Gold Ultimate Disconnect Between Paper and Bullion

Commodities / Gold and Silver 2013 Apr 24, 2013 - 12:24 PM GMTBy: Casey_Research

Bud Conrad, Chief Economist

Bud Conrad, Chief Economist

How can we explain gold dropping into the $1,300 level in less than a week?

Here are some of the factors:

- George Soros cut his fund holdings in the biggest gold ETF by 55% in the fourth quarter of 2012.

- He was not alone: the gold holdings of GLD have contracted all year, down about 12.2% at present.

- On April 9, the FOMC minutes were leaked a day early and revealed that some members were discussing slowing the Fed $85 billion per month buying of Treasuries and MBS. If the money stimulus might not last as long as thought before, the "printing" may not cause as much dollar debasement.

- On April 10, Goldman Sachs warned that gold could go lower and lowered its target price. It even recommended getting out of gold.

- COT Reports showed a decrease in the bullishness of large speculators this year (much more on this technical point below).

- The lackluster price movement since September 2011 fatigued some speculators and trend followers.

- Cyprus was rumored to need to sell some 400 million euros' worth of its gold to cover its bank bailouts. While small at only about 350,000 ounces, there was a fear that other weak European countries with too much debt and sizable gold holdings could be forced into the same action. Cyprus officials have denied the sale, so the question is still in debate, even though the market has already moved. Doug Casey believes that if weak European countries were forced to sell, the gold would mostly be absorbed by China and other sovereign Asian buyers, rather than flood the physical markets.

My opinion, looking at the list of items above, is that they are not big enough by themselves to have created such a large disruption in the gold market.

The paper gold market is best embodied in the futures exchanges. The prices we see quoted all day long moving up and down are taken from the latest trades of futures contracts. The CME (the old Chicago Mercantile Exchange) has a large flow of orders and provides the public with an indication of the price of gold.

The futures markets are special because very little physical commodity is exchanged; most of the trading is between buyers taking long positions against sellers taking short positions, with most contracts liquidated before final settlement and delivery. These contracts require very small amounts of margin – as little as 5% of the value of the commodity – to gain potentially large swings in the outcome of profit or loss. Thus, futures markets appear to be a speculator's paradise. But the statistics show just the opposite: 90% of traders lose their shirts. The other 10% take all the profits from the losers. More on this below.

On April 13, there were big sell orders of 400 tonnes that moved the futures market lower. Once the futures market makes a big move like that, stops can be triggered, causing it to move even more on its own. It can become a panic, where markets react more to fear than fundamentals.

Having traded in futures for over two decades, I want to provide some detail on how these leveraged markets operate. It's important to understand that the structure of the futures market allows brokers to sell positions if fluctuations cause customers to exceed their margin limits and they don't immediately deposit more money to restore their margins. When a position goes against a trader, brokers can demand that funds be deposited within 24 hours (or even sooner at the broker's discretion). If the funds don't appear, the broker can sell the position and liquidate the speculator's account. This structure can force prices to fall more than would be indicated by supply and demand fundamentals.

When I first signed up to trade futures, I was appalled at the powers the broker wrote into the contract, which included them having the power to immediately liquidate my positions at their discretion. I was also surprised at how little screening they did to ensure that I was good for whatever positions I put in place, considering the high levels of leverage they allowed me. Let me tell you that I had many cases where I was told to put up more margin or lose my positions. Those times resulted in me selling at the worst level because the market had gone against me.

The point of this is that once a market moves dramatically, there are usually stops taken out, positions liquidated, margin calls issued, and little guys like me get taken to the cleaners. Debates rage about the structure of the futures market, but my personal opinion is that a big hammer to the market by a well-heeled big player can force liquidations, increase losses, and push the momentum of the market much lower than the initial impetus would have. Thus, after a huge impact like we saw on April 13, the market will continue with enough momentum that a well-timed exit of a huge set of short positions can provide profits to the well-heeled market mover.

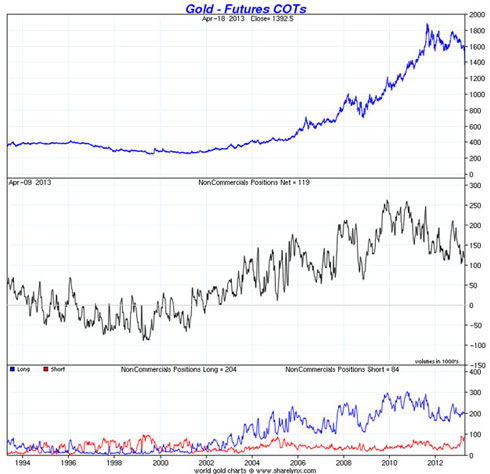

Moving from theory to practice, one of the most important things to keep your eye on is the Commitment of Traders (COT) report, which is issued every Friday. It details the long and the short positions of three categories of traders. The first category is called "commercials." They are dealers in the physical precious metals – for example, gold miners. The second category is called "non-commercials." They include hedge funds and large commercial banks like JP Morgan. Non-commercials are sometimes called "large speculators." The rest are the small traders, called "non-reporting" since they are not required to identify themselves. The ones to watch are the large speculators (non-commercials), as they tend to move with the direction of the market. Individual entities could be long or short, but in combination the net position of the group is a key indicator.

The following chart shows the price of gold as a blue line at the top, and the next panel down shows the net position of these large speculators as a black line. You can see that over the long term, they move together. When the net speculative position is above zero, this group is betting on rising gold prices. Of course, the reverse is true when it's below zero. In this 20-year view, the large speculators were holding net negative positions during the lowest point of the gold price, around the year 2000. As the price of gold rose, their positions went net long, and they profited.

An interesting thing about the chart above is that the increasing amount of net longs reversed itself before gold peaked in 2011, suggesting that these large speculators became slightly less bullish all the way back in 2010. The balance remains net long, but it remains to be seen how long that lasts.

What is not so obvious is that these large speculators are so big that they can affect the market as well as profit from it; when they initiate massive positions in a bull market, they drive the price of the futures contracts even higher. Similarly, when they remove their positions or actually go short, they can push the market lower.

So what happened a week ago was that a massive order to sell 400 tons of gold all at once hit the market. Within minutes the price plummeted, and over a two-day period resulted in the largest drop of the price for futures delivery of gold in 33 years: down $200 per ounce.

We don't have the name of the entity that did this. However, the way the gold was sold all at once suggests that the goal was not to get the best price. An investor with a position of this size should have been smart enough to use sensible trading tactics, issuing much smaller sell orders over a period of time. This would avoid swamping the market; and some of the orders would be filled at higher prices and thus generate more profit. Placing a sell order big enough to affect the overall market price suggests that someone with powerful backing wanted to drive the price of gold down.

Such an entity could have been a large speculator who already had a sizable short position and could gain by unloading some of its short position once the market momentum had driven the price even yet lower. Or it could be a central bank – one that might be happy to have the gold price move lower, as it would provide cover for its printing of more new money. Of course, it could be some entity that owned long contracts and wanted to get out of the position all at once. We don't know, but this kind of activity, resulting in the biggest drop in 30 years, raises more than just suspicion when we consider how important the price of gold is to many markets around the globe.

Can markets really be influenced by big players? Well, was the LIBOR rate accurately reported by huge banks? Have players ever tried to corner markets? The answer to all the above, unfortunately, is yes.

There's an even bigger problem with the legal structure of the futures market: even the segregated funds on deposit can be pilfered by the broker for the brokerage's other obligations. That is what happened to MF Global customers under Mr. Corzine. (I had an account with a predecessor company called Man Financial – the "MF" in the name. I also had an account with Refco, which is now defunct. Fortunately, the daggers did not hit my account, since I was not a holder when the catastrophes occurred.) My take: the futures market is dangerous, and not a place for beginners.

One last note: after the Bankruptcy Act of 2005, the regulations support the brokers, not the investors, when there are questions of legality about losses in individual investment accounts. Casey Research will be producing a report with much more detail on this subject in the near future.

So, what now? We aren't going to see a secret memo – no smoking gun to confirm that what happened on April 13 was an attempt to affect the market. Still, the evidence is suspicious. When big entities can gain from putting on big positions, the incentives are big enough for them to try – LIBOR, Plunge Protection Team, Whale Trade, etc., all support this view.

The Physical Gold Market

Previously, there was little difference between the physical and paper markets for gold. Yes, there were premiums and delivery charges, but everybody regarded the futures market as the base quote. I believe this is changing; people don't trust the paper market as they used to.

Instead of capitulating to fear of greater losses, the demand for physical gold has hit new records. The US Mint sold a record 63,500 ounces – a whopping 2 tonnes – of gold on April 17 alone, bringing the total sales for the month to 147,000 ounces; that's more than the previous two months combined. Indian markets, which are more oriented to physical metal, now have a premium of US$150 over the futures price in Chicago. Demand at coin dealers has increased as the price has dropped. And premiums are much bigger than they were as recently as a week ago.

Here is a vendor page that quotes purchase prices and calculates the premiums on an ongoing basis. It shows premiums of 50% and more in many cases. On eBay, prices for one-ounce silver coins are $33 to $35, where the futures price is quoted as $23. A look on Friday April 19 shows one vendor out of stock on most items:

Clearly, the physical gold market today is sending different signals than the paper market.

The Case for Gold Is Still with Us

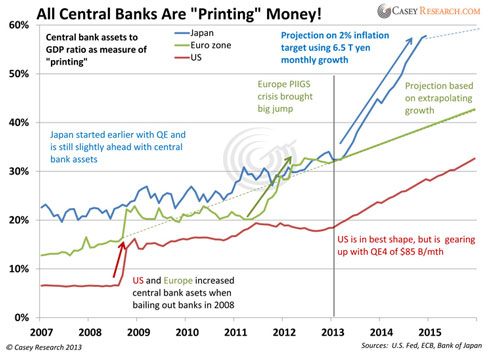

The long-term fundamental reasons to hold gold are undeniably still with us. The central banks of the world are acting in concert in "currency wars" or "the race to debase." As they print more money, the purchasing power of each unit declines. They are caught between the rock of having to keep interest rates low to support their governments' huge deficits and the hard place of the long-term effect of diluting their currency. If rates rise, even First World governments will be forced to pay higher interest fees, leading to loss of confidence in their ability to pay back their debt, which will bring on a sovereign debt crisis like what we have seen in the PIIGS or Argentina recently.

The following chart shows the rapid growth in the balance sheets as a ratio to GDP for the three largest central banks. I've extrapolated the expected growth into the future based on the rate at which they propose to buy up assets. One could argue about how long these growth rates will continue, but the incentives are all there for all central banks to bail out their governments and their commercial banks. I fully expect the printing game to continue to provide the fuel for hard-asset investments like gold and silver to increase in price in the years to come.

Buying Opportunity or Time to Flee?

So what does it all mean? The paper price of gold crashed to $1,325 in the wake of this huge trade. It is now hovering around $1,400. My first reaction is to suggest that this is only an aberration, and that the fundamentals of the depreciating value of paper currencies will eventually take the price of gold much higher, making it a buying opportunity. But what I can't predict is whether big players might again deliver short-term downturns to the market. The momentum in the futures market can make swings surprisingly larger than the fundamentals of currency valuation would suggest.

Traders will be looking for a significant turnaround to the upside in price before entering long positions. However, a long-term, fundamentals-based trader has to look at the low price as a buying opportunity. I can't prove it, but I think the fundamentals will drive the long-term market more than these short-term events. The fight between pricing from the physical market for bullion and that from the "paper market" of futures is showing signs of discrimination and disagreement, as the physical market is booming, while prices set by futures are seemingly pressured to go nowhere.

In short, I think this is a strong buying opportunity.

What would you do if the government outlawed gold ownership? If you had taken the steps outlined in Internationalizing Your Assets, you'd have little to worry about, as much of your gold – indeed, most of your assets – would be protected. Internationalizing Your Assets is a must-see web video for anyone concerned about losing wealth to increasingly desperate politicians. The event premiers at 2 p.m. EDT on April 20 and features some of the world's foremost experts on international asset protection, including Casey Research Chairman Doug Casey and Euro Pacific Capital CEO Peter Schiff. Attending Internationalizing Your Assets is free. To register or for more information, please visit this web page.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.