Stock Market Crash Alert

Stock-Markets / Financial Crash Apr 24, 2013 - 05:24 PM GMTBy: Money_Morning

Ben Gersten writes: If you're contrarian, then Barron's latest "Big Money" poll and its magazine cover just gave you reasons to be on the lookout for a stock market crash.

Ben Gersten writes: If you're contrarian, then Barron's latest "Big Money" poll and its magazine cover just gave you reasons to be on the lookout for a stock market crash.

The semiannual poll of professional investors found that 74% of money managers are bullish or very bullish about the prospects for U.S. stocks - an all-time high for Big Money, going back more than 20 years.

Barron's drives the point home with its over-the-top cover titled "Dow 16,000!"

But not everyone feels as confident as these polled investors - especially since the issue follows 2013's worst weekly performance for stocks.

"Rule o' Thumb: When the cover of a major financial magazine features a cartoon of a bull leaping through the air on a pogo stick, it's probably about time to cash in the chips," mutual fund owner John Hussman wrote on his Hussman Funds website.

Dow 16,000, or a Stock Market Crash?

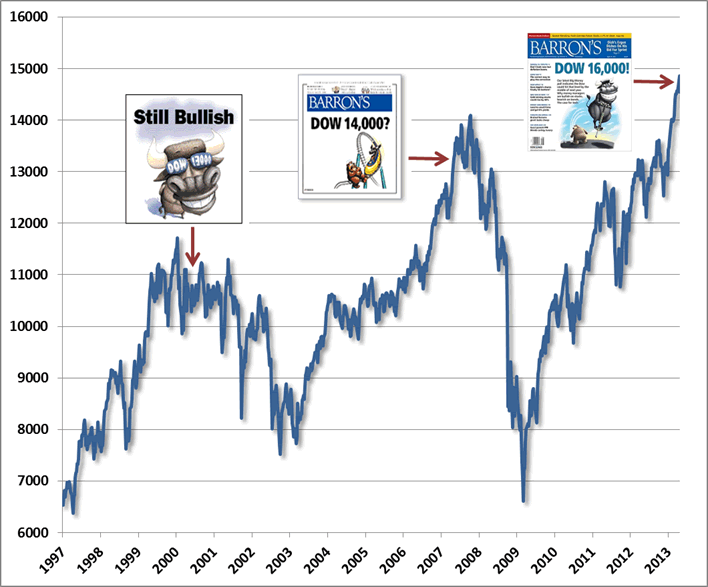

In its more than 20-year history, Barron's Big Money poll has a history of making overly bullish calls at precisely the wrong time.

"Still Bullish! (Dow 13,000)" was published May 1, 2000, with the Dow Jones Industrial Average at 10,733.91. The Dow had already fallen almost 1,000 points from its high in January 2000 and would go on to lose about 40% of its value in the 2000-2002 bear market. The S&P 500 and the Nasdaq performed much worse.

"Dow 14,000?" was published in Barron's May 2, 2007, with the Dow at 13,264.62. The Dow did actually hit 14,000 by October 2007.

In that year's second Big Money poll, released in November, the headline read, "The Party's Not Over," and bulls outnumbered bears 2-to-1.

But as we know, the market had already peaked and would go on to lose over half its value in the 2007-2009 bear market.

This graphic from Hussman sums up the "Barron's Cover Jinx."

Think of this as the investing equivalent of the "Madden Curse," in which the NFL player on the cover of the Madden video game every year suffers a serious injury or dramatically underperforms.

Magazine Covers: Stock Market Crash Indicator?

Hussman's not the only market analyst who likes to use magazine covers as potential contrarian indicators.

Money Morning Chief Investment Strategist Keith Fitz-Gerald pointed out last year, "Magazine covers help me to latch on to important market shifts and trends that others either miss or simply don't see coming."

Looking at these bold headline predictions from the past helps you see why.

"The Death of Equities" adorned the cover of Business Week's Aug. 13, 1979 edition - and the headline could hardly have been more wrong.

The Dow shot up 1,153.76% over the next 20 years. The S&P 500 tacked on 1,135.97% and the tech-heavy Nasdaq rose 1,705.9% over the same time period. The investors who went to the sidelines got left behind.

Then in 1999, Time magazine named Amazon CEO Jeff Bezos "Man of The Year."

Within 24 months, the Internet bubble had burst and shares of Amazon (Nasdaq: AMZN) closed below $6, shedding 94.32% from a previous high of $105.06.

In 2003, after the price of a barrel of oil had fallen to between $20 and $30 a barrel, The Economist ran the headline "The End of the Oil Age."

You guessed it: Oil took off on a triple-digit run, finally peaking in 2008 at $141.71 a barrel.

While investors shouldn't base decisions purely on magazine headlines, they do help give a sense of when markets may be too euphoric or fearful.

History has shown us that much.

Source :http://moneymorning.com/2013/04/23/contrarian-alert-is-this-investing-jinx-signaling-a-stock-market-crash/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.