The Most Profitable Gold Play of 2013

Commodities / Gold and Silver 2013 Apr 24, 2013 - 12:29 PM GMTBy: Investment_U

Matthew Carr writes: You can’t escape it.

Matthew Carr writes: You can’t escape it.

The headlines say it all as commodities sell off and even the most stalwart precious metals enter bear-market territory.

The “Golden Decade” appears to be at an end.

In January I said 2012 was it for gold.

I wrote:

“Europe… will likely have another difficult year in 2013. That strengthens the dollar against the euro, and with gold priced in U.S. dollars, that’s a negative impact.

“And if fear subsides – even though there’s always room for diversification in a portfolio for gold – there’s little reason to own it. It pays no dividend. It’s not a company that manufactures a good to be sold.

“It’s simply gold. A shiny rock that’s more valuable when people are afraid than not. So there’s little luster left in gold’s safe-haven glitter…”

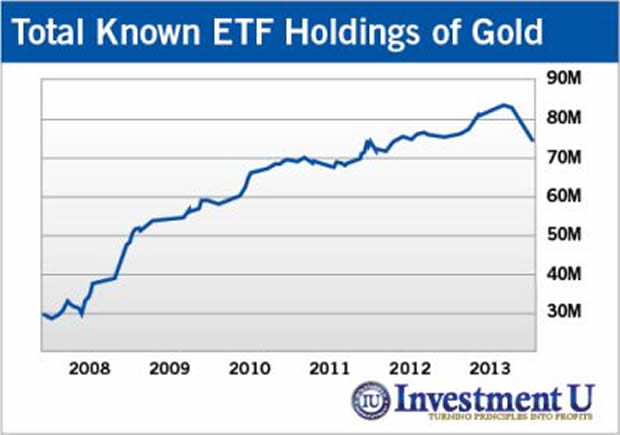

In March, I told readers that one of the most telling red flags of investing in gold appeared (a bearish signal I warned investors about more than a year ago): exchange-traded funds (ETFs) liquidated a record 109.5 tons of gold in February – more than 4% of their holdings.

It was largest single-month liquidation by ETFs since April 2008.

And the liquidation hasn’t eased up…

Today, gold is just off the lowest price it’s been in years.

Playing Gold’s Fall

There are a lot of factors coming to a head…

During the past week, we were hit with a barrage of data. And earnings will be piling in all across the board. Plus, we have our usual host of other economic indicators coming out, like mortgage applications, jobless claims, existing home sales, etc.

The seemingly endless bullish case for gold has faded. As all the support levels for gold were run through last week, the bears have emerged.

They have plenty to feed on.

Cyprus is being forced to sell its gold reserves to help pay for its bailout. And new fears are swirling that other heavily indebted nations will have to do the same.

In the most recent rout, gold tumbled as stop-losses were triggered, adding even more weight to the selling pressure.

Everyone who got into gold at a high price – $1,700 and above – when optimism was still in bloom is now underwater. Longs that got in years ago, though they have more wiggle room, are watching their gains slip away.

The big question is: where does it stop?

$1,200? $1,100? $1,000?

I can’t tell you.

But this is the time of year I look to short some of the hottest sectors. And playing gold’s downside has been hard to beat in 2013.

In fact, for owners of ProShares Ultra Short Gold ETF (NYSE: GLL), it was an early Christmas.

Gold generally shows seasonal weakness throughout the summer months. There’s often little to drive it higher, so the precious metal’s price has a tendency to slip – even during the decade-long bull run gold enjoyed.

GLL rose nearly 16% last Monday as gold plunged. Since Valentine’s Day, the ETF is up nearly 30%.

Trading on SPDR Gold Shares ETF (NYSE: GLD) was more than seven times the three-month average last Monday.

If you’re long gold – a gold bull riding out the downturn – trying to hold onto profits, GLL is a good hedge. If you’re a gold bear, GLL is a good bet to place on gold’s move lower.

But once we get toward the end of capitulation selling (we saw some of this in the last couple of days), you want to move back in the other direction.

Lower prices will spur some gold demand from India, which has been hit in recent years by high prices for the precious metal. But the euphoria surrounding gold has faded. The end of an era is nigh.

Good investing,

Matthew

Editor’s Note: A month ago, Matthew wrote about The Prime System – a seasonal trading strategy he’s been developing for the past few years. Around the office here in Baltimore, Matt is the go-to-guy for in-depth analysis, so expectations were pretty high for the launch of his new service.

However, I don’t think anyone expected this…

In just three weeks, one of his Prime System recommendations has already shot up 34%. I highly recommend you check out Matt’s work on the subject. His extensive research found you can greatly increase your gains – while decreasing your risk – by identifying historical patterns in companies and sectors.

For the full report, click here.

Source: hhttp://www.investmentu.com/2013/April/the-most-profitable-gold-play-of-2013.html

Copyright © 1999 - 2011 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.