The Misguided Case for Capital Controls

Politics / Credit Crisis 2013 Apr 25, 2013 - 01:29 PM GMTBy: Casey_Research

By International Man, Network

By International Man, Network

New York Times columnist Paul Krugman recently penned an article in which he comes out in favor of capital controls.

Not surprisingly, his argument follows the near cookie-cutter justification used by governments throughout history to seize more control over their citizens.

- Spuriously shift the blame for the crisis onto foreigners.

- Claim the increase in government control is for "your own good."

Krugman doesn't see irresponsible government spending and the resulting debt as the core cause of recent crises in Europe and around the world. Instead, he blames inflows of money by undefined foreigners.

He even says that the US is victimized by inflows of foreign money when he claims, "It's not just Europe. In the last decade America, too, experienced a huge housing bubble fed by foreign money."

According to Krugman, it's not the fault of the Federal Reserve's artificially low interest rates for blowing up the housing bubble, nor the profligate spending habits of European welfare states for causing the debt crisis, but rather those vague, evil "foreigners" who are to blame. And we need government actions (i.e., capital controls) to protect us.

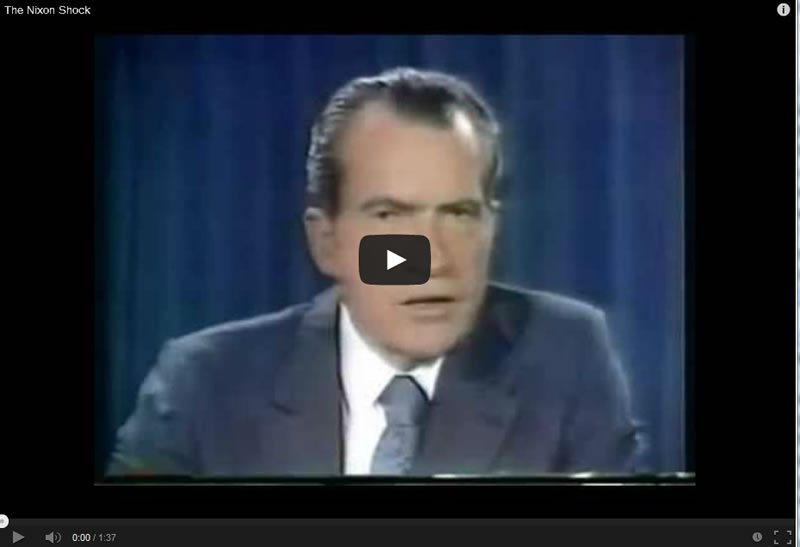

Nixon followed this pattern, too, when he infamously severed the last link of the dollar to gold on August 15, 1971, thereby removing any limit on the government's ability to finance itself by debasing the currency and stealthily confiscating the wealth of savers through inflation.

In the years preceding this announcement, the US government financed its out-of-control spending – which stemmed from the Vietnam War and new welfare programs – by printing more dollars than it had gold backing for.

Nixon claimed he was removing the last links of the gold standard because it was "in everybody's best interest" and that he was protecting us from foreigners, i.e., "international speculators." He also claimed that he was taking further action to "increase jobs for Americans." Watch his two-minute sales pitch below.

It is not a stretch of the imagination to think that another president could take similar measures and then sell it to the American people the same way Nixon did.

I view it as a near certainty that the US government will impose some form of capital controls and wealth confiscation when the US dollar loses its spot as the world's premier reserve currency. It will be the next "August 15, 1971" moment.

Selling such measures to the majority of the American people will probably be an easy task. Paul Krugman is already on board, and the rest of the mainstream media functions more like a bunch of government stenographers than an independent press.

It would be wise not to underestimate their ability to take something that is abjectly false and convince the American people that it's true.

Take, for example, the role the media played in helping to convince a whopping 70% of Americans of the falsehood that Saddam Hussein was personally responsible for the 9/11 attacks.

There should be no doubt that when the US government decides to implement capital controls or other restrictive measures, it will likely have the near-total support of the media and by extension the majority of the people (AKA "the mob").

The moment there is another August 15, 1971-style event is the moment the window closes for Americans. Nobody knows exactly when that will happen, but it appears to get closer each week. You want to be internationalized before that happens. Capital controls is not the only thing you need to worry about if all your assets are within your home country's borders. There are rising taxes to consider… government asset seizures… creeping inflation… the list of threats is long and getting longer. To help you diversify your assets, Casey Research has produced a critically important investors' web event, Internationalizing Your Assets, which premiers Tuesday, April 30 at 2 p.m. Eastern. Tune in to this free video and discover a multitude of legal ways to move your wealth abroad from Doug Casey, Peter Schiff, and other acclaimed experts on international diversification. Click here for details and to register.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.