.80 per ounce.

Friday’s AM fix was USD 1,462.25, EUR 1,123.43 and GBP 947.79 per ounce.

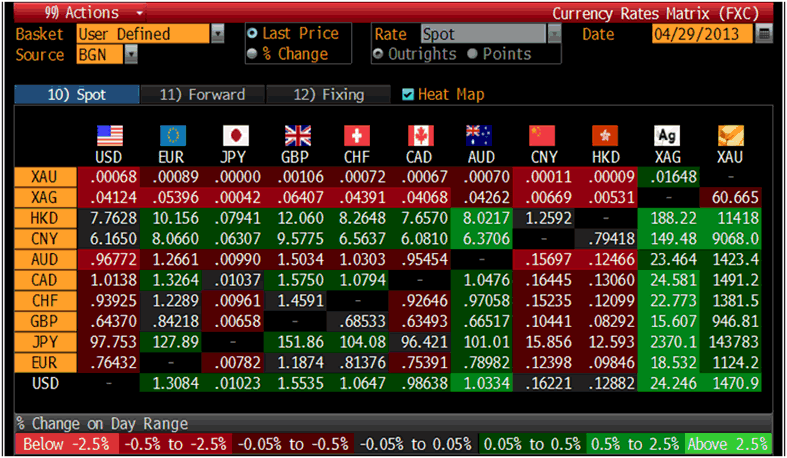

Cross Currency Table – (Bloomberg)

Gold fell $7.00 or 0.48% Friday to $1,467.30/oz and silver finished down 1.65%. Gold and silver both gained for the week at 4.74% and 3.11%, respectively.

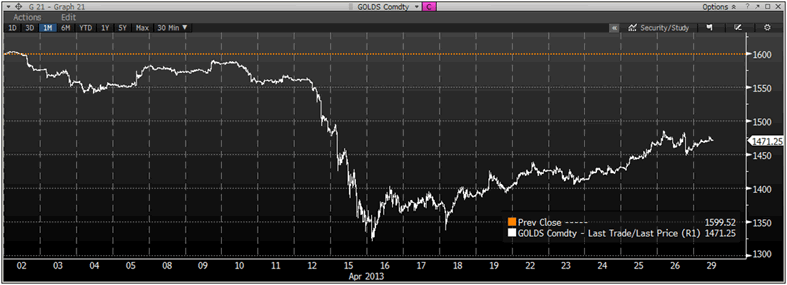

Gold rose another 1% overnight in Asia, consolidating on last week's 4% gain.

Gold in USD, 1 Month – (Bloomberg)

The slight rebound in prices from multi-year lows has as of yet failed to dampen the global appetite for bullion, causing a shortage in the physical supply of gold coins and bars.

Recent bleak U.S., European and Chinese growth data is also supporting gold due to concerns of recessions and of a global depression.

Central banks including the Federal Reserve and the ECB are set to continue with ultra loose monetary policies which will support gold.

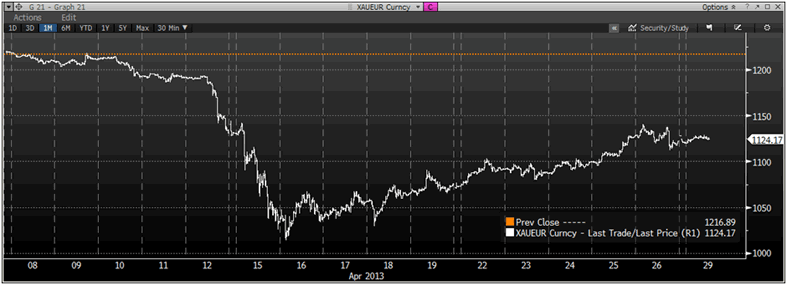

Gold in Euros, 1 Month – (Bloomberg)

The ECB has kept its main interest rate at a record low of 0.75% since July 2012 and may reduce interest rates to 0.5%, either this week or in June. This will further deepen negative real interest rates in most countries in the Eurozone.

The Fed alone is set to keep interest rates near 0% and continue its current pace of bond buying at a whopping $85 billion a month.

Ultra loose monetary policies will support gold as it is a hedge against currency devaluations and inflation and stagflation - all of which are real risks.

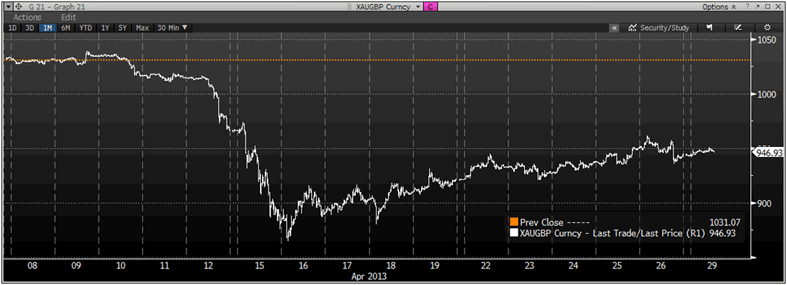

Gold in British Pounds, 1 Month – (Bloomberg)

Premiums for gold and silver bars have jumped higher all over the world. They have surged to multi-year highs in Asia. Reuters reports overnight that premiums are surging due to "strong demand from the physical market, which has led to a shortage in gold bars, coins, nuggets and other products."

Shortages of gold and particular silver coins and bars is not confined to the small coin and bar market and there are also supply issues in the larger bar market with kilo bars being increasingly difficult to secure.

Swiss refineries are struggling to meet global demand for refined gold bars. They have been cleared out of their stock of kilo gold bars – the preferred form of gold bullion amongst many store of wealth, affluent buyers in Europe and Asia. Buyers have been told that they will have to wait until late May prior to receiving delivery on paid for product.

Shortages are most prevalent in the silver coin and bar market where premiums have surged.

Silver coins and bars can now not be bought from the largest bullion dealers in the U.S. who have been cleared out of stock in recent days. Unlike after Lehman Brothers where there were shortages and delays of 3 to 4 weeks, there is no guidance being given as to when certain gold and silver coins and bars will be available again.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.