The End of the Gold Era, Why I'm Selling

Commodities / Gold and Silver 2013 Apr 24, 2013 - 07:02 AM GMTBy: John_Mauldin

Grant Williams writes: I am a seller of gold.

Grant Williams writes: I am a seller of gold.

Just not yet – and certainly not anywhere close to this price.

One day, long into the future, it will be time to sell gold – or, more likely, exchange it for something you want more – but it just ain't time yet, folks – no matter what you've been reading.

However, the past week has seen some truly amazing action in the gold (and silver) market – the kind of action that marks a shift in the status quo on a level so profound that it's hard to understand it at the time. But, as the years pass, these moments in time get viewed through the glorious prism of hindsight, and then they take on their full technicolour hues.

However, the past week has seen some truly amazing action in the gold (and silver) market – the kind of action that marks a shift in the status quo on a level so profound that it's hard to understand it at the time. But, as the years pass, these moments in time get viewed through the glorious prism of hindsight, and then they take on their full technicolour hues.

Friday, April 11th, 2013, began like so many before it, with gold at $1561, about $5 above its opening price on the previous Monday, having traded as high as $1590 and as low as $1550. In short, it had been an uneventful week.

However, there were a few things that had been bubbling away under the surface, each of which individually seemed to have relevance to the gold market but none of which apparently had any immediate effect.

Firstly, there was a report by Société Générale with the snappy title 'The End of The Gold Era', which hit the inboxes of the bank's clients on April 2. With the report forecasting the imminent demise of everybody's favourite immutable object, it obviously received a lot of coverage, as such viewpoints are apt to do. In fairness, the report was detailed and had a wealth of interesting charts, and I would recommend those amongst you interested in gold read to it in its entirety – whether you agree with SocGen's thesis or not.

Patrick Legland and his team of analysts declared gold's day in the sun had come and gone and that the yellow metal was 'in bubble territory'. The front cover of their report pulled no punches:

(Société Générale): Our expectations for rising interest rates, driven in part by a positive view of the US economy with an associated improvement in the dollar, could be the perfect storm to start a longer-term bear market. Professional sentiment, as evidenced by heavy redemptions in ETFs and the increasing willingness of managed money investors to trade from the short side, confirms our view that gold may have had its “last hurrah”.

Fair enough, but what did that mean for the price?

Our base case 2013 forecast for gold is for $1500/oz on average, and $1375/oz by year’s end.

Clear as a bell.

Then they explained what other purpose the report served:

This report outlines the bear case for gold and explores what it would take for a dramatic decline in gold prices beyond our forecast.

The extreme conditions that would be required for SocGen's bear-case scenario to play out were, in their own words, a 'perfect macro storm', and they put a 20% probability on that situation playing out and gold 'crashing' 20%.

“Among all forms of mistake, prophecy is the most gratuitous.”

— George Eliot

Three days later, stung into action, none other than two of Sprott's finest, the Davids Franklin and Baker, took it upon themselves to offer a 'A Retort To SocGen's Latest Gold Report', in which they carefully deconstructed the French bank's bear case in measured tones:

(Sprott): Société Générale (“SocGen”) recently published a special report entitled “The end of the gold era” that garnered far more attention than we think it deserved. The majority of the report focused on SocGen’s “crash scenario” for gold wherein they suggest that gold could fall well below their 2013 target of US$1,375/oz. It also included a classic criticism that we’ve heard so many times before: that the gold price is in “bubble territory”. We have problems with both suggestions.

Source: Sprott/Bloomberg

Addressing each of SocGen's points in turn, 'The Davids' laid out the case for continuing strength in the gold market eloquently and convincingly, with a particular focus on gold as a currency.

Their conclusion summed things up nicely:

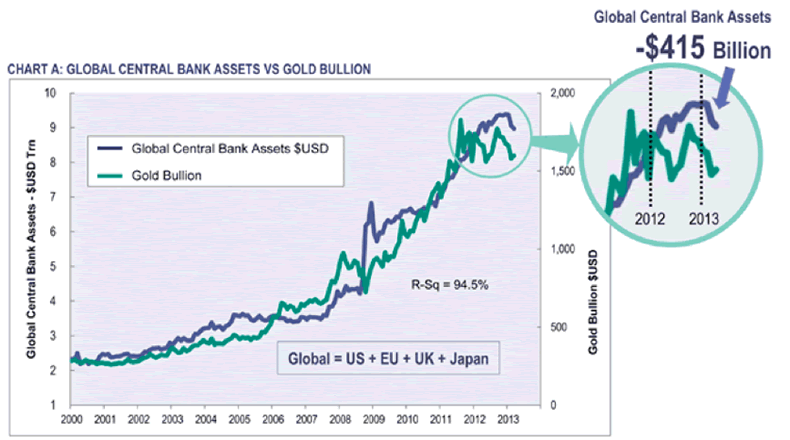

(Sprott): We believe gold is nowhere close to ‘bubble territory’ today. It is acting exactly as a currency should. Under its current stewardship, we expect the Federal Reserve’s balance sheet to continue to expand along with Japan’s. SocGen’s “crash” scenario would require a complete reversal of this trend, which we do not believe is even remotely possible at this point.

Gold is the base currency with which to compare the value of all government-sponsored money. Investors can incorporate it into their portfolios as ‘central bank insurance’, or ignore it entirely. Either way, we believe gold will continue to track the total aggregate of the central bank balance sheets of the US, UK, Eurozone and Japan. If SocGen believes the aggregate central bank balance sheet will continue to shrink as it did in Q1, then gold should continue its decline. We strongly suspect that shrinkage is over, however. Given Japan’s recent QE decision, we would expect the aggregate to grow a lot bigger, and fast. If there was ever a time for gold to be a relevant currency alternative – it’s now.

The next negative influence on gold was an extraordinary report from Goldman Sachs which (coincidentally) was published the same day that we discovered there had been an early leak of FOMC meeting minutes to a 'select' email list that consisted largely of lobbyists from the financial industry (yes, including Goldman Sachs).

In this report, Goldman made a call that is startling at best and at worst (in my humble opinion, at least) reckless in the extreme: they recommended their clients short gold.

Now, I can understand advising a 'sell' in gold from people who refuse to believe it is going higher, but to call it a 'short' within the context of the macro environment surrounding it I thought extraordinary.

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.